MTF Growth Sustains; ADTO Breaks 12-Month Downtrend by CareEdge Ratings

Synopsis

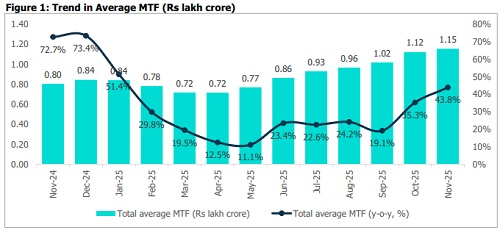

* The Margin Trading Facility (MTF) book has increased from Rs 0.80 lakh crore in November 2024 to Rs 1.15 lakh crore in November 2025. This includes a sequential rise of Rs 0.03 lakh crore, highlighting sustained momentum and active investor engagement.

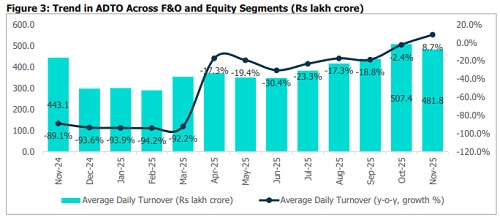

* Throughout the year, MTF exposure has grown steadily, supported by strong market confidence. The National Stock Exchange (NSE) continues to lead this segment, accounting for nearly 97% of total MTF financing. Meanwhile, the Average Daily Turnover (ADTO) increased by 8.73% year-on-year (y-o-y) to Rs 481.8 lakh crore in November 2025, breaking a 12-month decline streak.

* Looking ahead, the normalisation of regulatory adjustments, combined with ongoing investor interest, is likely to maintain healthy volumes and strengthen growth prospects in the MTF market.

MTF Book Continues Strong Growth Momentum

* MTF growth remained robust in November 2025, with the total MTF book increasing by 43.8% annually to Rs 1.15 lakh crore. Although this is lower than the notable 72.7% growth seen a year earlier, it still indicates strong momentum in leveraged trading. The increase was driven by favourable equity market conditions, enhanced broker financing capacity, and greater participation from retail investors.

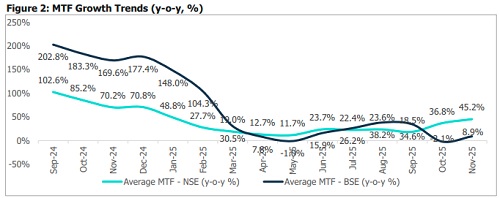

* The NSE continues to strengthen its leadership in this segment, holding a 97% market share. The average MTF book increased from Rs 0.77 lakh crore in November 2024 to Rs 1.12 lakh crore in November 2025, indicating a robust 45.2% annual growth, along with an additional increase of Rs 0.03 lakh crore.

* Conversely, BSE, despite operating on a significantly smaller base, experienced a 2.1% year-on-year contraction in the previous month. This trend reversed in November 2025, when its MTF book increased by 8.9% year-on-year sequentially to Rs 0.03 lakh crore, suggesting a modest recovery.

* Subsequently, the MTF book increased by a modest 2.9% in November 2025, a sharp contrast to the 172.7% surge recorded in the same period last year, as MTF utilisation had already stabilised at high levels.

Sequential Rise in MTF Books Across Exchanges

ADTO Rebounds, Marking First Y-o-Y Growth After a 12-Month Decline

Although November 2025 recorded an 8.7% y-o-y increase in ADTO to Rs 481.8 lakh crore, this rise is largely due to the suppressed base in November 2024 following regulatory changes. On a sequential basis, however, ADTO declined from Rs 507.4 lakh crore in October 2025. This marks a clear turnaround from the sustained declines observed since late 2024. The uptick in November reflects a rebound, partly supported by a favourable base effect. Market sentiment improved as trading activity normalised, with participants adjusting to earlier regulatory measures such as tighter position limits and the higher Securities Transaction Tax (STT). Additionally, improved liquidity conditions and stronger retail participation contributed to a more broad-based recovery, reinforcing the F&O-led growth in overall turnover. Additionally, the cash segment’s turnover increased by 5.31% y-o-y to Rs 1.12 lakh crore, a slowdown from the previous year's robust 41.2% growth. Sequentially, it increases by Rs 0.06 lakh crore, where retail and institutional participation remained steady.

CareEdge Ratings’ View

In November 2025, the MTF segment experienced a robust 43.8% y-o-y increase, reaching Rs 1.15 lakh crore. Market conditions appeared more balanced during the month, with MTF activity staying strong even as overall trading sentiment stabilised. NSE and BSE continued to support growth through their substantial liquidity, with BSE gaining additional strength due to its relatively smaller base. Additionally, the prevalent surplus system liquidity helped maintain favourable funding conditions for brokers, indirectly bolstering MTF activity during the month. The broader market also demonstrated signs of normalisation following the regulatory adjustments made in previous months. Retail participation remained resilient, highlighting the durability of trading activity. Looking ahead, consistent investor engagement and ongoing adaptation to regulatory changes are expected to sustain healthy volumes and promote further growth in the MTF segment.

Above views are of the author and not of the website kindly read disclaimer

Tag News

India`s API Industry Expected to Grow at a CAGR of 5-7% till FY28 by CareEdge Ratings