Life Insurance Industry Witnesses Decline in Individual Premiums in September 2025 by CareEdge Ratings

Overview

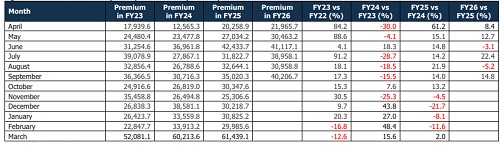

In September 2025, the Indian life insurance industry witnessed double-digit growth, with new business premiums rising by 14.8% year-on-year to Rs 40,206.7 crore, reversing the 5.2% decline seen in August 2025. This uptick was slightly higher than the 14.0% growth seen in September 2024. The group was driven by strong momentum in the group business, particularly in the single premium segment, which more than offset the decline in individual premiums. A favourable base effect and the impact of GST reductions aided this.

Figure 1: Movement in Monthly First-year Premium (Rs crore)

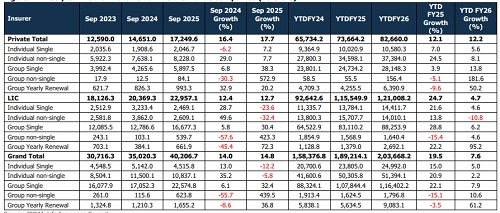

Figure 2: First-year Premium Growth of Life Insurance Companies (Rs crore)

Private insurers saw a 17.7% rise in new business premiums in September 2025, while LIC increased by 12.7%. The industry's overall growth was largely due to a growth in group non-single premiums. LIC’s group business witnessed a healthy recovery in September 2025, after a brief moderation in August 2025. The segment appears to be stabilising, with the high base effect stemming from last year’s regulatory changes largely normalising by now. Overall, the life insurance industry’s YTDFY26 growth moderated to 7.6% from 19.5% last year. Private insurers maintained steady growth of 12.2%, supported by performance in group segments.

Figure 3: Movement in Premium Type of Life Insurance Companies (Rs crore)

For September 2025, non-single premiums grew 2.3% y-o-y, slower than 27.1% last year, while single premiums rose 22.1% against 7.6% previously. This reflects the impact of softening market yields on product preference, with private insurers adapting well through a more balanced and recurring-premium-driven mix. Despite the decline, single premiums are still nearly twice the size of non-single premiums in absolute terms. Looking at the segmental mix, private insurers have a stronger presence in individual non-single premiums. Meanwhile, LIC remains the leader in single premiums, primarily due to group business.

Figure 4: Movement in Premium Type of Life Insurance Companies (Rs crore)

Group premiums rose significantly by 35.2% in September 2025, increasing from a 4.0% growth in September 2024. The increase was largely supported by a rise in the group's non-single segment, mainly due to significant traction by LIC. Meanwhile, individual premiums fell by 7.7%, compared with a 27.5% rise in the same month last year. Additionally, the market share of single premiums declined marginally from 70% in FY25 to 69% up to H1FY26, which could indicate a gradual shift in business composition towards the latter. Private insurers have managed this transition well by sustaining growth through diversified, recurringpremium offerings.

Figure 5: Movement in Individual Non-Single Policies of Life Insurance Companies (in Lakhs)

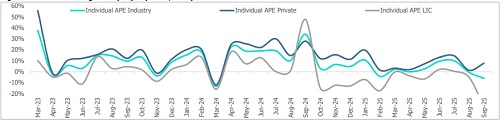

In September 2025, despite a recovery in new business premiums, individual non-single policies declined significantly by 31.7%, compared with a 47.0% rise in the same month last year. Private insurers reported a 2.7% decline, while LIC registered a 42.7% fall in September 2025. This decline is attributed to the base effect and surrender value regulations. This decline is expected to normalise next month onwards. Private players have been able to offset the decline in policies by increasing the premiums received per policy.

Figure 6: Movement in APE of Life insurance companies (Rs crore)

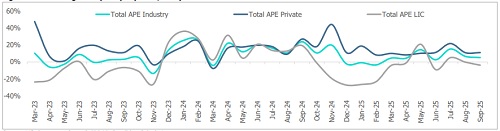

Figure 7: Total APE growth (on a y-o-y basis, in %)

Figure 8: Individual APE growth (on y-o-y basis, in %)

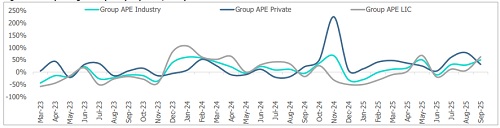

Figure 9: Group APE growth (on a y-o-y basis, in %)

CareEdge Ratings’ View

According to Sanjay Agarwal, Senior Director, CareEdge Ratings, “The Indian life insurance industry’s APE growth moderated to 5.2% in September 2025, lower than the 6.6% rise seen in August and well below the base of September 2024. However, the implementation of the GST waiver on individual life and health insurance premiums has had some impact, driving improved sales momentum towards the month-end. The industry is now showing signs of recovery, with underlying business growth returning to double digits. Over the medium term, CareEdge expects the sector to sustain a better growth trajectory, supported by favourable regulatory reforms, evolving product innovation, deepening digital reach, and expanding distribution efficiency.

According to Saurabh Bhalerao, Associate Director, CareEdge Ratings, “New business premiums in the Indian life insurance industry touched Rs 40,206.7 in September 2025, growing by 14.8%, slightly above the growth of 14.0% reported in September 2024. The group business drove growth, particularly in the single premium segment, which more than offset the decline in individual premiums. Individual non-single policies continued to fall due to the base effect and surrender value regulations. This decline is expected to normalise next month onwards. Private players have been able to offset the decline in policies by increasing the premiums received per policy. Meanwhile, the industry reported a 7.6% increase for the first half of the fiscal year, with premiums rising from Rs 1.89 lakh crore in H1FY25 to Rs 2.03 lakh crore in H1FY26. A gradual recovery is expected in FY26, supported by private insurers expanding their reach through deeper geographical penetration and the launch of the Bima Trinity, including the Bima Sugam digital marketplace. Together, these initiatives and regulatory changes are expected to enhance penetration and drive medium to long-term industry growth.”

Above views are of the author and not of the website kindly read disclaimer