India Inc. at Capex Inflection: Banking on Capital Creators: OmniScience Capital

According to a new report by OmniScience Capital, India is on the cusp of a new corporate capex supercycle, estimating potential for ~Rs.200 lakh crore in new corporate borrowings over the next five years. This comes after a decade of structural deleveraging that has left corporate balance sheets clean and highly profitable.

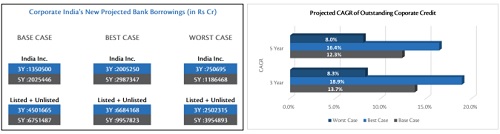

The report titled “India Inc. at Capex Inflection: Banking on Capital Creators”, shows that banks are positioned to be the primary beneficiaries of the coming investment cycle. Banks could potentially capture Rs.99.50 lakh crore over next 5 years. Based on RBI’s FY2024 corporate credit stock, this implies ~16% CAGR potential, compared with near-stagnation over the last decade.

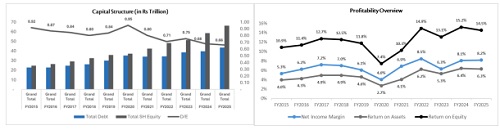

The report notes that the defining corporate response to the "twin balance sheet" crisis was structural deleveraging. This financial discipline, combined with cooling commodity prices and lower interest expenses, has led to a structural re-rating of corporate profitability.

A Golden Era for Indian Banking

With corporate balance sheets clean, profitability at multi-year highs, and asset utilization rebounding, the report concludes that India Inc. is fundamentally ready for its next major investment cycle. This dual recovery—healthy borrowers and healthy, well-capitalized lenders—has created a powerful, long-term investment opportunity. According to the report, banks are set to evolve from simple supporters of the economy to the strategic drivers and primary beneficiaries of India's next wave of capital expenditure and growth.

Private sector Capex will be complemented by massive government infrastructure push by Centre and top states projected at Rs.96 lakh crore over the next five years. According to the report, credit growth will be supported by sustained consumer demand driven by combined with a rationalized GST structure, income tax cuts and the monetary policy easing cycle, is likely to push capacity utilization above the 75–80% threshold and trigger widespread private capex.

Above views are of the author and not of the website kindly read disclaimer