MCX Crude oil June is likely to rise towards Rs 5450 level as long as it stays above Rs 5200 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to slip further towards $3200 level on strong dollar and surge in U.S. treasury yields. Further, demand for safe haven may decline on reduce tariff risk. A U.S. trade court found U.S President exceeding his authority in imposing reciprocal tariffs and has blocked Trump's tariffs from going into effect. Trump administration has filed a notice of appeal and questioned the authority of the court. Meanwhile, sharp fall may be cushioned on expectation of weak economic data from U.S, signaling slowdown in economic growth. Additionally, investors will keep an eye on speeches from FOMC member to get more clarity on rate trajectory

• Spot gold is likely to slip towards $3200 level as long as it stays below $3300 level. MCX Gold June is expected to slip further towards Rs 94,000 level as long as it stays below Rs 95,800 level

• MCX Silver July is expected to rise towards ?98,500 level as long as it trades above Rs 96,500 level. A break above Rs 98,500 level prices may rise further towards Rs 99,500 level

Base Metal Outlook

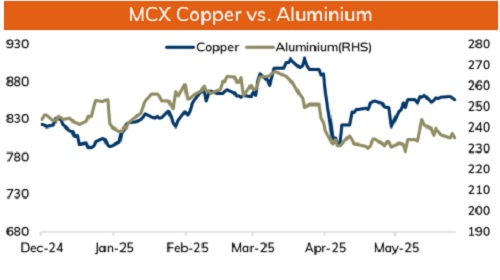

• Copper prices are expected to trade with negative bias on strong dollar and signs of weaker Chinese demand. Easing import demand from China, the Yangshan copper premium fell 5% to $89 a ton, lowest since April 24. Additionally, as per International Copper Study Group over the first 3 months of 2025, the world refined copper market showed preliminary surplus of about 289,000t compare to the surplus of about 268,000t in the same period of 2024. Meanwhile, sharp downside would be cushioned on rise in risk appetite in the global markets after U.S trade court blocked U.S. President Donald Trump from imposing reciprocal tariffs, a potential reprieve for global trade

• MCX Copper June is expected to slip further towards Rs 856 level as long as it stays below Rs 870 level. On contrary, a break above Rs 870 level prices may rally further towards Rs 875 level

• MCX Aluminum June is expected to rise back towards Rs 241 level as long as it stays above Rs 236 level. MCX Zinc June is likely to move north towards Rs 258.50 level as long as it stays above Rs 254.0 level.

Energy Outlook

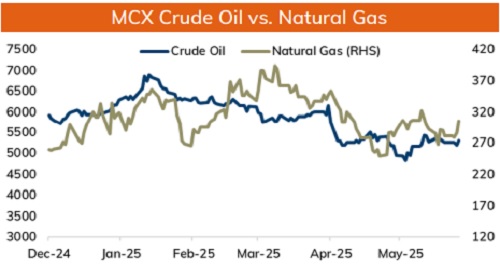

• Crude oil is likely to rise further towards $63.50 level on optimistic global market sentiments and concerns over tighter supply as U.S. barred Chevron from exporting crude from Venezuela. Further, market participants are worried over potential new U.S. sanctions on Russia curbing crude flows. On top of it, U.S. court blocked President Donald Trump’s tariffs from taking effect, easing trade war concerns and its impact on economic growth. Meanwhile, OPEC+ agreed to leave their output policy unchanged, but now market will focus on meeting of 8 member of group, that had been carrying on their own individual production cuts. Group is likely to accelerate their oil production hikes in July

• MCX Crude oil June is likely to rise towards Rs 5450 level as long as it stays above Rs 5200 level.

• MCX Natural gas June is expected to slip towards Rs 295 level as long as it stays below Rs 315 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631