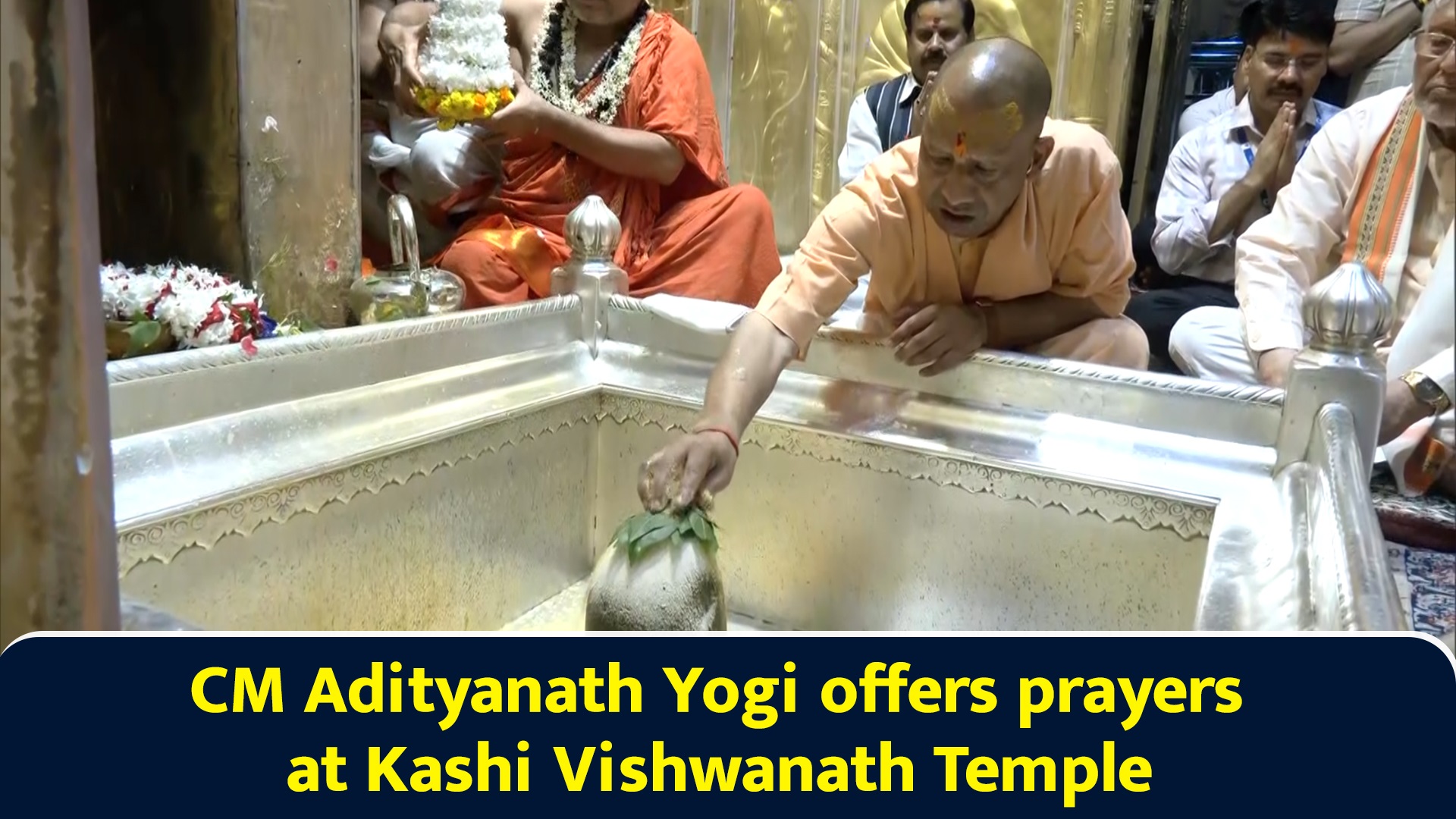

Kalyani Cast-Tech coming with IPO to raise upto Rs 30.11 crore

Kalyani Cast-Tech

- Kalyani Cast-Tech is coming out with an initial public offering (IPO) of 21,66,000 equity shares of face value of Rs 10 each in a price band Rs 137-139 per equity share.

