India`s Rapid Delivery Race - Q-Commerce set to Triple by 2028 : CareEdge Ratings

Synopsis

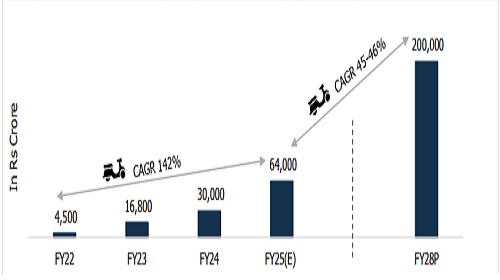

* India’s Quick Commerce (Q-commerce) market is estimated to have reached around Rs 64,000 crore in FY25, growing at a staggering CAGR of 142% during FY22-FY25, driven by evolving consumer preferences, hyperlocal infrastructure, and a lower base.

* The sector is expected to maintain strong double-digit growth in the coming years, led by rising adoption and expansion in Tier II & III cities, enhanced delivery networks, and a shift in consumer preference towards instant fulfilment.

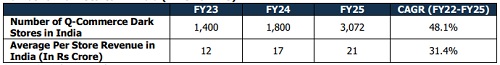

* The number of dark stores grew by 71% YoY in FY25, as players expanded into new geographies. Notably, amid the increasing number of dark stores, the average revenue per store also grew by 25% in FY25, indicating strong demand and a growing user base adopting the Q-commerce platform.

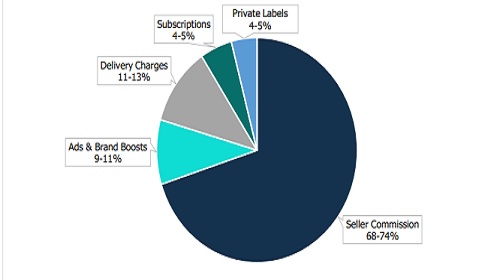

* Platforms are shifting focus from hypergrowth to revive profitability, leveraging advertising, subscriptions, private labels, and tech-led inventory optimisation. These strategic shifts are expected to support sustainable and longterm growth.

Overview

The Indian Q-commerce market (Gross Order Value - GOV), is poised for exponential growth, nearly tripling from an estimated Rs 64,000 crore in FY25 to around Rs 2 lakh crore by FY28. This exceptional growth trajectory is built on a lower base, supported by the increasing adoption of the Q-commerce platform, a wider geographic footprint and regional penetration, a shift in consumer behaviour towards convenience and speed of delivery, and an increase in digitisation in India.

Moreover, structural trends such as growing urbanisation, changing consumer lifestyles, and increasing disposable income favour quick app-based shopping experiences, further fueling industry growth. Major FMCG brands are also embracing Q-commerce through platform-specific SKUs, premium offerings, and marketing partnerships, thereby expanding product variety and boosting average order values. Simultaneously, companies are investing heavily in dark stores, tech infrastructure, and delivery optimisation, laying the groundwork for efficient and scalable operations. Together, these factors are supporting the Q-commerce industry to become one of the key pillars in India’s evolving retail landscape.

India Quick Commerce Market by GOV (Gross Order Value) (FY22-FY28P)

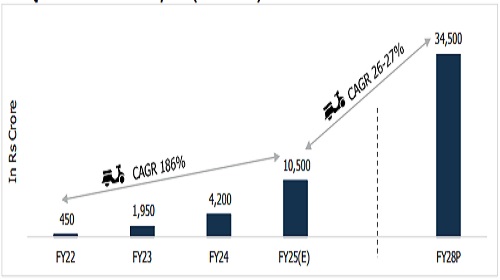

India Quick Commerce Market by Fees (FY22-FY28P)

The Q-commerce market revenue generated through fees has grown at a significantly faster pace than the GOV. The fee-based revenue, which stood at Rs 450 crore in FY22, has reached an estimated Rs 10,500 crore in FY25 and is further projected to reach Rs 34,500 crore by FY28, representing a significant CAGR of 26-27% from FY25 to FY28. This sharp increase is due to increased platform fees 1 by major players, resulting in higher revenue realisation and a substantial increase in overall GOV.

A key driver behind this trend is the improved monetisation take rate2 of leading platforms. The fee rate across the Q-commerce sector has shown a sharp upward trend between FY22 and FY25, driven by improved monetisation strategies. For instance, leading players reported take rate increases from around 7–9% in FY22 to 14–18% by FY25, effectively doubling in three years. These enhanced monetisation strategies, driven by convenience fees and delivery charges, have significantly contributed to the robust growth in fees revenue. As platforms optimise their fee structures and scale up their operations, fee-based revenue is expected to remain a major growth engine for the sector.

