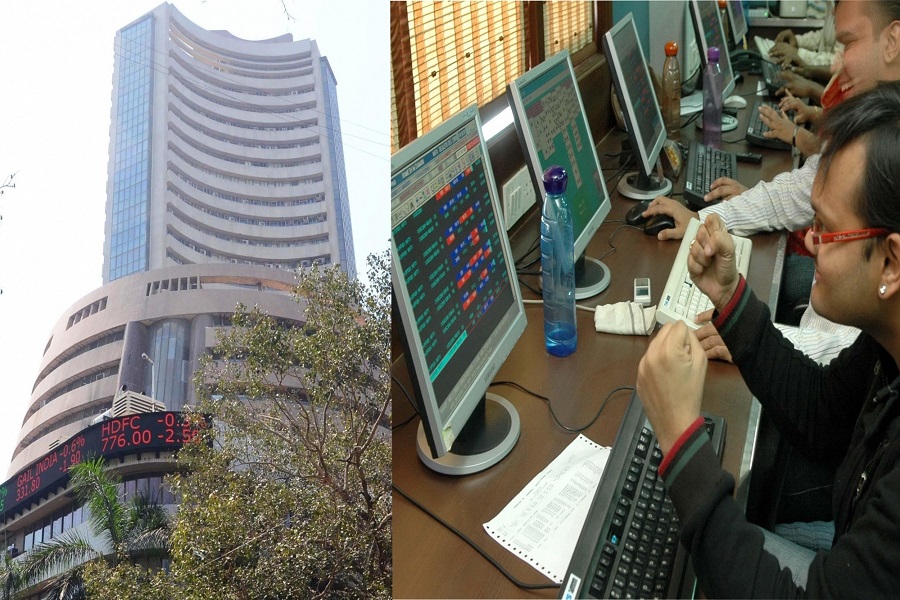

India`s growth on resilient trajectory, equity markets in consolidation phase

India’s economic momentum is expected to recover in the second half of FY25, driven by a rebound in government capex post-elections, recovery in rural consumption, and on the back of festive season demand, a report by Motilal Oswal Private Wealth (MOPW) said on Saturday.

The growth remains steady, positioning India as one of the fastest-growing major economies globally, with relatively low volatility and stable growth, said the Alpha Strategist Report.

Equity markets now are in consolidation phase after a corrective phase of 10-12 per cent in the benchmark indices.

“With the recent market correction, large-cap valuations appear attractive. Investors can adopt a lump-sum strategy for Hybrid, Large, and Flexi-cap funds while taking a staggered approach over three months for select mid- and small-cap strategies,” the report mentioned.

FII turned net buyers after 38 trading sessions with an infusion of Rs 9,947 crore.

“The Indian economy continues to remain on strong footing and signs are visible for growth coming back on track gradually. Hence, we continue to remain positive on the equity markets from long term perspective,” the report mentioned.

It cautioned investors to tread with caution by adopting a strategy which is balanced and resilient.

“Based on their risk profile, investors having the appropriate level of equity allocation can continue to remain invested,” the report mentioned.

Considering the recent corrections, if equity allocation is lower than desired levels, investors can increase allocation by implementing a lump sum investment strategy for Hybrid, large and flexicap strategies and 3 to 6 months for select mid and small-cap strategies with accelerated deployment in the event of a meaningful correction.

“With the evolving interest rate scenario, the fixed income portfolio should be Overweight on Accrual Strategies and Neutral on Duration Strategies,” the report mentioned.