MCX Crude oil Dec is likely to rise back towards Rs 5350 level as long as it stays above Rs 5180 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to correct further towards $4120 level amid rise in US treasury yields. Further, investors bet on rate cut in December meeting took a dive after hawkish comments from Fed officials. Boston Fed President Susan Collins, Cleveland Fed President Beth Hammack, and St. Louis Fed President Alberto Musalem all said they favored keeping interest rates steady. As per CME FedWatch tool traders are now pricing a 50.7% chance of a rate cut in December, down from about 62.9% a day ago. Meanwhile, sharp fall in the prices may be cushioned on strong central bank demand for gold and as the concern over Fed independence resurfaced.

* MCX Gold Dec is expected to correct further towards Rs 125,000 level as long as it stays below Rs 127,800 level. A break below Rs 125,000 will open doors for Rs 124,000

* MCX Silver Dec is expected to slip further towards Rs 159,000 level as long as it stays below Rs164,000 level.

Base Metal Outlook

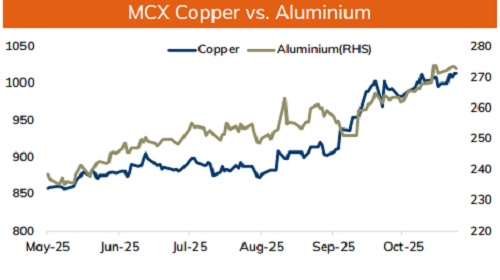

* Copper prices are expected to trade with a negative bias on risk aversion in the global markets and weak lending data from China. Outstanding total social financing (TSF) grew at its slowest pace in seven months in October and New loans by Chinese banks also fell sharply from the previous month. Moreover, investors will remain cautious ahead of slew of economic data from China including new home prices, retail sales and industrial output, that could help to gauge demand prospects.

* MCX Copper Nov is expected to slip towards Rs1004 level as long as it stays below Rs1021 level. A break below Rs1004 level may open doors for Rs1000-Rs998 level

* MCX Aluminum Nov is expected to slip towards Rs270 level as long as it stays below Rs 274.50 level. MCX Zinc Nov is likely to move south towards Rs 302 level as long as it stays below Rs308.0 level

Energy Outlook

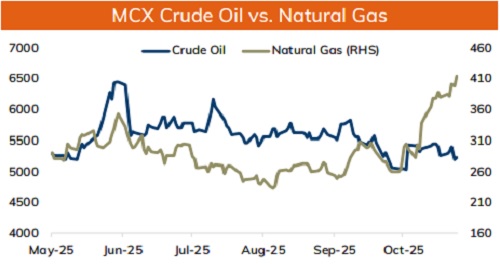

* Crude oil is likely to trade with positive bias and rise towards $60 on weakness in dollar and reopening of US government. Further, prices may rise on looming sanctions against Russia’s Lukoil. Investors fear that market may witness disruption to Russian export flows once sanctions kick in. The sanctions prohibit transactions with the Russian company after November 21. Meanwhile, sharp upside may be capped as EIA report showed larger than expected rise in crude oil stockpiles. Crude inventories rose by 6.4 million barrels to 427.6 million barrels in the week ended 7 th November. Additionally, OPEC said it expects the supply surplus next year. While, EIA raised its global oil supply growth forecasts for this year and next.

* MCX Crude oil Dec is likely to rise back towards Rs 5350 level as long as it stays above Rs 5180 level.

* MCX Natural gas Nov is expected to rise towards Rs 420 level as long as it stays above Rs 400 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631