MCX Crude oil July is likely to slip towards Rs 5600 level as long as it stays below Rs 5800 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to slip towards $3280 level amid strong dollar and rise in U.S treasury yields. Stronger than expected economic data from US signaled resilience in the economy, giving more room for US Fed to hold rates steady. As per CME Fedwatch tool, market expectations that the Fed will leave rates unchanged at its July meeting rose to a 94.8% probability, up from 76.2% a day ago. Additionally, investors are worried that despite of having trade deals with major trading partners, tariffs are still going to be significantly higher than they were before, fueling inflationary fears. Meanwhile, demand for safe haven may increase on concerns over rising U.S government debt and uncertainty surrounding trade deal between US and its key trading partners

• Spot gold is likely to slip back towards $3280 level as long as it stays below $3360 level. MCX Gold Aug is expected to slip towards Rs 96,000 level as long as it stays below Rs 97,500 level

• MCX Silver Sep is expected to rise towards Rs 109,500 level as long as it trades above Rs 107,200 level.

Base Metal Outlook

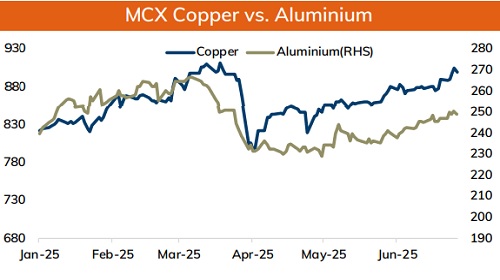

• Copper prices are expected to trade with negative bias amid strong dollar as better-than-expected job report, cemented expectations that US Fed may not immediately cut interest rates. Further, prices may slip on uncertainty surrounding trade deal. Several large trading partners of US including EU and Japan have yet to finalize deal ahead of deadline of 9 th July. Meanwhile, sharp fall in prices may be cushioned on worries over supply disruption in Peru and expectation of more stimulus packages from China to boost domestic consumption.

• MCX Copper July is expected to slip further towards ?890 level as long as it stays below Rs 906 level. A break below Rs 890 level prices may slide further towards Rs 885 level

• MCX Aluminum July is expected to slip towards Rs 247 level as long as it stays below Rs 251 level. MCX Zinc July is likely to move north towards Rs 259 level as long as it stays above Rs 256 level.

Energy Outlook

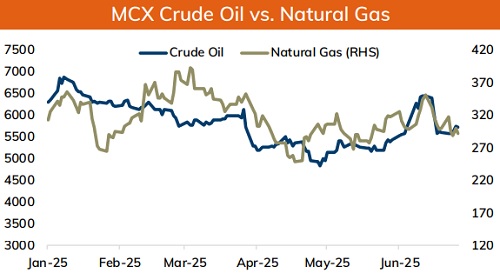

• Crude oil is likely to slip further towards $66 amid strong dollar followed by better-than-expected economic data from US. Solid job data from U.S cemented expectations that Fed would hold rates steady for more duration then anticipated. Moreover, investors are worried that U.S. tariffs could hurt economic growth, slowing energy demand ahead of an expected supply boost by major crude producers. US President Donald Trump said Washington will start sending letters to countries specifying what tariff rates they will face on goods sent to the U.S. Meanwhile, sharp fall may be cushioned as U.S. imposed new sanctions on Iran as well as sanctions targeting the Hezbollah network

• MCX Crude oil July is likely to slip towards Rs 5600 level as long as it stays below Rs 5800 level.

• MCX Natural gas July is expected to slip towards Rs 280 level as long as it stays below Rs 302 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631