MCX Natural gas March is expected to hold the support near Rs 340 level and rise back towards Rs 365 level - ICICI Direct

Bullion Outlook

• Gold is expected to trade with positive bias amid weakness in dollar and decline in US treasury yields. Yields are moving south as weaker than expected economic data from US raised alarm that economic growth is slowing down, which may prompt US Federal Reserve to keep lowering interest rates. Additionally, demand for safe haven would go up amid concerns over global trade war after US President Donald Trump said that 25% tariffs on goods from Mexico and Canada will take effect on Tuesday and reciprocal tariffs would take effect on April 2 on countries that impose duties on US products and reaffirmed that tariffs on all Chinese imports will increase to 20% from previous 10% levy.

• Spot gold is likely to hold the support near $2865 level and rise towards $2920 level. MCX Gold April is expected to rise back towards ?85,900 level as long as it stays above Rs 84,800 level.

• MCX Silver May is expected to rise towards ?96,700 level as long as it trades above Rs 95,000 level.

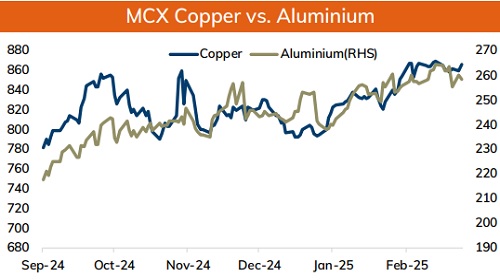

Base Metal Outlook

• Copper prices are expected to trade with negative bias amid risk aversion in the global markets. Further, prices may dip on concerns over global trade war, which may have adverse effect on economic growth denting demand for industrial metal. Additionally, investors fear that global trade war would fuel inflation making it difficult for major central banks across globe to continue with their easing monetary policy. Moreover, on supply side copper stocks in China rose toward 270,000 tonne mark, thrice the level from the start of the year.

• MCX Copper March is expected to slip towards Rs 860 level as long as it stays below Rs 871 level. A break below Rs 860 level copper prices may slip further towards Rs 857 level

• MCX Aluminum March is expected to correct further till Rs 256 level as long as it trades below Rs 260 level. MCX Zinc March is likely to slip back towards Rs 267 level as long as it stays below Rs 272 level

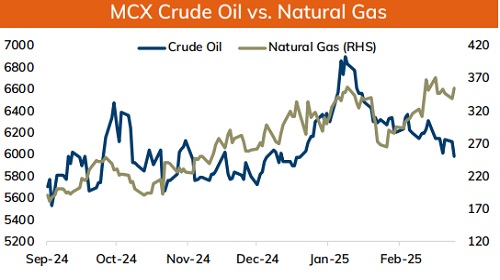

Energy Outlook

• NYMEX Crude oil is expected to trade with negative bias and slip further towards $67 level on weak global market sentiments. Further, prices may slip on worries that US trade policies would trigger global trade war hurting global economic growth and oil demand. Additionally, OPEC+ is likely to proceed with a planned April output increase. Moreover, risk premium is fading as Britain said several proposals had been made for a truce in fighting between Ukraine and Russia. Furthermore, there is a belief in the market that US may give Russia sanctions relief to restore ties with Moscow and put an end to the war in Ukraine

• MCX Crude oil March is likely to face stiff resistance near Rs 6120 level and slip further towards Rs 5850 level. A break below Rs 5850 prices may dip further towards ?5800 level.

• MCX Natural gas March is expected to hold the support near Rs 340 level and rise back towards Rs 365 level

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631