MCX Natural gas March is expected slip back towards Rs 380 level as long as it stays below Rs 400 level - ICICI Direct

Bullion Outlook

• Gold is expected to rise further towards $2930 level on weak dollar and softening of US treasury yields. Further, demand for safe haven may increase on concerns over global trade war. Investors fear that US tariffs on its major trading partners and retaliation from them would fuel global trade war hurting economic growth. US White house said a 25% tariffs on steel and Aluminium will go into effect for all US trading partners at midnight on March 12. Meanwhile, all eyes will be on inflation data from US to get more clarity on interest rate trajectory. Hotter than expected CPI data would evade the expectation of higher magnitude of monetary easing.

• Spot gold is likely to hold the support near $2890 level and rise towards $2930 level. A break above $2930 level prices may rally further towards $2950 level. MCX Gold April is expected to rise towards Rs 86,500 level as long as it stays above Rs 85,500 level.

• MCX Silver May is expected to rise further towards Rs 99,000 level as long as it trades above Rs 97,200 level.

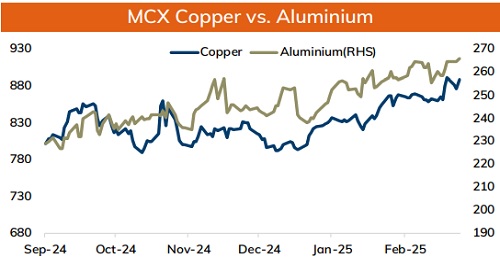

Base Metal Outlook

• Copper prices are expected to trade with positive bias amid weakness in dollar and improved market sentiments. Further, prices may rally on hopes of more stimulus packages from China to revive economic growth. Moreover, traders are worried that US President Donald Trump would impose tariffs on copper. Meanwhile, investors will keep an close eye on economic data from US to gauge economic health of the country and get cues on interest rate trajectory. Additionally, market fears that tit for tat approach increases the risk of global trade war, which may have adverse effect on economic growth denting demand for industrial metal.

• MCX Copper March is expected to rise further towards Rs 895 level as long as it stays above Rs 875 level. A break above Rs 895 level copper prices may rally further towards Rs 900 level

• MCX Aluminum March is expected to rise further towards Rs 268 level as long as it holds the support near Rs 264 level. MCX Zinc March is likely to move further north towards Rs 279 level as long as it stays above Rs 273 level

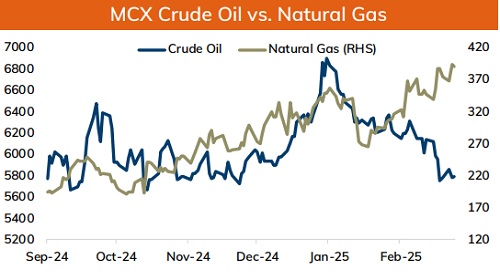

Energy Outlook

• NYMEX Crude oil is expected to trade with negative bias and slip further towards $65 level on larger than expected build in crude oil stockpiles. Furthermore, prices may slip on concerns over US economic slowdown and negative impact of US tariffs on global economic growth. Further, OPEC+ decision to increase oil output will continue to weigh on oil prices. Additionally, US EIA said crude oil production in US is poised to set a larger record this year. Moreover, risk premium would fade as Ukraine accepted US proposal for a ceasefire with Russia. If Russia also responds positively to the proposal than it would raise the expectation of Moscow's oil flowing in market freely

• MCX Crude oil March is likely to face stiff resistance near Rs 5910 level and slip back towards Rs 5700 level. A break below Rs 5700 prices may dip further towards Rs 5650 level.

• MCX Natural gas March is expected slip back towards Rs 380 level as long as it stays below Rs 400 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631