MOSt Advisor March 2025 by Motilal Oswal Wealth Management Ltd

Equity markets continued their slide for 5th consecutive month, on the back of slowdown in earnings growth, concerns over global economic growth due to the impending US tariff war, and persistent FII outflows.

Nifty fell 5.9% in Feb’25, its second steepest MoM decline since Mar’20. The sharpest being 6.2% in Oct’24. Broader market witnessed sharp selling pressure, with Nifty Midcap 100 falling -10.8% while Smallcap 100 declined -13.1%.

FIIs continued their selling spree, having sold ?58,988 crore - albeit lower than ?87,375 crore sold in Jan’25. Since Oct’24, FII have sold Rs.3.24 lakh crore – one of their highest selling spree in recent times. DII inflows remained strong at Rs.64,853 crore.

Nifty reported a single-digit PAT growth for the third successive quarter in 3QFY25. Earnings for the Nifty-50 rose 5% YoY (vs. our estimate of +5%). The aggregate performance was hit by global commodities (i.e. Metals and O&G). The earnings growth was driven by BFSI, Technology, Telecom, Healthcare.

India’s Real GDP grew 6.2% in 3QFY25, higher than 5.6% in 2QFY25 (revised up from 5.4%), in line with the market expectations. Both private and government consumption witnessed an improvement during the quarter. Nominal GDP growth was 9.9% in 3QFY25, compared to 8.3% in 2QFY25.

In the meantime, Nifty corrected by ~16% from its peak in the last 5 months. This correction has coincided with a slowdown in earnings growth, as the Nifty-50 has managed only 4% PAT growth in 9MFY25 (following a healthy 20%+ CAGR during FY20-24). The correction also factors in some of the potential disappointments in earnings ahead, in our view.

Post this, Nifty currently trades at a 12-month forward P/E of 18.6x which is at 9% discount to its 10- year average of 20.5x. However, the valuations for midcaps and smallcaps are still expensive visà-vis their history as well as vs. Nifty-50. Thus, we remain biased toward large-caps. On sectoral front, we are positive on Consumption, financials, durables, mid-cap IT, Tractors, Healthcare, Industrials and travel.

Equity Investment Ideas

Shriram Finance Ltd

* SHFL is well-positioned to capitalize on the recovery in vehicle finance, particularly as demand for CV and PV gains momentum.

* With a diversified portfolio, the company is set to benefit from lower borrowing costs, which will enhance NIM and profitability.

* Its strong focus on asset quality & collection efficiency suggests that it is well-prepared to navigate the evolving credit environment.

* We expect 18%/19% AUM/PAT CAGR over FY24-27 and expected RoA/RoE of 3.2%/16% in FY26.

Buy Shriram Finance Ltd CMP : 626 Target : 700

Varun Beverages Ltd

* The summer season is expected to be a significant driver for Varun Beverages' volume growth. The recent stock price correction makes valuation attractive & risk-reward favorable.

* Management has guided double-digit volume growth in the domestic market and a much higher growth rate in international markets.

* VBL is poised to sustain its earnings growth, with 17% PAT CAGR over FY24-26 driven by increased penetration in new African markets, stable domestic growth, continued expansion in distribution and growing refrigeration in rural areas.

Buy Varun Beverages Ltd CMP : 482 Target : 680

Mahindra and Mahindra Ltd

* Mahindra has gained 240bps market share in tractors, reaching a record-high 44.2% in Q3, supported by strong rural demand and successful product launches.

* The company’s UV business remains strong, with a 17% YoY volume growth in Q3, driven by robust demand for key models. A healthy order backlog and upcoming launches are expected to drive momentum.

* The budget's focus on electric vehicles (EVs) supports M&M’s EV initiatives, while increased agri spending & rural push could drive tractor demand. We estimate M&M to post a ~13%/16% CAGR in revenue/PAT over FY24-27E.

Buy Mahindra and Mahindra Ltd CMP : 2,702 Target : 3,675

Indian Hotels Company Ltd

* Management expects double-digit revenue growth in FY25, supported by strong demand from weddings, tourism, and MICE events. ARR and occupancy remain robust.

* The company’s expansion into spiritual tourism aligns with the government’s push to develop 50 key tourist destinations, with IH planning over 2,800 new rooms across Ayodhya, Hampi, Vrindavan, Ujjain, Prayagraj, and Makkah in the next three to five years.

* A healthy room addition pipeline, favorable demand-supply trends, and govt support for tourism position IH well for sustained growth. We expect revenue/adj. PAT to grow 31%/26% YoY.

Buy Indian Hotels Company Ltd CMP : 741 Target : 960

Technical& Derivatives Outlook

* Nifty index started February where it had left in the previous month but was followed by steep selling and it fell by over 1700 points. It broke its crucial support levels and went on near 22000 marks. On the sectoral front we have witnessed selling pressure in most of the sectors barring financial space which is showing some resilience amongst such market weakness.

* Technically, index has broken its upwards sloping channel on monthly scale and formed a bearish candle for the fifth consecutive month. Nifty has formed a bearish candle indicating pressure at higher zones and unwinding required for the next fresh leg of rally. Now Nifty has to hold above 22000 zones for some bounce towards 22800 and 23500 zones with immediate support near 22000 and 21800 zones.

