Mauritius Budget Analysis 2025-2026 by CareEdge Ratings

Budget 2025 -2026: From Abyss to Prosperity: Rebuilding the bridge to the future

The Mauritius Budget FY26 outlines a strategic plan to drive economic growth while ensuring fiscal responsibility. The Hon. Prime Minister and Minister of Finance has introduced measures to stimulate investment, support key sectors, and promote social inclusion, all while maintaining a focus on fiscal consolidation.

The budget emphasizes a balanced approach to sustaining economic growth and reinforcing fiscal prudence.

Key tax reforms include the rationalization of personal income tax bands from eleven to three and simplifying compliance is a welcome step. Notably, there will be no personal income tax for income up to MUR 500 ,000 , income tax exemption up to MUR 1 million for individuals aged between 18 -28 and lower tax vis - à -vis earlier year for those earning up to MUR 1 million. This is expected to boost consumer sentiment and spending for lower income earners. Introduction of Fair Share Contribution for a three -year period is likely to give boost to the tax collection and bring down the budget deficit.

The budget highlights the importance of Artificial Intelligence (AI) in driving innovation and economic growth.

Significant investments are planned for renewable energy, transport, and water infrastructure, alongside the establishment of a Future Fund to support strategic sectors such as food security, clean energy, and the blue economy. This marks the focus of this Government on investment led growth vis - à - vis a consumption led growth policy of former Government. The budget also places a strong emphasis on sectors crucial for job creation and economic diversification, including tourism, healthcare, and manufacturing.

Social inclusion and support for vulnerable groups are key focuses, with enhanced support for women entrepreneurs, increased social protection measures, and investments in education and skills development. The budget sets a fiscal deficit target of 4.9 % for FY26.

Overall, the Mauritius Budget FY26 outlines a clear and strategic path towards economic resilience and growth, fostering private sector participation and investment, and ensuring a more inclusive and sustainable future.

Highlights

Shift in momentum from consumption-led to investment-led growth

Post-Covid, several incentives were provided to support consumption. The new government’s focus is on a new trajectory of investment-led growth. For example, investment will drive more productive sectors of the economy, such as innovation, research, AI, renewable energy, blue economy, waste to wealth investments and creative art. This will also be inclusive of women through new measures such as flexible working.

Fiscal consolidation

Ambitious plans to reduce fiscal deficit from 9.8% in FY25 to 1.3% in FY28 through tax reform, incentives and subsidies reduction.

Utilizing the payments from Chagos deal to reduce the debt burden

69% of the domestic debt portfolio is set to mature by the end of FY30. Over the next 3 years, the government proposes to use operational cashflow and rentals of about MUR 30 billion from Chagos deal for debt repayment, which is expected to improve total debt to GDP ratio from 90% in FY25 to 79.7% in FY28.

Retirement Age

Retirement pension eligibility will increase from 60 years to 65 years which will be phased out over 5 years. The basic retirement pension is currently around 26% of recurrent expenditure. Raising the retirement age in Mauritius will ease pressure on public pensions, improve fiscal sustainability, and boost economic output by keeping more people in the workforce.

Proposal to replace the Contribution Sociale Généralisée (CSG) with the National Pension Fund (NPF)

Transitioning from a tax-funded universal pension to a contribution-based, earnings-linked system could improve funding predictability and restore confidence among formal workers. The informal sector workers may be at loss with this system.

Proposal to replace the Contribution Sociale Généralisée (CSG) with the National Pension Fund (NPF)

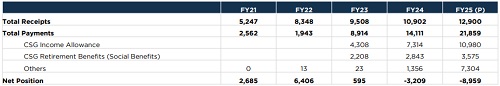

It is proposed that the CSG system, introduced in September 2020 to be replaced by the National Pension Fund (NPF). This is because it has become fiscally unsustainable. Since FY24, payouts have exceeded contributions by MUR 3.2 billion, reaching MUR 9 billion in FY25. This has led to a 1.4% increase in debt in FY25 only. Given this growing strain on public finances, a Commission of Experts will be established to provide advice on revamping the CSG with the NPF. Transitioning from a tax-funded universal pension to a contribution-based, earnings-linked system could improve funding predictability and restore confidence among formal workers. However, informal sector workers may be adversely affected by this proposed change.

Contribution Sociale Généralisée (CSG) Budgeting

Tax Snapshot

Personal Tax

* Removal of several slabs and attached complexity is a welcome step. Although, in general other than for those who are earning up to MUR 1 million chargeable income, eligible individual will end up paying higher taxes under new regime.

* In addition, eligible individual earning more than MUR 12 million annual chargeable income including dividend income from the domestic companies, will have to pay an additional tax of 15% on amount exceeding MUR 12 million (As per Budget Annexure, there is a disconnect between Budget speech and Annexure on this levy and might need clarification). This is similar to the Solidarity levy but under a new name of “Fair Share Contribution of High-Income Earners”.

* Given the need to raise additional revenue, one cannot really complain about it, given that as of now it is implemented for only 3 years. However, this levy may deter some high-net-worth individuals who were contemplating relocation to Mauritius, or potentially prompt others to leave the country.

* Exemption from income tax or tax on emoluments or business income for employees and self-employed individuals aged between 18 – 28 years and earning up to MUR 1 million annually as from 01 July 2025.

Corporate Tax

This segment has attracted some major new taxes as follows:

* Availability of partial exemption, especially on foreign sourced interest income has been subject matter of litigation in the past and it appears that some clarifications will be brought in to deny the partial exemption, unless there is substance in relation to this entity – May have serious impact on Global Business Companies in general.

* Banks will not be allowed to claim partial exemption on foreign source dividend – Impact on banks investing in private portfolios.

* Introduction of Alternative Minimum Tax (AMT) on certain sectors – like hotels, insurance companies, financial intermediaries, real estate and telecom. It is proposed that where the normal tax on chargeable income of these companies is less than 10% of the book profits (adjusted for capital gains/losses and dividends from domestic companies), an AMT of 10% on book profits will be payable. The bigger worry though is that against this tax such companies will not be allowed to take foreign tax credit. This is akin to double taxation in certain cases. This does not apply to GBC and exempt companies.

* The book profits that will be used for the computation of AMT will be adjusted for capital gains or losses and dividends received from resident companies.

* A capital gains tax (CGT) will be introduced for the first time in Mauritius.

* Applies to the sale of shares, securities, and real estate

* Likely it is Intended to reduce income inequality and capture wealth-based gains.

* VAT to be Zero-rated on the specific infant foods, canned and frozen packed vegetables, CCTV Cameras and hairdressing services.

* VAT registration threshold reduced for companies with revenue from MUR 6 million to MUR 3 million.

Corporate Tax (continued)

* Fair Share Contribution tax on companies (other than GBC and those which are exempted) where chargeable income is above MUR 24 million have been levied as follows:

a) 5% of chargeable income on companies which are taxable at standard rate of 15%

b) 5% of chargeable income of banks including income form GBCs and non-residents;

c) Additional 2.5% of chargeable income of banks from domestic operations, but excluding income form GBCs and non-residents;

d) 2% of chargeable income on companies which are taxable at rate of 3%

In addition, against this tax such companies will not be allowed to take foreign tax credit.

Further reading (b) and (c) together it appears that banks will overall pay additional 7.5% on their chargeable income from domestic operations and 5% on GBC and non-residents income.

It is also mentioned that the additional contribution will be introduced under the Value Added Tax (VAT) Act.

* Double and triple deductions incentives have been restricted to only companies not having annual turnover of more than MUR 100 million.

Above views are of the author and not of the website kindly read disclaimer

.jpg)