Neutral Nestlé India Ltd For Target Rs. 1,300 by Motilal Oswal Financial Services Ltd

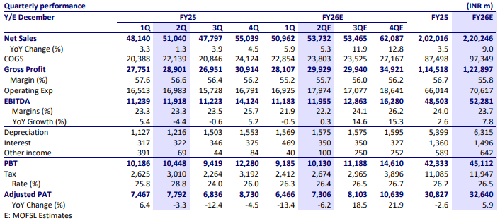

* Expect overall sales growth of 5.3% YoY, led by 5% growth in domestic sales and 10% growth in exports. While demand recovery is underway, a higher dependency on urban markets may weigh on NEST volumes.

* We believe the channel destocking due to GST rate cuts might weigh on NEST 2Q performance.

* NEST has been strategically taking pricing action in response to rising commodity prices.

* We expect GP margin contraction of 90bp YoY to 55.7%, impacted by high RM prices (coffee, edible oil). EBITDA margin to contract by 100bp to 22.2%.

* Nestle focuses on expanding its distribution reach, premiumization, and innovations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412