MOSt Advisor February 2025 by Siddhartha Khemka, Sr. Group Vice President, Head - Retail Research, Motilal Oswal Wealth Management Ltd

Below the MOSt Advisor February 2025 by Siddhartha Khemka, Sr. Group Vice President, Head - Retail Research, Motilal Oswal Wealth Management Ltd

Equity markets extended their weakness in Jan’25 with Nifty 50 further falling by 0.6% MoM after a 2% fall in Dec’24. The index closed in red for the fourth consecutive month. Broader market on the other hand witnessed sharp selling pressure with Midcap 100/Smallcap 100 plunging 6%/10% respectively.

Slowdown in earnings growth, weak urban demand, moderation in banks credit growth, and global uncertainty led to sell-off.

FIIs recorded their 4th consecutive month of outflows at Rs.87,374 crore, while DIIs inflows remained strong at Rs.86,591 crore – 18th consecutive month of net inflows.

The 3QFY25 earnings so far are in line with our modest expectations. As of 31st Jan’25, earnings of the 36 Nifty companies have inched up 1% YoY (vs. est. of +2% YoY). The modest earnings growth was driven by BFSI, with positive contributions from Technology, Real Estate, Healthcare, and Capital Goods. Conversely, it was dragged down by commodity sectors like Oil & Gas, Metals and Cement.

The government presented a dream Budget wherein after a decade, was saw shift in focus from capex to consumption. The major move of providing tax relief on income upto Rs12 lakh would go a long way to boost household income and thus consumption and investment. We believe it was a well-balanced budget, with focus on fiscal consolidation (fiscal deficit for FY26 is pegged at 4.4%), while outlining several strategic initiatives to promote inclusive growth and enhance India's competitive edge.

RBI followed budgets tax relief with rate cut announcement in Feb’25 MPC meet which could further fuel consumer demand. It cut repo rate by 25bps to 6.25% for the 1st time in five years and pegged India’s FY26 GDP growth at 6.7% and inflation at 4.2%. On the other hand, US Fed kept the interest rate unchanged at 4.25% to 4.5% in its Jan’25 meet, pausing its rate-cutting cycle after three consecutive reductions in 2024. Global market continues to be volatile given the rising concerns over the tariff war.

While rural demand was already steady, we expect urban demand to revive post the relief given in the budget. Thus we suggest investors to realign their portfolios more towards consumption from earlier capex related theme.

Equity Investment Ideas

Maruti Suzuki Ltd

* Maruti Suzuki’s 3QFY25 revenue & PAT grew 16%/13% YoY, driven by a 6.5% YoY increase in PV volumes, including a 7.5% growth in the compact segment.

* For FY26, MSIL will benefit from key launches, including its first EV, hybrid variants, and an SUV. Govt policies supporting hybrids could further boost MSIL as the main beneficiary.

* With budget boosting the purchasing power of the middle class, demand in the entry car segment is expected where MSIL remains a market leader. We estimate 11% earnings CAGR over FY24-27E.

Buy Maruti Suzuki Ltd CMP : 13033 Target : 14500

Tata Consumer Products Ltd

* Tata Consumer is enhancing growth through distribution expansion, digitization, and synergies from integrating Capital Foods & Organic India.

* In Q3, revenue grew 17% YoY, driven by strong international and non-branded performance, with EBIT rising 53% and 89% YoY, respectively.

* With rising consumer spending fuelling FMCG demand, Tata Consumer is well-positioned to achieve a robust 10%/9%/13% CAGR in revenue, EBITDA, and PAT over FY24-27.

Buy Tata Consumer Products Ltd CMP : 1020 Target : 1130

Indian Hotels Company Ltd

* Management expects double-digit revenue growth in FY25, supported by strong demand from weddings, tourism, and MICE segments.

* Indian Hotels delivered robust 3QFY25 results with consolidated revenue up 29% YoY, driven by 15% RevPAR growth and improved occupancy rates.

* With a robust pipeline of room additions and scaling new brands, IH is well-positioned for sustained growth. We expect ~24% PAT CAGR by FY26, citing strong operational momentum and favourable demand-supply dynamics.

Buy Indian Hotels Company Ltd CMP : 794 Target : 960

SRF Ltd

* SRF's Chemicals & Packaging Films segs. showed significant margin improvement in 3Q, driven by strong demand recovery, pricing gains, & better product mix, signalling a positive turnaround.

* Chemicals seg. (69% of EBIT) is reviving, led by Specialty Chemicals' healthy launch pipeline & Fluorochemicals' export ramp-up. Mngt expects strong sequential growth in 4Q & FY26.

