Gold rose in early Asian trade, supported by strong fundamentals driving investor interest - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

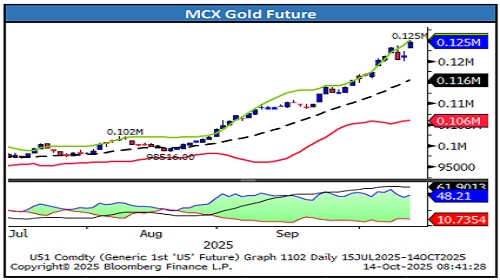

Gold prices edged higher in the early hours of the Asian trading session, supported by a strong fundamental backdrop that continues to drive investor interest in precious metals. The yellow metal is finding sustained demand amid growing macroeconomic uncertainties, with market participants increasingly turning to safe-haven assets like gold and silver.

Gold Silver ratio hovering near 78 is down from that peak, but still well above the long-term average, and miles away from the lows seen in previous secular bull runs. Now, Silver trades at a 3% discount to Gold. Fair value remains about 70% higher at $86/oz Silver. Probability and math suggest we still have a long way to go.

Copper edges lower but may be supported by tight supply and resilient demand across base metals. Chile's Codelco has warned that its El Teniente mine will run below capacity for the next several months, tightening copper supply. Meanwhile, demand from China remains strong, with refined copper imports climbing to 485,000 tons lately, the highest level this year. China's imports of copper concentrate also remained robust at 2.59 million tons, they add.

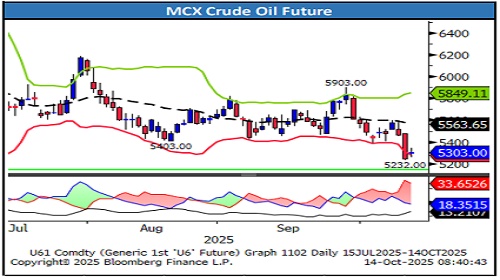

Crude oil prices rebounded on Tuesday after trimming losses from the week’s opening session, as markets attempt to balance the competing forces of renewed US-China trade tensions and ongoing concerns about global oil demand. While the bounce offers some shortterm relief for oil bulls, the medium-term outlook remains clouded by geopolitical tensions and demand-side uncertainties.

Asian shares retreated and US equity-index futures pared gains as a revival in risk appetite lost momentum, with MSCI’s gauge of Asian shares falling 0.4%. The S&P 500 jumped 1.6% to extend a bull market that’s already added $28 trillion to its value.

* Trading Range: 12300 to 127000

* Intraday Trading Strategy: Buy Gold Dec Fut at 124500-124700 SL 124100 Target 125800

Silver

• Trading Range: 15100 to 158500

• Intraday Trading Strategy: Buy Silver Dec. Fut. At 154900-155100 SL 152900 Target 157500

Crude Oil

* Trading Range: 5230 to 5560

* Intraday Trading Strategy: Sell Crude Oil Oct Fut between 5350- 5380 SL 5430 Target 5250

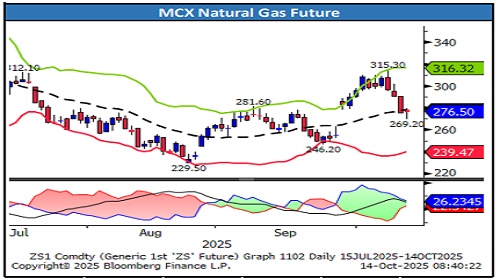

Natural Gas

* Trading Range: 268 to 289

* Intraday Trading Strategy: Sell Natural Gas Oct Fut at 273 SL 278 Target 265

Copper

* Trading Range: 970 to 1030

* Intraday Trading Strategy: Buy Copper Oct Fut at 990 SL 970 Target 1020

Zinc

* Trading Range: 285 to 298

* Intraday Trading Strategy: Sell Zinc Oct Fut below 291 SL 295 Target 285

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133