MCX Gold April is expected to slip further towards Rs146,000-Rs144,000 level as long as it stays below Rs156,000 level - ICICI Direct

Bullion Outlook

• Spot Gold is likely to trade with negative bias amid strong dollar. Additionally, demand for safe haven may decline amid ease in geopolitical tension in Middle East following US and Iran agreeing to hold talks in Oman despite of differences about the agenda. Even the White house said that diplomacy is President Donald Trump's first choice for dealing with Iran and he will wait to see whether a deal can be struck at high-stakes talks. Meanwhile, softening of US treasury yields following signs of weakness in labor market conditions would prevent further downside in prices. Labor market weakness would typically strengthen the case for interest rate cuts

• MCX Gold April is expected to slip further towards Rs146,000-Rs144,000 level as long as it stays below Rs156,000 level.

• MCX Silver March is expected to slip towards Rs225,000-Rs218,000 level as long as it stays below Rs265,000 level.

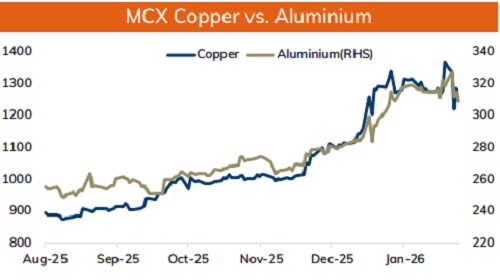

Base Metal Outlook

• Copper prices are expected to trade with negative bias amid strong dollar and pessimistic global market sentiments. Further, prices may slip as inventories rose at major trading hubs in Shanghai, London, and New York, signaling weak demand. Furthermore, Yangshan copper premium, which reflects Chinese appetite for imported copper, was at $37 a ton, compared with above $40 entering January. Additionally, expectation of unsatisfactory economic data from major economies would weigh on copper prices

• MCX Copper Feb is expected to slip towards Rs1200 level as long as it stays below Rs1260 level. A break below Rs1200 level prices may be pushed towards Rs1190-Rs1180 level

• MCX Aluminum Feb is expected to slip towards Rs 300 level as long as its stays below Rs 312 level. MCX Zinc Feb is likely to face stiff resistance near Rs 323 level and slip further towards Rs 316 level

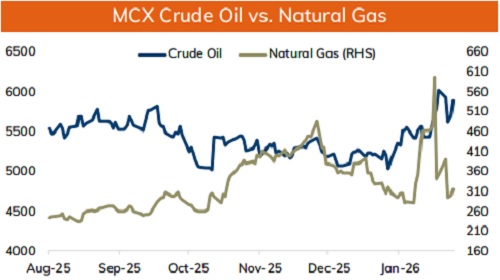

Energy Outlook

• NYMEX Crude oil is likely to trade with negative bias on strong dollar and risk aversion in the global markets. Further, concerns over supply disruption eased after US and Iran agreed to hold talks in Oman. Further, expectation of disappointing economic data from major countries will hurt demand outlook. Moreover, discounts on Russian oil exports to China widened to new records this week as sellers cut prices to attract demand and offset likely loss of Indian sales

• NYMEX crude oil prices likely to slip further towards $61.50 level as long as it stays below $64. MCX Crude oil Feb is likely to slip towards Rs 5600-Rs 5550 level as long as it stays below Rs 5900 level.

• Natural gas prices likely to rise amid record withdrawal. As per EIA report natural gas inventories fell -360 bcf in the week ended January 30. MCX Natural gas Feb is expected to rise towards Rs 340 level as long as it stays above Rs 295 level. A break above Rs 340 level prices may rise towards Rs 355 level

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631