Derivative Strategy

Nifty

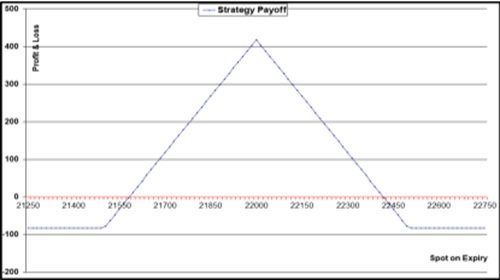

Bear Put Butterfly spread : Mar Series

* Nifty index is in downtrend and forming lower highs – lower lows on weekly scale from last few weeks.

* Index corrected almost 1000 points in last few days and weakness likely to continue.

* Call OI is seen at 22500 then 23000 strike which is likely to act as a major hurdle

* Thus suggesting Bear Put Butterfly spread to play the downside swing

BUY 1 LOT OF 22500PE, SELL 1 LOT OF 22000PE

SELL 1 LOT OF 22000PE, BUY 1 LOT OF 21500PE

Margin Required : Rs 70,000

Max Risk : 82 Points (Rs.6150)

Max Profit: 418 Points ( Rs.31350)

Lot size : 75

Profit if it remains in between 21582 to 22418

Bank Nifty

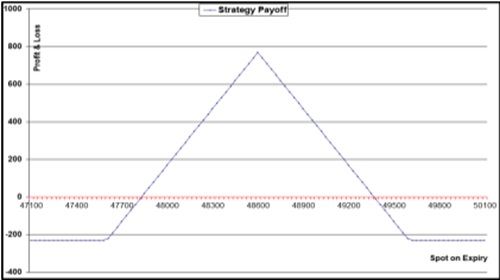

Iron Butterfly : Mar Series

* Bank Nifty index has got stuck in a wider range from last seven weeks in between 47800 to 49500 zones and likely to oscillate within this range

* Put OI is intact at 47000 levels while Maximum Call OI is at 50000 strike

* Thus suggesting Iron Butterfly Option Spread to play the benefit of time decay and decline in volatility

BUY 1 LOT OF 49600 CE, SELL 1 LOT OF 48600 CE

SELL 1 LOT OF 48600 PE, BUY 1 LOT OF 47600 PE

Margin Required : Rs.100,000

Max Risk : 225 Points (Rs.6750)

Max Profit: 775 Points ( Rs.23250)

Lot size : 30

Profit if it remains in between 47825 to 49375

Commodities & Currency Outlook

* Base metals ended the week on a positive note, following better-than-expected PMI figures, a drop in the US dollar, and anticipation of additional stimulus from China. As market participants struggle with Trump’s back-and-forth trade policy, industrial metals rose on a weaker dollar, bolstering the case for metal demand and China’s recovery.

* President Donald Trump approved tax exemptions for a number of items imported into the United States from Mexico and Canada just two days after imposing sweeping tariffs, leaving investors and businesses reeling from his inconsistent trade policies. According to a senior administration official, the exclusions to the 25% tariffs imposed on Tuesday would apply to roughly half of the commodities entering the United States from Mexico and around 38% of goods from Canada that comply with the North American trade agreement reached during Trump's first term.

* A major aluminum manufacturer has asked Japanese buyers for a $260 per metric ton premium for April-June primary metal shipments, up 14% from the current quarter, according to Reuters. For the January-March quarter, Japanese purchasers agreed to pay a premium of $228 per ton, the largest in nearly a decade and up 30% over the previous quarter. The proposed premium hike reflects concerns that new U.S. tariffs on Canadian aluminum could shift supply from the Middle East, Australia, or other countries that traditionally supply Asia to North America, tightening availability in Asia.

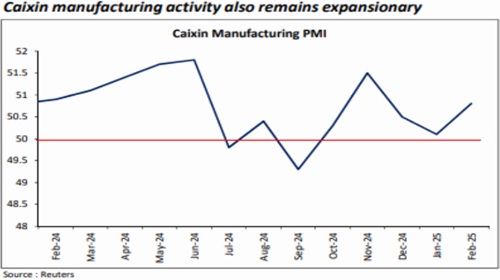

* Caixin China's General Manufacturing PMI increased to 50.8 in February 2025 from 50.1 the previous month, exceeding market expectations of 50.3. This was the highest level since November, with output and new orders up the most in three months as market conditions improved. China's official NBS Manufacturing PMI rose to 50.2 in February 2025 from 49.1 the previous month, exceeding market expectations of 49.9 and indicating an uptick in factory activity over three months.

* The weeklong NPC meeting in China, which began on March 5th, revealed pledges for increased fiscal stimulus and an emphasis on increasing consumer spending, although the immediate initiatives announced aimed at promoting household demand were limited. The government maintained its 2025 economic growth target of roughly 5%, unchanged from last year, while cutting the annual inflation target to around 2%, down from around 3% last year.

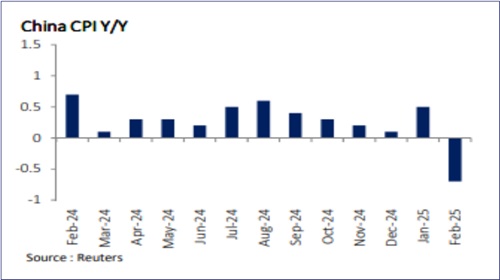

* CPI declined 0.7% last month compared to the previous year, reversing January's 0.5% increase. A key factor for the decline in inflation was likely the statistical effect of a high base from a year earlier, caused by elevated prices during the Lunar New Year, which started earlier than usual in 2025.

* Base metals remain supported by ongoing trade tensions, with China ready to fight back with retaliatory tariffs and strong manufacturing figures. Sentiment is slightly dampened by weakerthan-expected inflation figures, but optimism persists, as policymakers in China deploy their policy tools to drive growth.

Commodities &CurrencyOutlook

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412