MCX Crude oil November is likely to slip towards Rs 4900, as long as it trades under Rs 5140 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to trade lower amid strong dollar and easing USChina trade tension. Recent comment from the US President Donald Trump has opened the doors for negotiation as he signaled that 100% additional tariff on China is not sustainable. Additionally, easing US regional bank debt concerns and Middle East tenson would bring further correction in the yellow metal. Meanwhile, dovish comments from the US Fed members on concerns over US labor market and steady inflation numbers has increased the prospects of lose monetary policy. Prices would also get support from economic uncertainty and ongoing US Government shutdown.

• Spot gold is likely to face hurdle near $4300 and move lower towards $4180. MCX Gold December is expected to face resistance at Rs 129,500 level and move back towards Rs 125,500 level.

• MCX Silver Dec is expected to correct towards Rs 152,000 level as long as it trades under Rs 158,000 level.

Base Metal Outlook

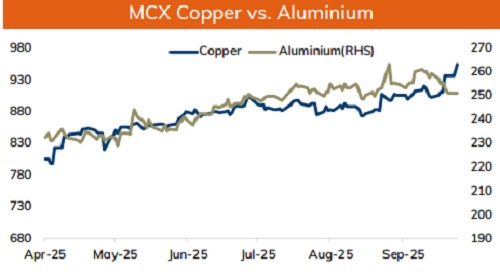

• Copper prices are expected to hold its ground and move higher amid easing US-China trade tensions. Further supply concerns and increasing prospects of US Fed rate cut would help metal regain its strength. Dovish comments from the US Fed chair Jerome Powell and other Fed members have increased the probability of 2 rate cuts in this year. Meanwhile growing bets of copper exports from Chinese smelters to gain price disparity between LME and SHFE would restrict any major upside in the metal. Furthermore, slowdown in China and weakness in new home prices could restrict any major up move in the metal. China’s GDP dropped to 4.8% q/y from previous reading of 5.2%.

• MCX Copper Oct is expected to hold support near Rs 978 and move back towards Rs 1000 level.

• MCX Aluminum Oct is expected to rise towards Rs 264 level as long as it stays above Rs 260 level.

• MCX Zinc Oct looks to rise towards Rs 294 as long as it holds key support at Rs 287. Only below Rs 287 it would correct towards Rs 283.

Energy Outlook

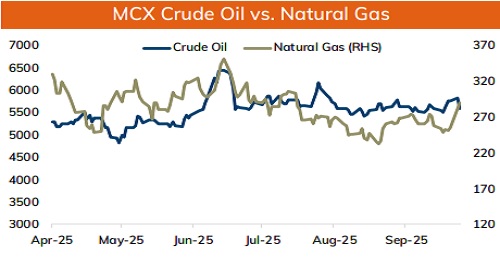

NYMEX Crude oil is likely to remain under pressure amid concerns over higher global supplies and easing geopolitical tension in the Middle East. The latest projection from IEA has signaled a market surplus amid rising production from OPEC+ members. At the same time, cooling tension in the Middle East would ease risk premiums and improve supply from the region. In addition to that US Govt. shutdown and economic uncertainties likely to weigh on oil prices. On the other hand, UK’s sanction on Russia’s oil sector and easing US-China trade tension could limit its decline.

• MCX Crude oil November is likely to slip towards Rs 4900, as long as it trades under Rs 5140 level. NYMEX crude oil is likely to move towards $55, as long as it trades under $58 per barrel.

• NYMEX Natural Gas is expected to move higher on cooler US weather forecast. MCX Natural gas Oct is expected to rise towards Rs 275 level as long as it holds above Rs 258 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631