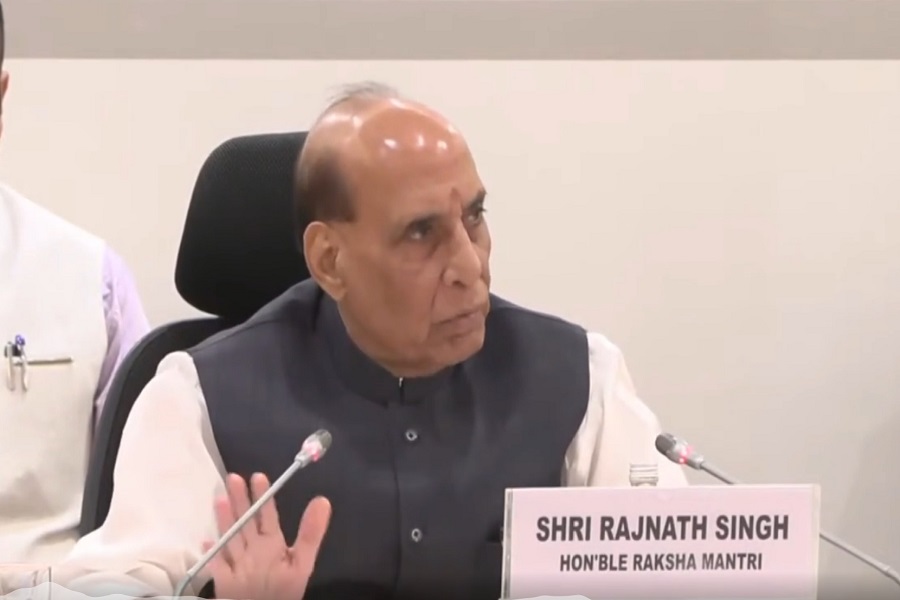

BLT Logistics coming with IPO to raise Rs 9.72 crore

BLT Logistics

- BLT Logistics is coming out with an initial public offering (IPO) of 12,96,000 equity shares in a price band Rs 71-75 per equity share.

- The issue will open on August 4, 2025 and will close on August 6, 2025.

- The shares will be listed on SME Platform of BSE.

- The face value of the share is Rs 10 and is priced 7.10 times of its face value on the lower side and 7.50 times on the higher side.

- Book running lead manager to the issue is Beeline Capital Advisors.

- Compliance Officer for the issue is Rama Kanojia.

Profile of the company

BLT Logistics is engaged in providing surface transportation of goods in containerized trucks and warehousing services to various industries and businesses. The company’s logistics operations are supported by its own fleets of containerized trucks and hired from its 99.99% subsidiary, Sabarmati Express India (Sabarmati) and third-party operators i.e. small fleet owners and agents who provide it with necessary transportation facilities such as containerized trucks. As on March 31, 2025, it owned operational fleet of 106 vehicles having capacity ranging from 3.5MT to 18MT in the name of the company and 15 vehicles as part of the fleet of its 99.99% subsidiary, Sabarmati, having capacity of 9MT. It mainly serves B2B customers which require transporting bulk quantities of their goods from one place to another within India. It has gradually developed the business and increased the ambit of its Transportation & Allied Services which includes other services like packing and moving and transportation of project cargo. It has started end-to-end warehousing solutions to add to its repertoire of offerings.

The company’s 99.99% subsidiary Sabarmati is engaged in the business of providing transportation and logistics services mainly in the B2C segment i.e. distribution of goods to customer of client. Sabarmati also provide the company fleet of vehicles for its transportation & allied services on hire basis from its owned fleets of vehicles as well as it hires from small and unorganized third-party operators. Its subsidiary company owns 15 of the carrier/vehicles as on March 31, 2025. Consolidated number of vehicles of the company with the subsidiary company is 121 as on March 31, 2025.

