MCX Natural gas Dec is expected to weaken towards Rs 350 level as long as it trades under Rs 366 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to hold support at $4270 per ounce and move higher towards $4370 per ounce on weak dollar and fall in US treasury yields. Prices would get support as delayed US employment data signaled sluggish growth in the labor market. Further, weaker than expected. Prices would also get support amid safe haven buying due to escalating tension between US and Venezuela. Moreover, strong central bank buying and investment inflows would also fuel its bullish momentum. On the other hand, any optimism over peace deal between Russia and Ukraine could restrict its upside.

* MCX Gold Feb is expected to hold the floor near Rs 133,000 level and rise towards Rs 135,500 level. Only move below Rs 133,000, it would slip towards Rs 131,500.

* MCX Silver March hold strong support at Rs 194,000 level and move higher towards Rs 201,500. Above Rs 201,500 it would rise toward Rs 204,500.

Base Metal Outlook

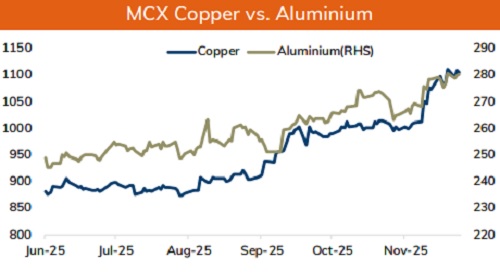

* Copper prices are expected to hold its ground and move higher on tight supplies and strong US demand. Further, strong import demand from key such as electric vehicle and energy infrastructure in China would help the metals to stay firm. Additionally, growing bets of fresh round of stimulus from China to counter slowdown in the property sector would also help the metal to hold firm. Moreover, a softer dollar and increasing prospects of lose monetary policy would again strengthen the bullish bias in the red metal.

* MCX Copper Dec is expected to hold support near Rs 1096 and move higher towards Rs 1120 level. Only break below Rs 1096 level it may fall towards Rs 1080-Rs 1075 level.

* MCX Aluminum Dec is expected to rise towards Rs 282 level as long as it stays above Rs 277 level. Only a move below Rs 277, it would slip towards Rs 270. MCX Zinc is hovering near below 20-day EMA at Rs 306.50. As long as it stays under Rs 306.50 it would remain under pressure and slide towards Rs 299 mark

Energy Outlook

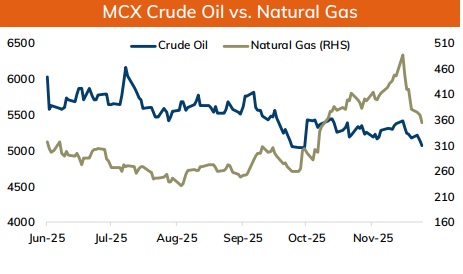

* Crude oil is expected to hold support near $55 per barrel and move towards $57 mark amid escalating tension in Venezuela. Further, total sanction on oil tankers linked to Venezuela would hurt global supplies. Meanwhile, upside in oil prices could be capped on growing optimism over Russia-Ukraine peace deal. The prospects of the deal have strengthened after US offered to provide NATO-style security guarantees for Ukraine. A peace deal would improve oil flows from Russia. Crude oil crack spread has hit 2-month lows signaling weaker demand from the oil refiners.

* On the data front, a strong put base at $55 would act as strong support. MCX Crude oil Dec is likely to consolidate in the band of Rs 5000 and Rs 5180 level. Only move below Rs 5000 it would turn weak.

* MCX Natural gas Dec is expected to weaken towards Rs 350 level as long as it trades under Rs 366 level. Forecast of above normal temperature in US would reduce heating demand

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631