Digital and Demographic Tailwinds

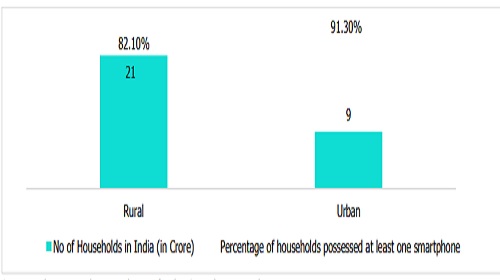

India's Q-commerce surge is strongly driven by rising digital adoption and expanding consumer spending power. As of early 2025, the country had over 1.12 billion mobile connections, with 806 million internet users, representing a 6.5% Y-o-Y Increase, and is projected to exceed 900 million users by year-end. Smartphone penetration has been increasing among Indian households, including a growing share in rural areas, mainly on account of low data costs and government initiatives.

This digital backbone has enabled the rapid adoption of e-commerce and Q-commerce platforms. India had over 270 million online shoppers in 2024, making it the second-largest e-retail user base globally. The e-commerce market grew 23.8% Y-o-Y in 2024 and is expected to maintain a CAGR of 21.5% through 2030.

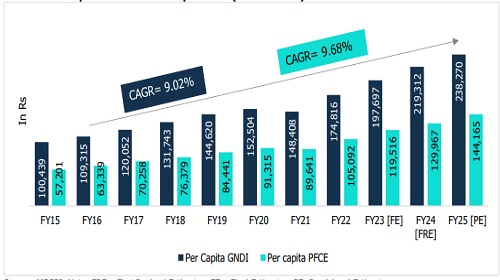

Also, with an increase in disposable income, there has been a gradual change in consumer spending behaviour as well. Per capita Private Final Consumption Expenditure (PFCE), which is a measure of consumer spending, has also showcased significant growth from FY15 to FY25 at a CAGR of 9.68%. Rising disposable income and higher spending capacity are likely to fuel the growth of Q-commerce.

Trend of Per Capita GNDI and Per Capita PFCE (Current Price)

Dark Stores: The Backbone of Hyperlocal Delivery

The actual operational engine driving Q-commerce is in dark stores, or micro-warehouses, which enable ultra-fast delivery. During FY24-25, the number of dark stores increased from approximately 1,800 to 3,072, representing a 70.7% Y-o-Y growth. Moreover, average per-store revenue increased by 25.1% during the same period, indicating improved unit economics and a more efficient use of space and inventory. Most players already rely on real-time inventory sync, AI-based replenishment, and zone-specific SKU planning. As the sector scales further, the next wave of optimisation, through intelligent zoning, advanced demand forecasting, and warehouse automation, is expected to revive the profitability scenario, reinforcing the backbone of India’s logistics ecosystem.

Number of Dark Stores3 in India (FY23 Vs FY25)

Going forward, momentum is expected to continue, with major players and new entrants planning significant store additions in the years to come. Major key players are actively expanding their dark store networks, while other players are also scaling up operations to enhance service reach and delivery speed. This expansion is not limited to metro cities. Still, it is gradually extending into tier 2 and tier 3 locations, indicating a clear intent to build wider national coverage and improve last-mile efficiency.

Q-Commerce Market – Revenue Profile

CareEdge Research View

India's Q-commerce is moving from simply fast to more innovative and more strategic. Multiple players are not only growing SKUs and introducing premium and D2C product lines but also monetising storefronts with in-app advertising and brand placements. They're leveraging AI for hyperlocal demand forecasting, optimising dark store layouts through heatmaps, and facilitating quicker picking with voice and light-assisted systems. Logistics is becoming more focused, with automated dispatching and dynamic rider routing.

“India’s Q-commerce market is set to grow 3X by FY28, with Gross Order Value (GOV) expected to reach nearly Rs 2 lakh crore and platform fee revenues surpassing Rs 34,000 crore. While growth remains strong, the focus is shifting from rapid expansion to reviving profitability and operational efficiency. Going forward, deeper penetration in Tier 2 & 3 cities, and tech-led innovations will likely define the next phase of India’s Q-commerce landscape,” says Tanvi Shah, Senior Director & Head, CareEdge Advisory & Research.

Furthermore, Amir Shaikh, Assistant Director, CareEdge Advisory & Research, adds, “Q-commerce industry is still just around 1% of India’s massive grocery market, but that’s exactly what makes it exciting. As more consumers embrace the speed and convenience it offers, Q-commerce is set to grow rapidly, even if the broader grocery market growth remains flat.”

Above views are of the author and not of the website kindly read disclaimer