MCX Crude oil June is likely to rise towards Rs 5500 level as long as it stays above Rs 5250 level - ICICI Direct

Bullion Outlook

• Gold is expected to rise further towards $3350 level on weakness in dollar and softening of short-term U.S. treasury yields. Dollar is losing steam due to concerns over ballooning fiscal debt, trade frictions, and weakened confidence. Moreover, demand for safe haven may increase on escalating geopolitical tension in Middle East and uncertainty over U.S. tariff polices. As per Media report, new intelligence obtained by the U.S. suggests that Israel is making preparations to strike Iranian nuclear facilities. Moreover, all eyes will be on critical vote in Washington over U.S. President Donald trump sweeping tax cuts which would add $3 trillion to $5 trillion to the debt. Investors are worried over ballooning fiscal debt and interest expenses.

• Spot gold is likely to rise further towards $3350 level as long as it stays above $3240 level. MCX Gold June is expected to rise towards Rs 95,500 level as long as it stays above Rs 93,500 level

• MCX Silver July is expected to rise towards Rs 98,000 level as long as it trades above Rs 95,500 level.

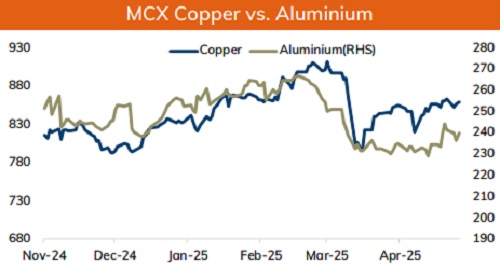

Base Metal Outlook

• Copper prices are expected to trade with positive bias on weakness in dollar and persistent decline in LME inventories. Additionally, China cut benchmark lending rates for the first time since October. Authorities eased monetary policy to protect Chinese economy from the impact of trade war. Meanwhile, sharp upside may be capped on cautious remarks about the U.S economy by Federal Reserve officials and uncertainty over U.S tariff policy. Investors fear that uncertainty over U.S. President Donald Trump policies could hurt economic growth as it would force household and businesses to put a pause on their spending and investment decisions

• MCX Copper May is expected to rise towards Rs 865 level as long as it stays above Rs 848 level. On contrary, a break below Rs 848 level prices may slip further towards Rs 842 level

• MCX Aluminum May is expected to rise further towards Rs 243 level as long as it stays above Rs 237 level. MCX Zinc May is likely to move north towards Rs 263 level as long as it stays above Rs 257 level.

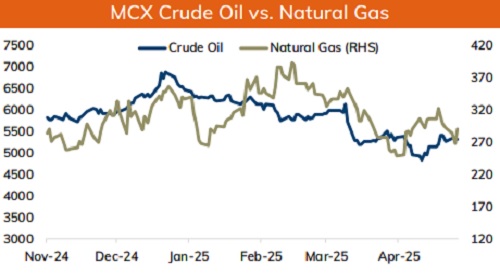

Energy Outlook

• NYMEX Crude oil is likely to rise further towards $64 on weakness in dollar and escalating geopolitical tension in Middle East. As per Media report, new intelligence obtained by the U.S. suggests that Israel is making preparations to strike Iranian nuclear facilities. Although it is unclear whether Israel has made a final decision but report will raise concern about potential supply disruption in Middle East region. Investors fear that Iran may retaliate by closing vital Strait of Hormuz, through which Saudi Arabia, Kuwait, Iraq and UAE export crude oil and fuel. Additionally, doubt over the progress of US-Iran nuclear negotiations and uncertainty surrounding ceasefire talks between Russia and Ukraine will support prices

• MCX Crude oil June is likely to rise towards Rs 5500 level as long as it stays above Rs 5250 level.

• MCX Natural gas June is expected to rise further towards Rs 335 level as long as it stays above Rs 310 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631