MCX Silver July is expected to rise towards Rs 107,400 level, as long as it holds above Rs 104,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to rise towards $3450 amid safe haven buying. Escalating geopolitical tension in the Middle East would bring safe haven demand in the bullions. Israel’s preemptive strike against Iran, has raised a significant threat on wider Middle East conflict. Safe haven demand will get further boost amid growing uncertainty over US trade policy. At the same time, softer than expected US inflation data has raised the bets of September rate cut. Meanwhile, all focus will remain on Middle East situation.

• Spot gold has breached the psychological mark at $3400 and moved higher. It is expected to extend its rally towards $3450. A break above $3450 would open the doors towards $3500. MCX Gold Aug is expected to rise towards Rs 99,300 as long as it trades above Rs 97,500 level. A move above Rs 99,300 would take price towards Rs 100,000 mark

• MCX Silver July is expected to rise towards Rs 107,400 level, as long as it holds above Rs 104,000 level. Only below Rs 104,000, it would turn bearish

Base Metal Outlook

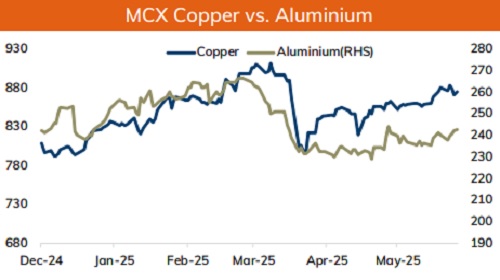

• Copper prices may trade lower amid risk off sentiments due to escalating geopolitical tension in the Middle East. Further, sluggish industrial demand from China would likely to restrict any major upside in prices. Additionally, Chinese smelters are trying to export spot cargoes to take advantage of higher international price. On the other hand, tariff uncertainty specially import duty on Copper could provide some support to the metal. Further, backwardation in LME indicates tightness in the market.

• MCX Copper June is expected to move in the band of Rs 868 and ?884 level with weaker bias. A move below Rs 868, would open the downside towards Rs 860.

• MCX Aluminum June is expected to rise towards Rs 244, as long as it holds above Rs 240 level. MCX Zinc June is likely to find support near Rs 250 level and rebound towards Rs 255 level. A move below Rs 250, would bring correction towards Rs 248.

Energy Outlook

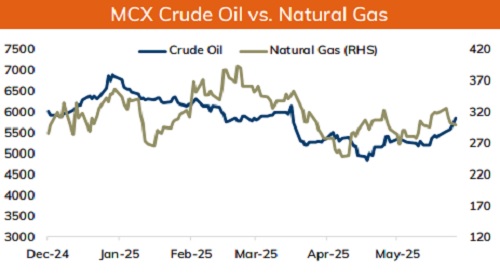

• Crude oil is likely to extend its rally towards $75 per barrel amid rising tension between Iran and Israel, which could threaten global oil supplies. The Middle East region is the key supply zone, which would hurt oil supplies. Further, no clear sign of any deal between US and Iran could bring more sanctions on Iranian oil. Additionally, increasing probability of lower rates by the US Fed in September would also bring some buying interest in oil.

• On the data front unwinding of OI at 70 strike call suggest more upside. Next key hurdle is at $75 mark. Furthermore, put addition also observed at 70 strike. MCX Crude oil July is likely to rise towards ?6050 as long as it trade above Rs 5800 level. A move above Rs 6050 would open the doors towards Rs 6300.

• MCX Natural gas June is expected to move in the band of Rs 295 and Rs 315. Only a move above Rs 315 would bring fresh buying interest in gas prices and push it towards Rs 325

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631