MCX Copper April is expected to rise further towards Rs.925 level as long as it stays above Rs.908 level - ICICI Direct

Bullion Outlook

* Gold is expected to rise back towards $3040 level on weakness in dollar and US treasury yields. Further, demand for safe haven may increase on concerns that US President Donald trump tariff policies will ignite potential global trade war, hurting economic growth and fueling inflation. Moreover, recent consumer confidence data showed uncertainty surrounding US President Donald Trump policies weighing heavily on households. Additionally, expectation of disappointing economic data from US will be supportive for the prices. Meanwhile, hawkish comments from Fed officials will cap sharp up move in prices.

* Spot gold is likely to rise towards $3040 level as long as it stays above $3000 level. on contrary, break below $3000 level prices may slip further towards $2980/$2960 levels. MCX Gold April is expected to rise towards Rs.88200 level as long it holds the support near Rs.87200 level

* MCX Silver May is expected to rise further towards Rs.100,800 level as long as it trades above Rs.98,000 level.

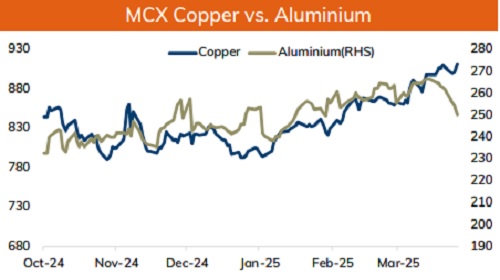

Base Metal Outlook

* Copper prices are expected to trade with positive bias on weakness in dollar and rise in risk appetite in the global market. Further, prices may rise on fears over hefty import duty on industrial metal and on reports that Glencore Plc temporarily suspended copper shipments from its Altonorte smelter after an issue affecting the plant’s furnace. After US President Donald Trump Ordered US Commerce Department to conduct a probe into possible copper tariffs, spread between front-month Comex and LME prices reached an all time high. Widening of spread suggest expectation for tariffs going higher, leading to massive amount of flow in US, leaving rest of global market short. China’s Yangshan premium, an indicator of import demand, rose to $75 per ton, indicating recovery in demand

* MCX Copper April is expected to rise further towards Rs.925 level as long as it stays above Rs.908 level.

* MCX Aluminum April is expected to slip further towards Rs.252 level as long as it stays below Rs.256 level. MCX Zinc April is likely to move north towards Rs.281 level as long as it stays above Rs.276 level

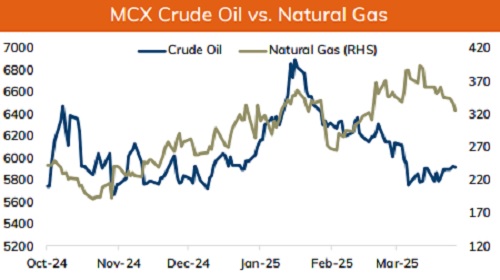

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rally further towards $70.50 level on weak dollar and optimistic global market sentiments. Further, prices may rally on concerns over tighter supplies after US President Donald Trump imposed new sanction on Iran and Venezuela. Additionally, API data showed US crude oil inventories fell more than expected, signaling demand. US crude inventories fell by 4.6 million barrels in the week ended March 21. Meanwhile, US reached deals with Ukraine and Russia to pause attacks at sea and against energy targets, which would limit the gains in oil prices. All eyes will be on official US government data on oil inventories

* MCX Crude oil April is likely to hold support near Rs.5800 level and rise towards Rs.6050 level. A break above Rs.6050 prices may rally further towards Rs.6100 level.

* MCX Natural gas April is expected to face stiff resistance near Rs.340 level and slip towards Rs.320 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631