India’s Market Resilience Deepens as Risk Appetite Rebounds and Earnings Cycle Stabilizes: PL Asset Management

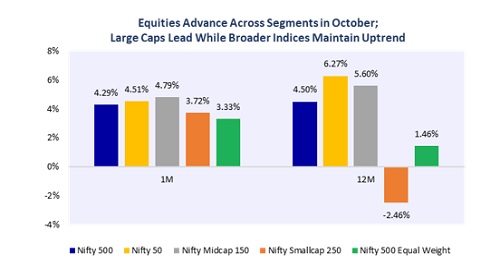

PL Asset Management, the asset management division of PL Capital Group (Prabhudas Lilladher), in their recent report ‘PMS Strategy Updates and Insights’, cited a powerful resurgence in India’s equity markets, driven by strong festive consumption, stabilizing earnings, and a clear revival in foreign investor appetite. While global markets continued to advance on optimism around U.S.–China trade progress and expectations of a Fed rate cut, India distinguished itself with robust domestic demand, strengthening macros, and improving liquidity conditions. Sectors such as PSU Banks, Capital Markets, Metals, Defence and Realty led the domestic rally, signalling renewed confidence across both institutional and retail participants.

India’s macroeconomic backdrop remained notably supportive through the month. Consumer inflation eased to 1.54 percent, marking its lowest level since 2017, while the Reserve Bank of India retained the repo rate at 5.5 percent and revised the FY26 GDP growth forecast to 6.8 percent. The rupee held steady at Rs 88.76 to the U.S. dollar despite a firmer dollar index, underscoring currency stability in a period of global volatility. Industrial activity showed further strength, with the manufacturing PMI jumping to 59.2 from 57.7 in September, and domestic liquidity remained robust as SIP inflows touched an all-time high of Rs 29,361 crore. This stability was complemented by buoyant festive-season consumption, which generated record sales of over USD 67 billion across automobiles, electronics, and consumer durables.

A key theme emerging through October was the stabilization of India’s corporate earnings cycle. Earnings downgrades, which had pressured market sentiment in earlier quarters, have now largely bottomed out. At the same time, the country’s investment cycle continues to show encouraging signs. New demand triggers such as GST 2.0, potential tax cuts, and an eventual rate-cut cycle are expected to support earnings growth on a low base, lending a positive bias to Indian markets. Gross fixed asset additions between FY20 and FY25 represent the strongest expansion since FY10, with visible capex traction in construction materials, electricity generation, and consumer goods. Capacity-building momentum remains strong in chemicals, while metals are recovering after two muted investment cycles. These trends, supported by improving liquidity conditions and neutral valuations, strengthen the outlook for a sustained cyclical recovery as the country moves toward FY26.

In the near term, PL Asset Management expects markets to remain resilient yet range-bound as investors assess Q2FY26 earnings and track global interest rate expectations. However, the medium-term outlook appears decisively constructive. Structural macroeconomic indicators remain firm, foreign inflows are gradually returning, sector rotation is broadening, and domestic liquidity continues to anchor equity performance. Together, these factors enhance the overall risk–reward setup for Indian equities heading into the next fiscal year.

Market internals further reinforce this optimistic narrative. Participation breadth has widened significantly, with more than one-third of listed stocks now hovering near their 52-week highs, compared with only a small fraction near their lows. Nearly half of the Nifty 500 constituents are outperforming the index on a rolling 12-month basis, highlighting the broad-based nature of market enthusiasm. The average distance of stocks from their 52-week highs has narrowed sharply, underscoring renewed risk appetite. After two years of heavy foreign outflows amounting to USD 30 billion, valuations have normalized meaningfully, creating an attractive re-entry point for global investors. As the global AI-led market rally shows signs of fatigue, India’s expanding earnings momentum—supported by MSCI EPS growth expectations of rising from 10 to 14 percent year-on-year—positions the market favourably for rotation from overheated global themes into broader emerging-market opportunities.

Mr. Siddharth Vora, Head - Quant Investment Strategies & Fund Manager, PL Asset Management, said, “India is entering a phase of synchronized macro stability and earnings recovery. With festive demand strong, foreign inflows reviving and the investment cycle strengthening, the medium-term outlook for equities appears favourable. Our models indicate improving breadth and sentiment, supported by attractive valuations and rising growth visibility.”

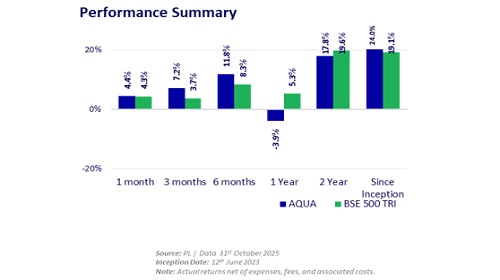

These macro and market developments were also reflected in the performance of PL Asset Management’s AQUA PMS strategy, which delivered a return of 4.38 percent in October, marginally outperforming the BSE 500 TRI’s 4.27 percent. The strategy’s results were driven by tactical sector allocation and strong stock selection, especially within the mid-cap segment. AQUA maintained a disciplined positioning across financials, materials, and industrials while sustaining a healthy tilt towards mid-cap opportunities. Since its inception in June 2023, the strategy has generated 23.98 percent returns, outpacing the benchmark’s 19.09 percent and reinforcing the effectiveness of its adaptive quantitative approach.

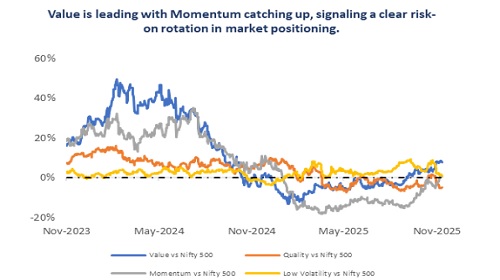

Proprietary quantitative indicators tracked by PL Asset Management—including its Value-Meter, Risk-o-Meter and sector-level beta spreads—point to an increasingly risk-on environment. Value factors continue to lead market performance, while momentum indicators are gaining strength, reflecting growing confidence among investors. Sentiment and liquidity metrics also show a decisive shift away from the pessimism that dominated earlier months, signalling a market that is entering a more constructive and broad-based recovery phase.

Above views are of the author and not of the website kindly read disclaimer

More News

Market Commentary (closing) for 15th October 2025 by Bajaj Broking