MCX Crude oil Dec is likely to rise towards Rs 5420 level as long as it stays above Rs 5250 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to correct further towards $4020 level amid rise in US treasury yields and strong dollar. Further, prices may slip as hawkish comments from Fed officials has dim hopes for December rate cut. More Fed officials are signaling caution over further easing, citing worries about inflation. Additionally, investors fear that longest government shutdown which ended recently has created gaps in economic data and it will take time to gather and publish it. As per CME FedWatch tool traders are now pricing a 45.8% chance of a rate cut in December, down from about 66.9% a week ago. Meanwhile, sharp fall in the prices may be cushioned on rise in demand for safe haven amid geopolitical tension.

* MCX Gold Dec is expected to slip further towards Rs 121,800 level as long as it stays below Rs 124,800 level. A break below Rs 121,800 will open doors for Rs 121,000

* MCX Silver Dec is expected to slip further towards Rs 153,000 level as long as it stays below Rs 158,000 level

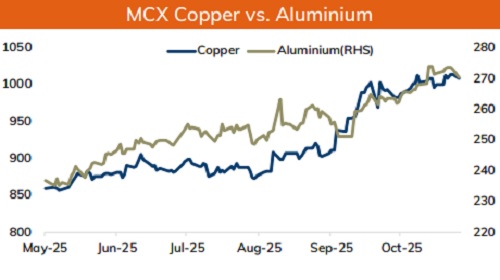

Base Metal Outlook

* Copper prices are expected to trade with a negative bias on risk aversion in the global markets and strong dollar. Further, prices may slip as disappointing economic data from China raised concerns over demand outlook. China's factory output and retail sales grew at their weakest pace in over a year in October, while new home prices fell to the steepest since October 2024. Moreover, prices may move south as hopes for rate cut from US Federal Reserve faded after growing numbers of Fed policymakers signaled restraint on further easing

* MCX Copper Nov is expected to slip towards Rs 998 level as long as it stays below Rs 1015 level. A break below Rs 998 level may open doors for Rs 995-Rs 992 level

* MCX Aluminum Nov is expected to slip towards Rs 269 level as long as it stays below Rs 271.50 level. MCX Zinc Nov is likely to move south towards Rs 301 level as long as it stays below Rs 305.0 level

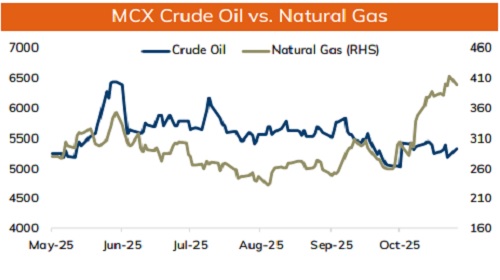

Energy Outlook

* Crude oil is likely to trade with positive bias and rise back towards $60.50 on concerns over supply disruption after Ukraine launched drone and missile attacks on Russian energy infrastructure. It attacked Russia's key oil export port of Novorossiysk and Rosneft Saratov refinery in Russia's Volga region. Further, prices may rise on looming sanctions against Russia’s Lukoil. Investors fear that market may witness further disruption to Russian export flows once sanctions kick in. The sanctions prohibit transactions with the Russian company after November 21. Moreover, Iran confirmed that it has seized a tanker in Strait of Hormuz, adding to concerns about safety of ships in that region

* MCX Crude oil Dec is likely to rise towards Rs 5420 level as long as it stays above Rs 5250 level.

* MCX Natural gas Nov is expected to correct towards Rs 388 level as long as it stays below Rs 408 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Sell Silver Mar @ 246500 SL 248500 TGT 244000-242800. MCX - Kedia Advisory