January 2026 Monthly Market Outlook from the desk of Mr. Prateek Agrawal, MD & CEO, Motilal Oswal AMC

Indian stock market had a difficult year in 2025 and was among the relatively weaker performing market in the year. However Indian market may be turning around things seem to be turning around slowly. We have seen some improvement in our position across certain global performance tables.

INR has depreciated:

* INR has depreciated quite sharply in the past period. The depreciation of INR may support margins of India Inc. Export oriented businesses make extra margins as Indian costs get lower in USD. Moreover, with most items priced in USD on landed cost basis, a currency depreciation may increases the attractiveness of most domestic businesses also. Imported items may become more expensive and which could lead to demand reduction, leading to a more balanced global trade. Moreover, INR depreciation has supported predominantly Indian value addition businesses like cotton textiles and shrimps. While our exports are seeing an additional levy of 25% vs the world, we have seen an INR depreciation of 17% from the beginning of the year. With low inflation in India and in combination with some price increases in the US, Indian businesses are able to mostly continue to function, albeit at a lower margin.

* Depreciation of currency causes markets to retract initially as foreigners try to preserve USD value of their investments but over time, it may contribute to improved market sentiment. Turkey and Pakistan have seen weak currencies but have seen strong stock markets. We have witnessed sharp FPI outflows in the past. As the currency stabilizes at new level, flows could improve gradually.

FPI activity appears to be improving

* 2025 saw sustained FPI outflows. However, with relative valuations having adjusted and with prospects of currency stabilizing at new levels after depreciation, and with cost of capital going down in the west, FPI activity has been less negative and we have seen a few consecutive days of buying.

Domestic flows may improve if sentiment improves

* Indian domestic flows into MFs have remained positive but have averaged below the peak seen during last Sep to Jan period. This has happened even though economy has grown and inflation remains low. While one factor is increased investment into precious metals, we sense lower equity investments on account of poor performance of equities. We believe market construct is very light and low market volumes point to the same. Investors could come back strongly as sentiment improves and markets get a direction.

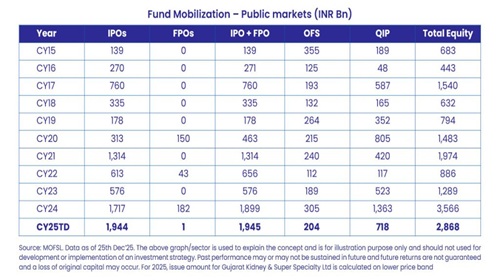

Supply of paper may have its peak and troughs

* Supply of paper in the Indian market has been strong. We are witness to amongst the largest fund raise as a percentage of market cap in our markets. This trend may continue. However, the fund raise intensity likely to have its peaks and troughs. We believe that the next peak is a few months away. With good outcomes for investors in the past large issues, there are a chance of market doing relatively better in the interim.

Economy is managing higher US tariffs

* While a deal with the US remains elusive, India is using the crisis period to its advantage by pursuing FTAs and Preferential Trade Agreements with EU, UK (finalizing), Canada, EFTA, South Africa, Eurasia, Israel, Mercosur, and a deal with Mexico to counter recent tariff hikes. Discussions also involve reviewing pacts with ASEAN & South Korea, while strengthening ties with Oman (new FTA) and exploring deals with Peru, Japan, Russia, and blocs like SACU, which includes South Africa, to potentially boost global trade outreach.

* While it is still early days, Indian exports seem to be holding up well, supported by spaces which, as yet, don’t attract US duties, such as electronics. Shrimps have found alternative markets. This may suggest that, in the event of a trade deal with the US, as India potentially reclaims its traditional markets, exports may see a jump.

* GDP growth seem to be holding up quite well too. Q2 FY2026 (July-Sept) GDP was 8.2%, driven by services and manufacturing, leading forecasters like ADB and RBI to raise FY26 growth projections to over 7% for the whole year.

Crude prices are down

* Crude prices are continuing to be weak in-spite of sanctions on Russia and Iran and blockade on Venezuelan crude. There are reports of a lot of Russian crude floating off coast of China in oil tankers for want of takers. If a truce in Russia-Ukraine war emerges, crude prices could remain weak. Lower crude prices may support the Indian economy. The country saves close to 1.3bn per USD of crude price decline.

Quarter 3 result season is around the corner

* Quarter 2 result season was strong and better than expected while it was impacted by long monsoons and purchase deferment on account of GST cuts. The effects of strong monsoon and GST cut may be reflected in quarter 3. Most companies had indicated strong demand outlook during their result calls which could support positive Q3 outcomes. Moreover, while the impact of US duties has been the focus, the impact of currency depreciation may have a favourable effect on margins.

