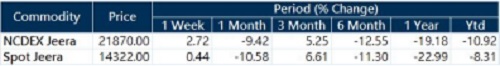

NCDEX Jeera dropped over 9% in a month period due to peak arrivals and aggressive farmer offloading - Kedia Advisory

Highlights

* NCDEX Jeera dropped over 9% in a month period due to peak arrivals and aggressive farmer offloading.

* FY25 production estimated at 92.78 lakh bags, down 10% YoY, signaling moderately tight forward supply.

* FY25 opening stock surged 755.38% YoY to 40.95 lakh bags, creating a heavy inventory overhang.

* March 2025 exports touched 36,920 MT, the highest monthly figure in the past 12 months.

* FY25 exports rose 49.98% YoY to 45.65 lakh bags, easing domestic oversupply stress.

* April arrivals dropped to 67,972.90 MT from March’s 1,04,726.66 MT, indicating waning peak supply pressure.

* Total supply for FY25 expected at 139.90 lakh bags, up 20.21% YoY, exceeding demand growth.

* FY25 demand estimated at 85.65 lakh bags, showing a narrow gap from production, but surplus remains.

* FY25 stock-to-use ratio at 56.33%, reflects structurally loose supply and weak price support outlook.

* Closing stock forecast at 48.25 lakh bags for FY25, up 17.83% YoY, capping upside potential.

* CAIT projects 53 lakh weddings in 2025, vs 48 lakh last year — could revive seasonal demand.

* Global freight costs have softened (Baltic Dry Index down), improving export competitiveness for Indian Jeera.

* Weak buying interest from China and cautious corporate buyers suggest prolonged downside risk.

* Any slowdown in exports post-June can cause mandi congestion and add pressure on spot prices.

Conclusion

* Price Support from Lower April Arrivals: Arrivals fell 35% MoM to 67,972.90 MT in April, signaling temporary supply relief and supporting prices.

* Export Momentum to Cushion Downside: FY25 exports rose 49.98% YoY to 45.65 lakh bags; strong overseas demand may continue into early June.

* High Stock Levels Still a Major Concern: FY25 opening stock surged 755.38% YoY; total supply at 139.90 lakh bags keeps long-term pressure intact.

* Short-Term Demand Boost from Marriage Season: CAIT forecasts 53 lakh weddings in 2025, suggesting strong retail and wholesale demand in June.

* Speculative Volatility Likely in Futures: High open interest with uncertain demand recovery may lead to erratic price swings this month.

* Cautious Corporate and Chinese Buying: Limited bulk buying by key corporates and weak Chinese demand may restrict aggressive price recovery.

* Recommendation: Buy Jeera around 21200–21500 with stop loss at 20200 and targets of 22800 followed by 23500. Overall in bigger range, China crop update in June/July will trigger fresh move. Supply we have

Above views are of the author and not of the website kindly read disclaimer