MCX Copper November is expected to hold support near Rs.999 and move back towards Rs.1020 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is hovering near the $4000 per ounce mark. For the day it is expected to face resistance near $4050 and move lower towards $3950 on easing safe haven buying. Optimism over US-China trade deal and outflow from gold backed ETF’s likely to weigh on prices. Meanwhile, focus will shift towards this week key central bank policies from US Fed, ECB and BOJ. US Fed is likely to lower the rates by 25 bps this week. ECB and BOJ is most likely to hold rates steady. SPDR Gold Trust, the world’s largest gold-backed ETF, said its holding fell by 0.77% to 1038.92 tons on Monday from 1046.93 tons last week.

* Spot gold is likely to face hurdle near $4050 and move lower towards $3950. MCX Gold December is expected to face resistance at Rs.122,500 level and move back towards Rs.119,200 level.

* MCX Silver Dec is expected to face hurdle near Rs.145,500 level and correct towards Rs.141,000 level.

Base Metal Outlook

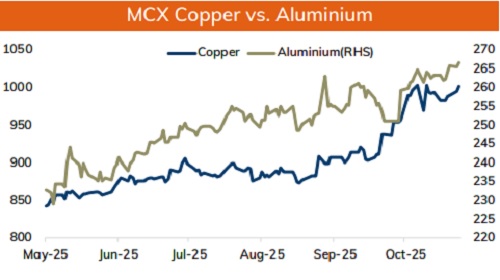

* Copper prices are expected to hold its gains and move higher amid persistent supply concerns. Optimism over US-China trade deal has eased fears of trade driven volatility. Top official from China and US has set the framework of a trade deal for both the President’s to finalize the deal, which will pause steeper US tariffs and China’s planned export controls on rare earths. Additionally, depleting inventory levels in LME and expectation of fresh round of stimulus from China would support the bullishness in the metal. Prices would also get support on higher probability of 25 bps rate cut from the US Fed.

* MCX Copper November is expected to hold support near Rs.999 and move back towards Rs.1020 level.

* MCX Aluminum November is expected to rise towards Rs.272 level as long as it stays above Rs.267 level.

* MCX Zinc November looks to rise towards Rs.304 as long as it holds key support at Rs.295. Depleting inventory levels in LME would likely to support prices.

Energy Outlook

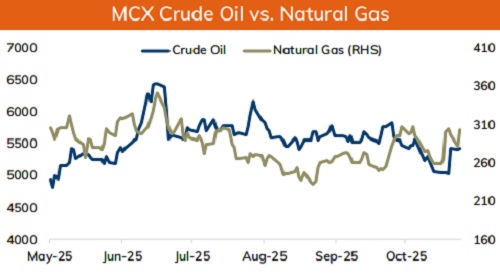

* NYMEX Crude oil expected to face resistance near $62.70 and move back towards key support at $60 per barrel on growing prospects of higher OPEC+ supply. OPEC in its upcoming meeting is expected to increase the oil output by 137,000 barrels per day in December. Meanwhile, improved risk sentiments and easing trade tensions between US and China would limit downside in prices. Moreover, interest rate cut by the US Fed in its upcoming meeting would limit the downside in oil prices.

* On the data front , a strong put base at $60 strike indicates NYMEX crude to hold strong support. On the upside $65 call strike has higher OI concentration which may act as key hurdle. MCX Crude oil November is likely to consolidate in the band of Rs.5280 and Rs.5550 in the near term.

* NYMEX Natural Gas is expected to move higher on colder weather forecast. MCX Natural gas November future is expected to move towards Rs.364 as long as it stay above Rs.344 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631