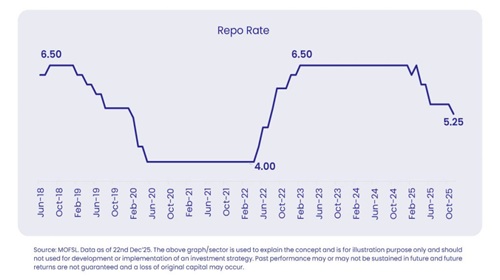

RBI has cut rates and has indicated the possibility of more rate cuts

* RBI cut repo rates by 25bps in its last policy. Given the continued comfort on inflation front and rates cuts by western central banks, there may be further cuts in the future. Rate cuts over time could reduce cost of capital potentially providing a tail wind for growth investing.

Valuations have improved over the past one year

* With market being in a range and earnings having seen an expansion, there has been a valuation correction. Large cap earnings have growth at around 10% resulting in a valuation correction of that order for large caps. However, the fast earnings growth spaces had a challenging year and may have seen over 30% correction in valuation.

* Not only has valuation improved on earnings, they have improved vis-à-vis other markets on a relative basis also. Our markets have underperformed while most other global markets have been buoyant and versus large markets like China and the US, our valuation correction could be around 35%

A fair US trade deal, if it happens, may support sentiment

* While the direct impact of US duties has been manageable, it has affected investing sentiment. US is the significant allocator of flows globally and absence of deals may mean that India is less favoured nation, potentially impacting investing sentiment.

* A positive deal if it happens, may would change that and money on the side-lines may come in, possibly induced by strengthening INR. This could set in motion a favourable cycle of flows potentially supporting the secondary market strength, FPI flows aiding forex reserves allowing RBI which in turn may further support sentiment and flows from the domestics.

How are our portfolios positioned and why?

* Our portfolios have representation from all of the growth spaces in the economy including defence, renewables, EVs, capital markets, electronics, new tech, fast growing spaces in tech services and lenders. The export orientation of our portfolios is limited to about 15% in most constructs. Banks had a good run in the past period but now face the headwind due to potential rate cuts. Our portfolios have limited exposure to banks but have a reasonable allocation to NBFCs.

* In our investing history, we have witnessed strong outcomes in certain periods. For example, in the 1990s, software as a space emerged. It was small, but grew for several years. In the same manner new private sector banks did it in the early 2000s, followed by spaces like construction and real estate in the 2004-2007 period. In the 2008-2020 period, it was the turn of consumers, life-sciences companies, select pharma companies, premium bikes, and select NBFCs. The common thread in all of these has been simple businesses coupled with strong growth sustaining for several years. In this period we have been witness to India pledging gold in early 90s, tech bubble bursting in early 2000s, 9/11 attack in 2001, attack on Indian parliament on 13 Dec 2001, GFC with collapse of Lehman in Sep 2008, 26/11,2008 attack on Mumbai, Covid-19 in 2020, US fed pumping in liquidity and then tapering, oil prices rising to over USD110 in 2022, Japan increasing interest rates in 2006-2010 period and then decreasing it and now again increasing it, and more recently Russia Ukraine, Israel Hamas and Indian Pakistan wars, etc. While these events impacted equity markets, historically, markets have generally followed earnings growth over the long term.

* Our portfolios reflect these lessons. We have tried to include representation from all the spaces where the combo of strong growth and sustained growth potential exists and in most cases have been with the top few players from the spaces with a thought that the leaders have already demonstrated the best fire in the belly, an attribute we want. Growth investing is high beta and hence volatile and short-term returns can vary, but may work well for a long term investor. Historically, markets generally have followed earnings growth and as lot of examples in the past period demonstrate.

* Our constructs are differ from index and in this manner risky, however they are structured to participate in potential earnings growth opportunities over the long term.

Summing up Market outlook for Calendar 2026

Calendar 2025 been tough for equity markets. However, every tough period can potentially increase the probability of a better next period. As we get into 2026, there is some hope. This hope stems from

* Improved relative and absolute valuations,

* Potentially improved money supply globally and lower cost of capital if central banks cut rates,

* Positive developments in trade relations with EU, the US and others given the importance of Indian market

* Good earnings growth outlook on a low base from last fiscal

* Lower crude prices which could be helpful for the Indian economy

* Improved investor sentiment, potentially leading to better FPI and domestic flows and resultant broader market participation

* High growth spaces are sustaining relative outperformance in earnings growth. More growth areas like circular economy, data centres, etc. are emerging. Since we believe markets follow earnings growth, we continue to believe that this is time for alpha.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Daily Market Commentary : Equity markets recovered losses and closed higher as US and Asia t...