The company has ISO Certification 9001:2015 for Quality Management System for Transportation and Warehousing Services. It operates primarily from its registered office situated in Delhi and its logistics operations are supported by its owned fleet of operation and third-party operators i.e. small fleet owners and agents who provide it with necessary transportation facilities such as containerized trucks and vendors that enables it to service client requirements in various states of India. It provides logistics services via roadways and also have warehouses in Thane, Gurugram, Hooghly, Ambala and Bengaluru apart from its office in Delhi. Its clientele stands at more than 200 in Financial Year 2024-25 and it serves to a diverse mix of clients engaged in electronics, retail, food and confectionery, wholesale traders and other MNCs.

Proceed is being used for:

- Funding capital expenditure requirement of the company towards purchase of trucks (Vehicles) and ancillary equipment (Equipment)

- Meeting working capital requirements

- General corporate purpose

Industry Overview

Logistics sector in India is transforming at an unprecedent pace due to key factors like changing global and local trade dynamics, growing manufacturing industry, expansion of eCommerce market, sustainability pressures, and large-scale digitisation of supply chain. Sector is breaking away from traditional brick and mortar approach to a more technology enabled sector, enabling businesses of all sizes and individuals from diverse backgrounds to take part in this dynamic and economically important sector. Recognising the strategic importance of Logistics sector and the transformational impact it can have on the overall economy, Government of India has adopted a comprehensive and synergised, ‘whole of Government’ approach to ensure that both demand and supply side fundamentals of the sector are viewed in their entirety with an end-to-end perspective. Traditional sectoral approach has been replaced by a renewed ‘whole of Government’ and ‘data driven’ approach leveraging the power of technology to ensure integrated development of logistics sector in the country.

With the launch of PM GatiShakti (PMGS) and National Logistics Policy, 2022, logistics sector has got a new direction and the task of integrating these efforts and magnifying their gains through network effect has been set in motion. While PMGS addresses integrated development of hard infrastructure and network planning, the NLP addresses soft infrastructure and logistics sector development aspect, inter alia, including process reforms, improvement in logistics services, digitisation, human resource development and skilling.

States and UTs have made commendable progress towards building a vibrant logistics eco-system across the country through proactive infrastructure, policy, and regulatory reforms. Improvement in user perception regarding performance of logistics eco-system is a real positive for the sector and probably reflects impact of various initiatives taken by States / UTs to enhance logistics efficiency. The transformation in the logistics sector signifies the positive impact of government infrastructure investments and the sector’s growing emphasis on efficiency. With alignment between the Central Government, States, UTs, and the private sector, this is a crucial time to improve logistics efficiency, supported by reforms like PMGS and NLP that enhance infrastructure and competitiveness, benefiting Indian goods’ quality and cost-effectiveness. India’s transition into a global manufacturing powerhouse is underway, driven by key trends like Investments, sustainability, and digitalization, with the commitment of States/UTs playing a pivotal role in this transformation.

Pros and strengths

Long-standing business and track record: Founded in 2011 by Krishan Kumar and Rakesh Kumar, its logistics services company was established to address the growing market demand for efficient logistics solutions and to provide tailored logistics services that meet the needs of its clients. The company started as Household Packers and Movers and subsequently it started commercial shifting as well. Further, the company started providing transportation of goods services in year 2011. It has achieved this scale due to its longstanding customer relationships, which have been pivotal in driving its growth and market presence. It provides its services to a diverse range of industries, including electronics, retail, food and confectionery, wholesale traders and other MNCs.

Strong relationship with diverse customer base: The quality of services provided by it has helped it to achieve customer satisfaction and develop long-standing relationships with these customers. Maintaining strong relationships with its key customers is essential to its business strategy, towards the growth of its business, as a result, it has been able to retain a number of its customers for a long period ensuring uninterrupted supplies of its logistics services to them. During financial year 2024-25, it has served a diverse customer base of more than 200 customers. To serve its customers closely, it maintains office in Delhi, along with warehouses in Thane, Gurugram and Bengaluru.

