MCX Natural gas Jan is expected to face hurdle near Rs 340 and move lower towards Rs 310 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot gold is expected to move higher amid geopolitical risks. Tension between UAE and Saudi Arabia have widened into an unprecedented public confrontation. The rift escalated dramatically in late December 2025 due to a series of military and diplomatic clashes. Prices would also get support from increasing prospects of further monetary policy easing from the US Fed and safe haven buying. As per the CME Fed-watch tool March rate cut probability gone above 50%. Further, rising frictions between US and Venezuela continue to underpin gold’s defensive appeal. Spot gold is expected to move towards $4380, as long as it holds above $4300 mark.

• MCX Gold Feb is likely to move in a wider range of Rs 134,500 and Rs 137,200 with bullish bias. Only a move below Rs 134,500, it would correct towards Rs 132,500.

• MCX Silver March is expected to hold support at Rs 232,000 and rise towards Rs 242,000.

Base Metal Outlook

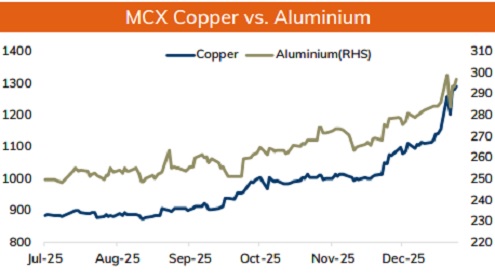

* Copper prices are expected to hold its ground and move higher, driven by a convergence of structural supply deficits and unprecedented demand from new-age industries. Production remains constrained by a major outage at Freeport's Grasberg mine in Indonesia and disruptions at Chile's El Teniente. Further, better than expected manufacturing activity from China would also bring optimism in prices. Rising copper premiums and planned output reduction for 2026 by China's leading copper smelters would support prices to move higher.

* MCX Copper January is expected to hold support near Rs 1260 and move higher towards Rs1325 level. Only move below Rs 1260 level it may fall towards Rs 1200 level.

* MCX Aluminum January is expected to hold support near Rs 294 and move towards Rs 301 level. Only a move below Rs 294 it would slip towards Rs 289-290 zone. MCX Zinc is likely to remain the band of Rs 303 and Rs 312. Only a move below Rs 303 it would turn bearish towards Rs 300.

Energy Outlook

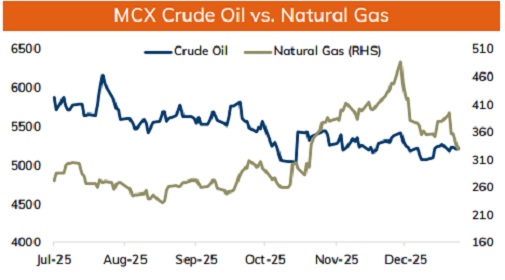

• NYMEX crude oil is expected to face hurdle near $58 per barrel and move lower towards $56 on sign of supply improvement and higher inventory levels in US. Meanwhile, renewed tension in the Middle East and ongoing geopolitical tension in Venezuela could counter improved supply outlook. Venezuela reportedly began shutting wells in a key oilrich region amid a US blockade aimed at financially pressuring the country. At the same time, no clear sign of peace negotiation between Russia and Ukraine could also limit downside. On the other hand, investors will await key outcome form OPEC+ meeting on this Sunday.

• MCX Crude oil Jan is likely to consolidate in the band of Rs 5180 and Rs 5300 level. Only move above Rs 5300 it would rise towards Rs 5380.

• MCX Natural gas Jan is expected to face hurdle near Rs 340 and move lower towards Rs 310 level. Forecast of warmer than expected weather in US could hurt its demand outlook.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631