- The issue will open for subscription on November 8, 2023 and will close on November 10, 2023.

- The shares will be listed on SME Platform of BSE.

- The share is priced 13.70 times of its face value on the lower side and 13.90 times on the higher side.

- Book running lead manager to the issue is Gretex Corporate Services.

- Compliance Officer for the issue is Pankaj Kumar.

Profile of the company

The company was incorporated in the year 2012, initially it started with the business of casting for which it had commissioned a casting unit at Rewari in Haryana. The company has a class A foundry and manufactures products such as MG Coupler Components, CI Brake Blocks, Adapter for WDG4 Loco, Bearing housing for electrical loco, Corner casting for Containers motor hub traction motors etc. It caters to a diverse client base such as Indian railways, companies engaged in Mining Industry, Cement Industry, chemicals and fertilizer and power plants. The company while catering to railways saw an opportunity in the year 2018 and started an addition line of business of manufacturing Containers. These containers were used by the railway transporters to transport goods via rail network in India.

Being a cargo container manufacturing Company, it manufactures a wide product range of castings, including finished components and are specialists in various types of cargo containers such as ISO containers 20’, 25’, 40’, 42’ and other special containers including dwarf containers, cuboid containers, special containers for parcel cargo and containers for two & three wheelers. With an unparalleled experience, technical know-how and a state-of-the-art manufacturing facility, Kalyani proves to be a reliable name for their clients. The company has adopted the no-bake system of moulding and having automatic sand plant starting from knock out, screening, cooling and mixing of sand. The company is also involved in exports.

In the Financial Year 2022-23, the Company generated revenue from export sales for the products sold in Russia. Kalyani Cast-Tech with its strong technical foundations and innovative excellence has had an eventful and successful journey. From the commissioning of first plant, it started pioneering breakthrough innovations in inline cargo in India. Within a span of almost a decade of operations, its organization has grown many folds and expanded in terms of product portfolio, manufacturing facility, in-house designing and implementation excellence. As a result, it is able to have excellent clients list who are always happy with its professional services.

Proceed is being used for:

- Working capital requirements

- General corporate purposes

Industry Overview

The India foundry market size is estimated to grow at a CAGR of 10.77% between 2022 and 2027. The market size is forecast to increase by $15,684.57 million. The growth of the market depends on several factors, including a focus on technology upgrades, make-in-India initiatives, and increasing confidence within the foundry industry. India’s railway network is recognized as one of the largest railway systems in the world under single management. The railway network is also ideal for long-distance travel and movement of bulk commodities, apart from being an energy efficient and economic mode of conveyance and transport. Indian Railways is the preferred carrier of automobiles in the country.

The size of the India air freight market is estimated at around $15 billion in the current year and is anticipated to register a CAGR of over 4% during the forecast period. The Rail Logistics project will assist India in diverting more traffic from the road to the rail, improving the efficiency of freight transportation while lowering annual GHG emissions by millions of tonnes. Additionally, the project will encourage more private-sector investment in the railroad industry. The fourth-largest rail network in the world, Indian Railways (IR), moved 1.2 billion tonnes of freight during the fiscal year that ended in March 2020. However, just 17% of India’s freight is moved by rail; 71% of it is conveyed by road. Volumes have been constrained, and shipping speeds and reliability have suffered due to IR capacity restrictions.

Indian Railway network is growing at a healthy rate. In the next five years, Indian railway market is expected to be the third largest, accounting for 10% of the global market. The government has announced two key initiatives for seeking private investments-running passenger trains by private operators across the railways network and redevelopment of railway stations across the country. According to Indian Railways, these projects have the potential of bringing an investment of over $7.5 billion in the next five years.