Wide range of logistics services and solutions: The company, being a multifaceted transport operator, are capable of offering a wide range of logistics services with a focus on creating tailored solutions that adequately address the diverse requirements of its clients. Its range of services encompasses 2PL services including freight management and other value-added services and it has also started 3PL (Storage and distribution) services by offering warehousing solutions to its customers. These services are designed to enhance its clients' operational efficacy, reduce costs, and ensure superior quality, scalability, and visibility of their supply chain. This along with a combination of its logistics and transportation network and diversified service portfolio, has made it possible for it to attract and retain clients across various industry segments.

Risks and concerns

Substantial portion of revenue comes from limited customers: The company generates a significant portion of its revenues from, and are therefore dependent on, certain customers for a substantial portion of its business. It has garnered 64.46% 66.46% and 61.27% of its total revenue from top 10 customers in FY25, FY24 and FY23 respectively. The company’s business operations are highly dependent on its clients and the loss of any of its clients may adversely affect its sales and consequently on its business and results of operations. While it typically has long term relationships with its clients, it has not entered into long term agreements with its clients and the success of its business is accordingly significantly dependent on it maintaining good relationships with its clients and suppliers. The actual sales by the company may differ from the estimates of its management due to the absence of long-term agreements.

Maximum revenue comes from certain geographical regions: The company generates its major portion of revenue from its operations in certain geographical regions. substantial part of its revenue is generated from the State of Maharashtra i.e., Rs 2,004.84 lakh, Rs 1,887.69 lakh and Rs 1,599.72 lakh, constituting 41.83%, 47.53% and 51.55% of the total revenue from operations for the Financial Year ended March 31, 2025, 2024 and 2023, respectively. Such concentration of revenue on few states may have an adverse effect on its business, financial condition, cash flows and results of operations. An economic slowdown or change of laws or regulations, particularly in relation to logistics sector in such few states may have a significant adverse impact on its business, financial condition, cash flows and results of operations.

Dependent on a few suppliers for purchases of product/service: The company has purchased 48.17%, 56.91% and 51.07% of its total product/services from top 10 customers in FY25, FY24 and FY23 respectively. The company cannot assure that it will be able to get the same quantum and quality of supplies, or any supplies at all, and the loss of supplies from one or more of them may adversely affect its purchases and ultimately its revenue and results of operations.

Outlook

BLT Logistics is engaged in providing surface transportation of goods in containerized trucks and warehousing services to various industries and businesses. The company's logistics operations are supported by its fleet, Sabarmati Express India Private Limited, and third-party operators, providing necessary transportation facilities like containerised trucks from small fleet owners and agents. The company has strong relationship with diverse customer base. It has wide range of logistics services and solutions. On the concern side, substantial portion of the company’s revenues has been dependent upon few customers. The loss of any one or more of its major customers would have a material adverse effect on its business, cash flows, results of operations and financial condition. Moreover, the company is dependent on a few suppliers for purchases of product/service. The loss of any of these large suppliers may affect its business operations.

The company is coming out with a maiden IPO of 12,96,000 equity shares of Rs 10 each. The issue has been offered in a price band of Rs 71-75 per equity share. The aggregate size of the offer is around Rs 9.20 crore to Rs 9.72 crore based on lower and upper price band respectively. On performance front, the company’s total income increased by 20.36% from Rs 4,003.81 lakh in FY24 to Rs 4,818.80 lakh in FY25. Moreover, profit after tax (PAT) surged by 13.32% to Rs 300.35 lakh in FY25 as compared to Rs 265.04 lakh in FY24.

Strengthening the company’s existing service model is a key business strategy for the company. It aims to enhance its transportation, warehousing, and logistics services by leveraging its expertise and experience in the industry. Its focus is on providing better transportation services to its customers, including PAN India Full Truckload (FTL) & Less-than Truckload (LTL) freight management, real-time order processing, and fulfilment-based MIS. It also offers machinery/equipment packing and moving services, project transportation management, storage and distribution, and packing and moving services. It has started offering warehousing solutions to add to its repertoire of service offerings. Its goal is to provide comprehensive logistics solutions that meet the evolving needs of its clients and enable it to maintain its position as a logistics service provider in India.