MCX Silver Sep is expected to slip towards Rs 106,500 level as long as it trades below Rs 108,600 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to slip towards $3260 level amid strong dollar and rise in U.S treasury yields. Further, prices may slip on optimism over possible trade deal between U.S and its key trading partners. Countries will try to use new three-week window to negotiate with U.S. Additionally, U.S President said trade talks have been going well with the European Union and China. Additionally, investors fear that threat to inflation from higher tariffs will give more room to Fed to keep rates steady. Additionally, markets will keep a close eye on U.S Fed monetary policy meeting minutes and speeches from Fed officials for more insight on central banks policy path

• Spot gold is likely to slip back towards $3260 level as long as it stays below $3330 level. MCX Gold Aug is expected to slip towards Rs 95,500 level as long as it stays below Rs 97,000 level

• MCX Silver Sep is expected to slip towards Rs 106,500 level as long as it trades below Rs108,600 level.

Base Metal Outlook

• Copper prices are expected to trade with positive bias as U.S President Donald Trump announced that he would impose 50% tariff on imported copper, metal which is critical to EV, military hardware, consumer goods and power grid. This move will attract more shipments into U.S, potentially tightening global supplies. Meanwhile, all eyes will be on details, as when will it take effect, which copper products would be included and will it be implemented on all partners who supply copper to U.S. Additionally, prices may move up on optimism over possible trade deal between U.S and its key trading partners

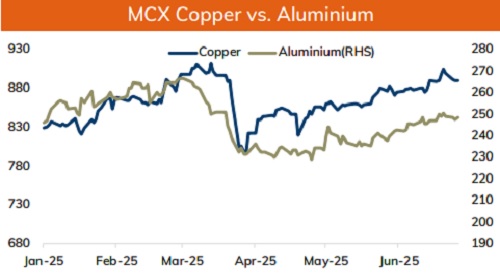

• MCX Copper July is expected to rise further towards ?906 level as long as it stays above Rs 885 level. A break above Rs 906 level prices may rally further towards Rs 915 level

• MCX Aluminum July is expected to rise towards Rs 252 level as long as it stays above Rs 247 level. MCX Zinc July is likely to move north towards Rs 259 level as long as it stays above Rs 254 level.

Energy Outlook

• Crude oil is likely to slip back towards $67 amid strong dollar and unexpected increase in crude oil stockpiles. As per API figures U.S crude oil inventories rose by about 680,000 barrels for the week ending 4 th July, compared with a decline of 2.8M barrels in previous week. Further, prices may dip on renewed concern over trade war which will have negative impact on economic growth and dent demand for oil. Additionally, OPEC+ plans to raise production by 548,000 bpd in August, more than previous hike of 411,000 bpd will weigh on prices. Meanwhile, sharp fall may be cushioned on rising tension in Middle East. Further, as per EIA report U.S. will produce less oil in 2025 than previously expected

• MCX Crude oil July is likely to slip back towards Rs 5750 level as long as it stays below Rs 5950 level.

• MCX Natural gas July is expected to slip towards Rs 280 level as long as it stays below Rs 295 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Sell Aluminium SEP @ 256 SL 258 TGT 254-252. MCX - Kedia Advisory