MCX Silver Dec is expected to rise towards Rs 145,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to extend its rally towards $3900 per ounce level on concerns over US Government shutdown. The US shutdown is set to begin at midnight unless US Congress reaches a temporary funding deal. A delay in the funding deal would delay the release of key economic numbers from US. Price would also get support from geopolitical concerns and tariff uncertainty. Moreover, persistent buying from the central banks and increasing ETF inflows would support the yellow metals to hold above $3800 per ounce. Meanwhile, investors will eye on key US ADP Non-Farm employment data. Any sign of moderation in job growth likely to push bullion prices higher.

• MCX Gold December is expected to rise towards Rs 118,200 level as long as it stays above Rs 115,800 level

• MCX Silver Dec is expected to rise towards Rs 145,500 level. Key support for the December futures exists near Rs 140,000 level.

Base Metal Outlook

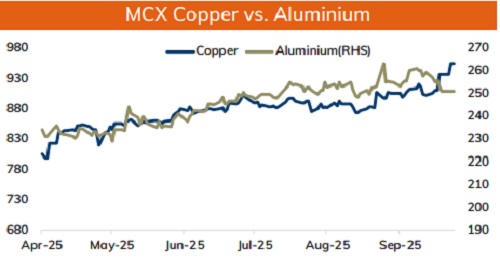

• Copper prices are expected to hold its ground and trade with a positive bias amid supply concerns and persistent decline in inventories at LME registered warehouses. Prices would also get support amid soft dollar and growing bets of further monetary policy easing from the US Fed. Meanwhile, expectation of contraction in the manufacturing activity in US and Eurozone would hurt demand outlook and restrict any major up move. Meanwhile, investors will keep an eye on US private payroll numbers as it could bring more volatility in metal prices.

• MCX Copper Oct is expected to hold its gains and rise back towards Rs 962 level as long as it stays above Rs 943 level. A move above Rs 964 would open the doors towards Rs 970 level

• MCX Aluminum Oct is expected to rise towards Rs 261 level as long as it stays above Rs 257 level.

• MCX Zinc Oct looks to rise towards Rs 292 as long as it holds the key support at Rs 284

Energy Outlook

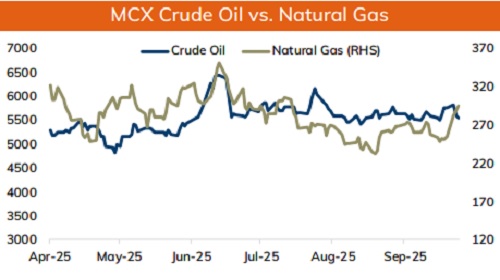

• Crude oil is likely to remain under pressure on expectation of another output hike form OPEC+ from November. OPEC in its upcoming meeting is likely to announce an increase in November output to reclaim its market share. Additionally, fears over US Government shutdown and expectation of sluggish job growth numbers would weigh on oil prices. Furthermore, any sign of Gaza peace deal could ease uncertainty and improve oil supplies from the Middle East. On the other hand, supply concerns from Russia on fears over sanction from NATO nations could limit its downside. Additionally, drawdown in API crude oil inventories would provide support to stay above $61 per barrel mark.

• MCX Crude oil Oct is likely to dip towards Rs 5480 level as long as it stays under Rs 5720 level. NYMEX crude oil is likely to slip towards $61, as long as it trades under $65 per barrel mark.

• MCX Natural gas Oct is expected to rise towards Rs 305 level as long as it stays above Rs 288 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631