India`s Home Loan Supercycle: Rs.150 Trillion Credit Opportunity by 2035 : OmniScience Capital

India is undergoing a historic housing finance upcycle, with cumulative home loan disbursements projected to touch Rs.150 trillion over the next decade, according to a new report titled “India’s Home Loan Supercycle: Driving an Inevitable Investment Opportunity” released by Omniscience Capital.

The report highlights that a powerful convergence of demographics, urbanisation, infrastructure investment, and policy support is laying the foundation for one of the most enduring structural credit opportunities in India’s financial services landscape.

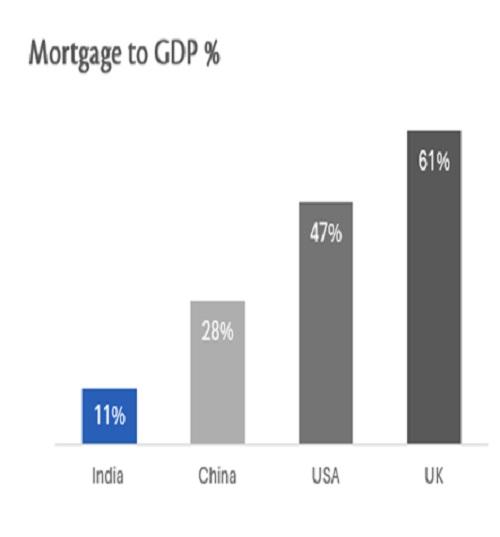

With mortgage penetration at just ~11% of GDP, far below global benchmarks, India’s housing finance market remains deeply underpenetrated. As incomes rise and urban aspirations expand, the sector is entering a inflection point offering substantial headroom for sustained, multi-year growth backed by strong structural catalysts.

A powerful structural catalyst underpinning the opportunity is India’s accelerating urban transformation. By 2035, the country’s urban population is projected to exceed 650 million with urbanisation rate rising to 43% fuelled by unprecedented investments in highways, metro rail networks, logistics corridors, and the rapid emergence of satellite townships. This infrastructure-led expansion is dramatically widening the addressable housing market, pushing demand well beyond the traditional metros.

Further, government initiatives are strengthening affordability and aiding supply creation with PMAY-2.0 aimed to support financing for 30 million additional homes, SWAMIH-2 targeting completion of 100,000 stalled mid-income housing units, and the Rs.1 lakh crore Urban Challenge Fund is designed to reshape Indian cities into future growth hubs. Continued enforcement of RERA has also enhanced transparency and buyer confidence across the real estate ecosystem.

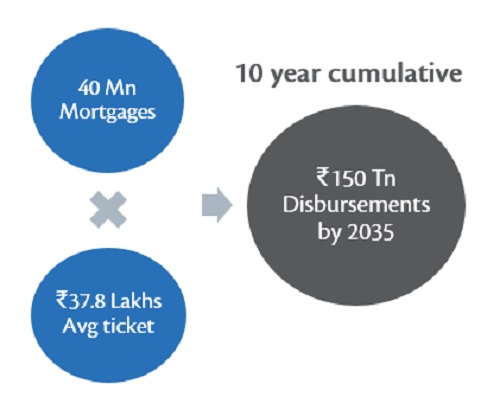

The report estimates a cumulative disbursement opportunity of ~Rs.150 trillion by 2035 even under conservative assumptions of 40 million urban mortgages demand and an average mortgage loan value of ~38 lakhs.

With resilient balance sheets, rising affordability, and multi-year demand visibility, the housing finance industry is poised to become a cornerstone of India’s next phase of economic growth.

Despite improving fundamentals, valuations across the sector remain relatively muted and Omniscience Capital believes the period ahead could trigger a re-rating for well-positioned lenders, making India’s home loan supercycle a defining investment theme.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Staying the Course: Capex-Led Growth with Fiscal Discipline by OmniScience Capital