* Improved margins and pricing power, supported by a capex plan of INR15b-20b annually is expected to drive 20%/36%/53% CAGR in revenue/EBITDA/PAT over FY25-27E.

Buy SRF Ltd CMP : 2875 Target : 3540

* Nifty index started January series with negative bias as it failed to hold above 24200 zones and continued the formation of lower top - lower bottom by drifting towards 22786 levels by the end of the series. It gained some stability near its key support of 22800 levels and witnessed signs of recovery towards the beginning of new series. On the sectoral front we have witnessed marginal buying interest in Financial, IT, Auto and FMCG names while weakness in most of the other sectorial indices mainly Reality, Media, Metal, Pharma, Energy and Infra sector.

* Technically, index is respecting its upwards sloping channel on monthly scale by connecting the key swing lows of 7511, 15183, 16828, 18837, 21281 and 22786 zones. Nifty has formed a doji sort of candle on monthly scale with longer lower shadow indicating support based buying after the profit booking of last four months. Now Nifty has to hold above 23333 zones for an up move towards 24000 and 24444 zones with immediate support near 23000 and 22800 zones.

Derivative Strategy

NIFTY: Bull Call Ladder Spread : Feb Series

BUY 1 LOT OF 23700 CALL

SELL 1 LOT OF 24100 CALL

SELL 1 LOT OF 24400 CALL

Margin Required : Rs. 1,75,000

Net Premium Paid : 115 Points (Rs.8625)

Risk Scenario 1 : 115 Points (Rs.8625)

Risk Scenario 2 : Unlimited risk above 24685 levels

Max Profit: 285 Points ( Rs.21375)

Lot size : 75

Profit if it remains in between 23815 to 24685 zones

Rationale

* Nifty index is on the verge of giving falling channel pattern breakout and it formed a strong bullish candle

* On daily scale Index surpassed its 50 DEMA and small follow up buying could set the next leg of rally but with capped upside

* Maximum Put OI is at 23500 strike while Call OI is seen at 24500 strike

* Thus suggesting Bull Call Ladder Spread to play the upside swing but with capped upside

Commodities &CurrencyOutlook

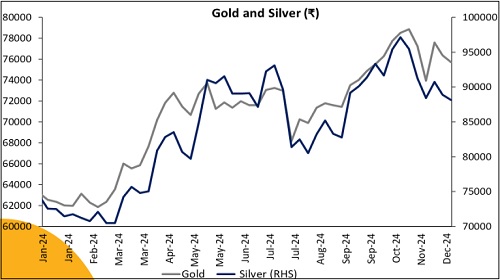

* Gold and Silver has a strong start to 2025, gaining ~7% in January, recovering most of the post-US election losses

* Despite rising bond yields and a stronger dollar, gold remained resilient, driven by geopolitical risk hedging

* Dollar index marked a high of ~110 in the previous month before falling marginally; similarly US 10Y Yield also inched higher towards ~4.8

* Gold’s strength is supported by US economic uncertainty, unaffected by the Israel-Gaza ceasefire announcement

* The Israel-Hamas ceasefire deal hasn’t led to further updates, increasing uncertainties

* President Trump also threatened Russia of sanctions if the Russia-Ukraine war doesn’t ease off

* Trump recently mentioned about requesting OPEC+ to increase production to lower oil prices and favors lower global interest rates

* He also levied import tariffs of 25% on Mexico and Canada and additional 10% on China

* However, a quick pause was levied on these tariffs by the Trump administration

* Fed left interest rates unchanged, with Powell noting persistent inflation and resilient growth, indicating a "wait and watch" approach

* Fed officials also shared similar views in their comments last month

* According to IMF, global growth is projected at 3.3% both in 2025 and 2026, below the historical average of 3.7%

* US GDP was reported better than expectations, US inflation was majorly flat; however US labour market still shows signs of tightness

* PBoC added 10 tonnes of gold in December, continuing its buying spree

* In January, silver followed industrial metals, later catching up with gold, fuelled by supply deficits and growing industrial demand

* Silver followed Gold’s foot steps towards the end of last month weighing slightly on Gold/Silver ratio

* A market squeeze, with arbitrage between New York and London gold markets, is boosting sentiment.

* Managed net long positions in gold increased by 25% in January; silver’s rose over 50%

* Key factors to watch include Trump’s tariff moves, Dollar Index, Fed commentary, economic data, and updates from China.

* After a sharp rally bouts of correction could be seen; Buy on dips is recommended for both metals

Commodities &CurrencyOutlook

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : Nifty future closed positive with gains of 0.65% at 22589 levels by Mo...