MCX Natural gas May is expected to slip back towards Rs.298 level as long as it stays below Rs.318 level - ICICI Direct

Bullion Outlook

* Gold is expected to correct further towards $3190 level on expectation of recovery in dollar and rise in US treasury yields. Yields may move up on fears that US President Donald Trump tariffs on its major trading partners will fuel inflation in coming months, giving more space to US Federal Reserve to wait on cutting interest rates. Despite of having trade deals with major trading partners including China, tariffs are still going to be significantly higher than they were before. Further, demand for safe haven may fade as trade war fear recede. Moreover, all yes will be on budget and tax cut legislation discussion in congress

* Spot gold is likely to slip further towards $3190 level as long as it stays below $3270 level. MCX Gold June is expected to slip towards Rs.92,400 level as long as it stays below Rs.94,400 level

* MCX Silver July is expected to correct back towards Rs.95,000 level as long as it trades below Rs.97,700 level.

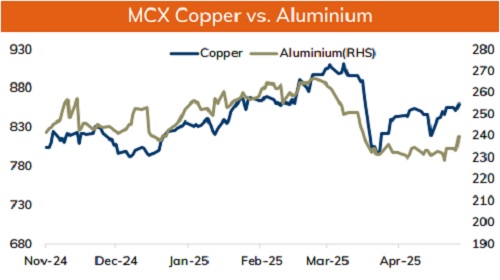

Base Metal Outlook

* Copper prices are expected to trade with positive bias on rise in risk appetite in the global markets and signs of improved demand from China . Yangshan copper premium, which reflects demand for copper imported into China, reached $101 per ton, indicating recovery in demand. Moreover, US and China paused their trade war for 90 days, bringing down reciprocal tariffs and removing other measures as well while negotiating a more permanent arrangement. Additionally, persistent decline in LME inventories will support prices. Meanwhile, eyes will be on economic data from China to gauge economic health of the country

* MCX Copper May is expected to rise towards Rs.865 level as long as it stays above Rs.849 level (20-Day EMA). A break above Rs.865 level prices may rise further towards Rs.870 level

* MCX Aluminum May is expected to rise towards Rs.242 level as long as it stays above Rs.237 level. MCX Zinc May is likely to move north towards Rs.258 level as long as it stays above Rs.252 level.

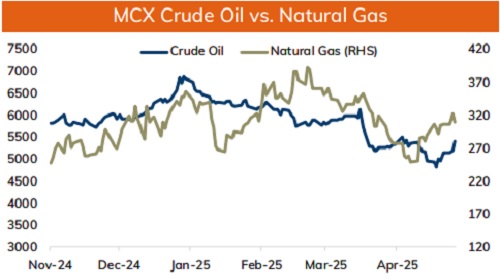

Energy Outlook

* NYMEX Crude oil is likely to correct back towards $62 on expectation of recovery in dollar, surprise jump in weekly crude oil inventories and concerns about oversupply. As per API figures US Crude oil inventories rose by 4.3M barrels for the week ending 9 th May. Moreover, any positive progress in nuclear deal with Iran, will raise expectations that sanctions on Iranian oil exports would be eased by US. Additionally, all eyes will be on developments on Russia-Ukraine talks in Turkey. Meanwhile, sharp fall may be cushioned as US and China agreed to lower tariffs temporarily, a move to cool trade tension between 2 largest economies and gave 3 more months to resolve differences

* MCX Crude oil June is likely to slip back towards Rs.5250 level as long as it stays below Rs.5500 level. On contrary, a break above Rs.5500 level prices may rally towards Rs.5600 level.

* MCX Natural gas May is expected to slip back towards Rs.298 level as long as it stays below Rs.318 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631