Pros and strengths

Integrated manufacturing facility: It does continuous endeavour to maintain the requisite infrastructure and technological upgradation for the smooth running of the manufacturing process as well as to cope up with the changing market demand situation. There is a continuous change in the technology and the markets are very dynamic to the change in technology. It keeps ourselves technologically upgraded with the latest machines and infrastructure.

Well-developed distribution network: The Company has developed and implemented a wide range of networking channels throughout the industry and society to strengthen the scope of identifying core customer base and designing right marketing strategies for procurement and liaising of projects to deliver customized solutions for clients. Its distribution and marketing network ensures its product availability to its customers translating into efficient supply chain, focused customer service and short turnaround times for product delivery.

Quality Assurance and Control: Quality control through trained inspectors with respect to weld quality, sand/shot blasting surface quality and final painting quality. The company has excellent record of providing quality services which makes the company unique from its competitors.

Risks and concerns

Dependent on certain key customers: It is dependent on certain key customers in the rail transportation sector. Its top 7 customers accounted for 97% and 96% of its revenues from sale of products on for Fiscals 2023 and 2022 respectively. As it is dependent on certain key customers, the loss of such customers including as a result of a dispute with or disqualification by them may materially affect its business and results of operations. The volume of sales to its customers may vary due to its customers’ attempts to manage their inventory, design changes and changes in its customers’ manufacturing strategy, which may result in a decrease in demand or lack of commercial success of a particular product of which it is a major supplier.

Changes in consumer demands: Its success depends on its ability to identify, originate and define product and market trends, as well as to anticipate, gauge and react to rapidly changing consumer demands in a timely manner. Its products must also appeal to a broad range of customers whose preferences may vary. If it misjudges the market or fail to anticipate a shift in consumer preferences, it may be faced with a reduction in revenues. Any inability to respond to changes in consumer demands and market trends in a timely manner could have a material adverse effect on its business, financial condition and results of operations.

Highly dependent on economic and market condition: Its business is highly dependent on economic and market conditions in India and other jurisdictions where it operates. General economic and political conditions in India, such as macroeconomic and monetary policies, industry-specific trends, mergers and acquisitions activity, legislation and regulations relating to the financial and securities industries, household savings rate, investment in alternative financial instruments, upward and downward trends in the market, business and financial sectors, volatility in security prices, perceived lack of attractiveness of the Indian capital markets, inflation, foreign direct investment, consumer confidence, currency and interest rate fluctuations, availability of short-term and long-term market funding sources and cost of funding, could affect its business.

Outlook

The company is a customer-centric IT solutions provider with a vision to being committed to excellence. The company has evolved from an IBM Business Partner into a prominent player in the IT segment. The company offers a comprehensive range of distributed IT solutions, including consulting, enterprise and end-user computing, managed print and network services. On the concern side, it operates in a very niche industry in which there are very few players due to strong requirement of technical know-how and high capital requirement both in terms of setting up manufacturing facility and also working capital requirements. This industry is dependent on Railways and Private Freight companies which are in turn regulated by Government policies.

The issue has been offered in a price band of Rs 137-139 per equity share. The aggregate size of the offer is Rs 29.67 crore to Rs 30.11 crore based on lower and upper price band respectively. On performance front, its total revenue increased by 28.08% to Rs 6,336.46 lakh for the financial year 2022-23 from Rs 4,947.12 lakh for the financial year 2021-22. The profit after tax increased by 585.07% to Rs 803.79 lakh for the financial year 2022-23 from Rs 117.33 lakh for the financial year 2021-22. Meanwhile, it intends to cater to the increasing demand of its existing customers and also to increase its existing customer base by enhancing the distribution reach of its products in different parts of the country. It proposes to increase its marketing and sales team which can focus in different regions and also maintain and establish relationship with customers. Enhancing its presence in additional regions will enable it to reach out to a larger population.