MCX Crude oil Dec is likely to slip towards Rs 5250 level as long as it stays below Rs 5410 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to move further south towards $3980 level amid strong dollar and rise in US treasury yields across curve. Further, prices may slip as increasing number of Fed policymakers have maintained hawkish stance on policy, dimming hopes for December rate cut. Additionally, investors fear that longest government shutdown has created gaps in economic data and it will take time to gather and publish it. They are also worried over the quality of releases. As per CME FedWatch tool traders are now pricing a 42% chance of a rate cut in December, down from about 62% a week ago.

* MCX Gold Dec is expected to slip further towards Rs121,500 level as long as it stays below Rs124,000 level. A break below Rs121,500 will open doors for Rs120,500

* MCX Silver Dec is expected to slip further towards Rs 152,000 level as long as it stays below Rs157,000 level. A break below Rs152,000 level prices may slip further towards Rs150,000

Base Metal Outlook

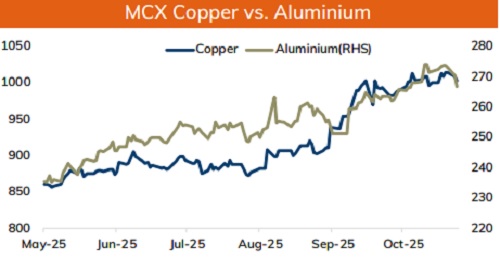

* Copper prices are expected to trade with a negative bias on strong dollar and pessimistic global market sentiments. Further, prices may slip as disappointing economic data from China has raised concerns over demand outlook. Recent industrial data has been lacklustre. Additionally, Yangshan copper premium, a gauge of China's appetite for importing copper dropped to $32 a ton from $58 in late September. Moreover, prices may move south as hopes for rate cut from US Federal Reserve faded after growing numbers of Fed policymakers signaled restraint on further easing

* MCX Copper Nov is expected to slip towards Rs 995 level as long as it stays below Rs 1012 level. A break below ?995 level may open doors for Rs 992-Rs990 level

* MCX Aluminum Nov is expected to slip towards Rs 264 level as long as it stays below Rs 269.50 level. MCX Zinc Nov is likely to move south towards Rs 299 level as long as it stays below Rs 305.0 level

Energy Outlook

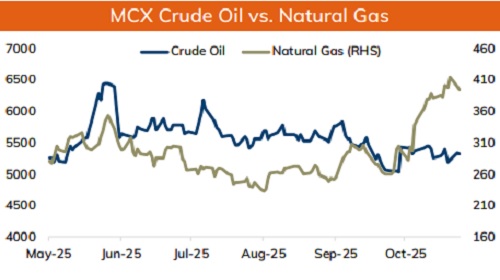

* Crude oil is likely to trade with negative bias and slip towards $58.50 amid strong dollar and risk aversion in the global markets. Further, disappointing economic data from China has raised concerns over demand outlook. Moreover, investors will remain cautious ahead of slew of economic data from US that was delayed during the government shutdown and it is expected to provide clues on the health of the economy. Additionally, prices may slip as concerns over supply disruption from Russia's key oil export port of Novorossiysk eased as loadings resumed. Furthermore, concerns about global oversupply would weigh on looming sanctions against Russia’s Lukoil. In addition, hawkish comments from US Fed officials fade hopes for another rate cut in December meeting

* MCX Crude oil Dec is likely to slip towards Rs 5250 level as long as it stays below Rs 5410 level.

* MCX Natural gas Dec is expected to correct towards Rs 403 level as long as it stays below Rs 422 level

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631