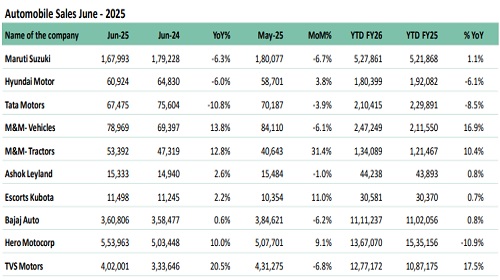

Monthly Auto Sales - June 2025 by ARETE Securities Ltd

The June automobile dispatches reported a 6% YoY growth and 2% MoM decline. PV continued its five-month slide, dragged by urban caution and monsoon effects, with discounts likely on the horizon. CV grew 2% MoM, led by a 20% bus sales surge, though truck volumes softened seasonally. 2W eased 1% MoM but rose 10% YoY, with exports balancing domestic dips. Tractors climbed 27% MoM and 11% YoY, driven by Kharif sowing and monsoon strength. These divergent patterns reflect the subtle balance of urban setbacks and rural-export strengths guiding the industry's trajectory.

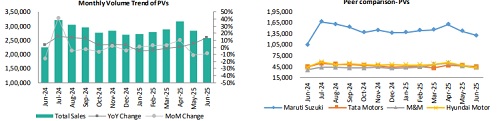

PV Segment

PV dispatches declined sequentially for the fifth consecutive month, driven by subdued buyer sentiment this year-particularly in urban areas-amplified by June's seasonal softness, absence of festive uplift, ongoing inventory realignments, promotional fatigue, and monsoonrelated purchase hesitancy. Among OEMs, only HMIL achieved a sequential growth, supported by strong SUV sales, with domestic volumes projected to rise in H2FY26 following the operational commencement of the Talegaon plant. On a yearly basis, M&M alone recorded volume growth. MSIL, the volume leader, faced continued declines due to persistent weakness in small car demand and recent softening in UV segment sales as well. Tata Motors hit a 42-month low in volumes but remains focused on new rollouts, with bookings for the Harrier.ev already underway. Steep discounts are expected across the segment in the near term to boost retail demand.

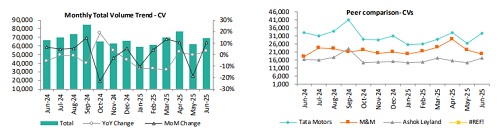

CV Segment

The CV segment in June recorded a 2% MoM increase but a 4% YoY decline in volumes. Domestic trucks, comprising 24% of CV volumes, fell 3% MoM and 23% YoY, led by AL sequentially and M&M on an annual basis. Ongoing monsoon conditions are expected to weigh on truck dispatches due to reduced construction and logistics activity. As anticipated, domestic bus sales, which account for 12% of CV volumes, surged 20% MoM and 9% YoY, largely driven by AL. LCVs, representing 20% of CV volumes, rose 2% MoM but declined 5% YoY, with AL contributing to the sequential gain and M&M to the yearly drop.

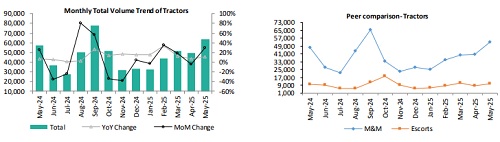

Tractor Segment

June's tractor segment volumes surged 27% MoM and 11% YoY, spearheaded by M&M's strong performance. Domestic dispatches, the primary growth engine, rose 29% MoM and 10% YoY, driven by Rabi harvest proceeds, Kharif sowing preparations, and a robust monsoon supporting agriculture. Export volumes dropped 11% MoM but increased 28% YoY, with ESC and M&M achieving annual growth despite sequential dips tied to market dynamics. Future prospects appear solid, backed by abundant water resources from higher reservoir levels, a favourable foodgrain production outlook, increased MSPs lifting farmer incomes, and sustained government support, all poised to maintain the tractor industry's upward trajectory.

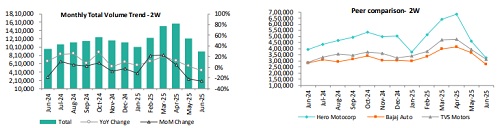

2W Segment

The 2W segment in June exhibited persistent volume fluctuations, declining 1% MoM but advancing 10% YoY. Domestic dispatches, accounting for 77% of total volumes, triggered the sequential drop, falling 3% MoM, led by BAJAJ, though a 3% YoY rise was noted, driven by TVS. HERO alone posted 7% growth on both MoM and YoY bases. Exports, comprising 23% of volumes, grew 6% MoM - which helped limit the overall sequential decline to just 1% - and fuelled annual growth with a 38% YoY increase, led by HERO across both periods. In the e2W segment, TVS/BAJAJ/HERO sold 25,274/23,004/7,664 units, capturing 24%/22%/7% market shares this month.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127

More News

Real Estate Sector Update : 1QFY26 Preview: Healthy start to the year by JM Financial Servic...