MCX Silver July is expected to slip towards Rs 96,500 level as long as it trades below Rs 98,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to rise further towards $3350 amid weakness in dollar and softening of U.S. treasury yields. Further, demand for safe haven may increase on mounting economic and geopolitical uncertainty. Investors fear that uncertainty over tariffs may impact trade talks. U.S. Court of Appeals for the Federal Circuit in Washington paused the lower court's ruling to consider the government's appeal, and ordered the petitioners in the cases to respond by June 5 and the administration by June 9. Meanwhile, all eyes will be core-PCE price index data to get more clarity on Fed interest rate path

• Spot gold is likely to rise towards $3350 level as long as it stays above $3265 level. MCX Gold Aug is expected to rise towards Rs 97,200 level as long as it stays above Rs 95,500 level

• MCX Silver July is expected to slip towards Rs 96,500 level as long as it trades below Rs 98,500 level. A break below Rs 96,500 level prices may slide further towards Rs 95,500 level

Base Metal Outlook

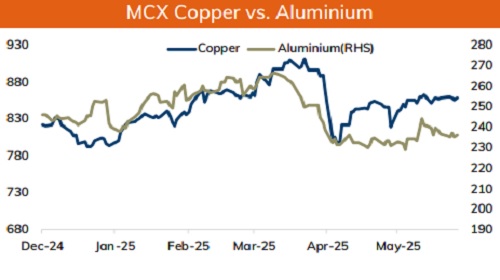

• Copper prices are expected to trade with negative bias on risk aversion in the global markets and signs of weaker Chinese demand. Further, disappointing economic data from U.S. raised concerns over slowdown in economic activity. Additionally, U.S. trade court has blocked most of Trump’s tariffs from going into effect but were temporarily reinstated by federal appeal court, adding another layer of uncertainty over the economy. Meanwhile, weakness in dollar and threat to global copper supply may cushion sharp fall in prices. Ivanhoe Mines Ltd.’s KamoaKakula complex in the Democratic Republic of Congo status remains clouded in uncertainty as seismic activity caused widespread flooding

• MCX Copper June is expected to slip further towards Rs 854 level as long as it stays below Rs 869 level. On contrary, a break above Rs 869 level prices may rally further towards Rs 875 level

• MCX Aluminum June is expected to slip further towards Rs 234 level as long as it stays below Rs 239 level. MCX Zinc June is likely to move south towards Rs 251 level as long as it stays below Rs 256.50 level.

Energy Outlook

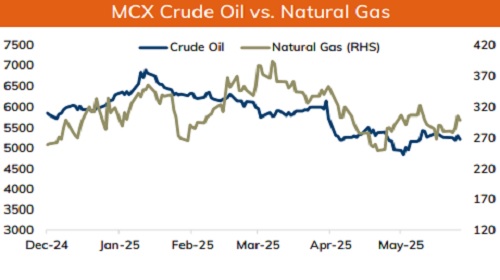

• Crude oil is likely to slip further towards $59.50 level on pessimistic global market sentiments as U.S. President Donald Trump’s tariffs were to remain in effect after a federal appeals court temporarily reinstated them, reversing a trade court’s decision. Further, disappointing economic data from U.S. signals crack in economy and deteriorating outlook. Moreover, all eyes will be OPEC+ meeting, where group may agree to accelerate oil production hikes in July. Group may agree on another large supply increase of 411,000 bpd. Meanwhile, sharp fall may be cushioned on weak dollar, potential new U.S sanction on Russia and a wild fire in Canada’s province of Alberta prompted temporary shutdown of some oil and gas production, hurting supply.

• MCX Crude oil June is likely to slip towards Rs 5100 level as long as it stays below Rs 5350 level.

• MCX Natural gas June is expected to slip towards Rs 290 level as long as it stays below Rs 310 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631