MCX Gold Feb is expected to rise towards Rs 139,000 level as long as it stays above Rs 137,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to trade with the positive bias and rise towards $4500 level on weakness in dollar and softening of US treasury yields across curve. Further, prices may rally as weaker set of economic data from US has raised concerns over economic slowdown, bolstering hopes for more than 1 rate cut in 2026. Additionally, demand for safe haven may increase on escalating geopolitical tension in Eastern Europe, Middle East and Venezuela. Furthermore, US President Donald Trump has warned of another strike if Caracas resist US efforts to open up its oil industry and stop drug trafficking and signaled possible action against Colombia and Mexico. Moreover, prices may rally on strong central bank demand for gold and ongoing concern over Fed independence.

• MCX Gold Feb is expected to rise towards Rs 139,000 level as long as it stays above Rs 137,000 level.

• MCX Silver March is expected to rise towards Rs 251,000 level as long as it stays above Rs 243,000 level

Base Metal Outlook

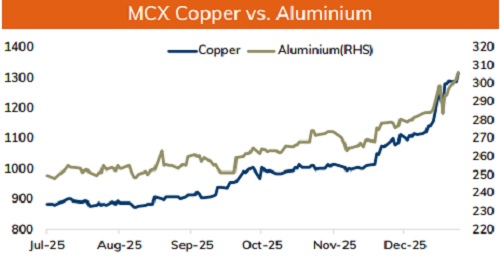

• Copper prices are expected to trade with a positive bias on weak dollar and optimistic global market sentiments. Further, prices may rally as weaker than expected economic data from US and dovish comments from Fed officials have reinforced expectations that the Fed will cut more than 1 rate cut in 2026. Moreover, prices may move north on supply concerns amid series of mine disruption and recurring protest. Additionally, projections for market deficit and low stock levels in LME registered warehouses would support prices

• MCX Copper Jan is expected to rise towards Rs 1330 level as long as it stays above Rs 1295 level. A break above Rs 1330 level may open doors for Rs 1340-Rs 1350 level

• MCX Aluminum Jan is expected to rise towards Rs 310 level as long as it stays above Rs 303 level. MCX Zinc Jan is likely to hold support near Rs 307 level and rise towards Rs 313 level

Energy Outlook

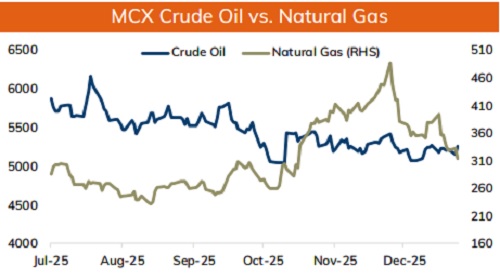

• NYMEX Crude oil is likely to trade with positive bias and rise towards $59 level on weak dollar and rise in risk appetite in the global markets. Further, prices may move up on escalating geopolitical tension in Eastern Europe and Venezuela. Russia launched 5 missile strikes on Ukraine’s city of Kharkiv, damaging energy infrastructure. Moreover, U.S. President Donald Trump warned U.S. interventions, suggesting Colombia and Mexico could face military action if they did not reduce the flow of illicit drugs. Moreover, OPEC+ decided to maintain their output

• WTI crude oil prices may move higher towards $59 level as long as it stays above $57.50 level. MCX Crude oil Jan is likely to rise towards Rs 5350-Rs 5370 level as long as it stays above Rs 5170 level.

• MCX Natural gas Jan is expected to slip towards Rs 300 level as long as it stays below Rs 330 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631