MCX Silver May is expected to face stiff resistance near Rs.98,500 level and slip back towards Rs.97,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to move back towards $2930 level on weakness in dollar and decline in US treasury yields. Dollar and Yields are moving south as recent batch of economic data from US signaled crack in economy and trade war with major trading partners will have adverse effect on already slowing economy, giving room to US Federal Reserve to lower interest rates. Recent trade data showed deficit widening amid front loading of imports ahead of expected tariffs, signifying that trade could be a drag on economic growth in the Q1. Moreover, all eyes will be on much awaited job data and US Fed Chair Powell speech to get more clarity on interest rate trajectory. Any indication of easing policy would be supportive for bullions.

* Spot gold is likely to hold the support near $2880 level and rise towards $2930 level. MCX Gold April is expected to rise towards Rs.86,400 level as long as it stays above Rs.85,300 level.

* MCX Silver May is expected to face stiff resistance near Rs.98,500 level and slip back towards Rs.97,000 level.

Base Metal Outlook

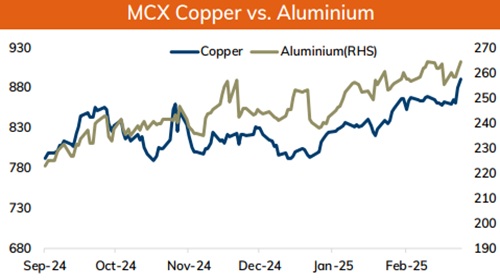

* Copper prices are expected to trade with positive bias on weak dollar and on hopes of more stimulus packages from China to revive economic growth and to cushion the impact of an escalating trade war with the US. Chinese officials highlighted more monetary policy easing at an appropriate time and left the door open to more stimulus measures if economic growth slows. Moreover, central bank governor Pan reiterated his stance to cut interest rates and inject liquidity into the financial system at an suitable time. Meanwhile, investors will keep an close watch on Non-Farm payrolls data and comments from Fed officials to get cues on future rate paths.

* MCX Copper March is expected to rise further towards Rs.895 level as long as it stays above Rs.883 level. A break above Rs.895 level copper prices may rally further towards Rs.900 level

* MCX Aluminum March is expected to rise further till Rs.267 level as long as it trades above Rs.263 level. MCX Zinc March is likely to rise further towards Rs.278 level as long as it stays above Rs.273 level

Energy Outlook

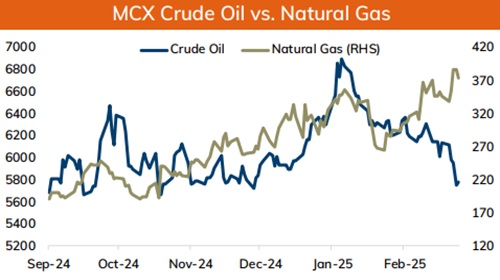

* NYMEX Crude oil is expected to trade with negative bias and slip further towards $65.00 level on larger than expected build in US crude oil inventories, OPEC+ decision to increase oil output and uncertainty around US President Donald Trump's tariff plans. Moreover, risk premium is fading amid easing geopolitical tension in Middle East and Russia-Ukraine peace deal looking more promising. Russia said it will seek a peace deal in Ukraine that safeguards its on long term security. Meanwhile, US Treasury Secretary Scott Bessent said they will exert maximum pressure of sanctions on Iran to collapse its oil exports

* MCX Crude oil March is likely to face stiff resistance near Rs.5950 level and slip further towards Rs.5650 level. A break below Rs.5650 prices may dip further towards ?5600 level.

* MCX Natural gas March is expected slip further towards Rs.365 level as long as it stays below Rs.382 level

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631