India`s ESDM market to double to Rs 7-8 lakh crore by 2030, powered by Smartphones by CareEdge Ratings

Synopsis

* Strong Market Momentum: India’s Electronics System Design & Manufacturing (ESDM) industry is witnessing rapid expansion, with design, engineering, and manufacturing. The Indian ESDM market is expected to reach Rs 7-8 lakh crores by 2030, expanding at a CAGR of 20-25% over the next five years. The strong growth momentum is backed by robust demand for smartphones, consumer electronics, and automotive electronics, underscoring India’s growing strength in the design and engineering space.

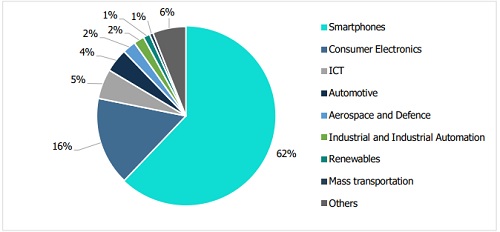

* Smartphones Driving Growth Momentum: Accounting for 62% of the ESDM industry in FY25, the segment grew at a CAGR of 28% during the FY20-25 period, fuelled by rising incomes, smartphone adoption, and smart device penetration. Going forward, the segment is estimated to grow at a CAGR of 23-25% for the FY25-30 period.

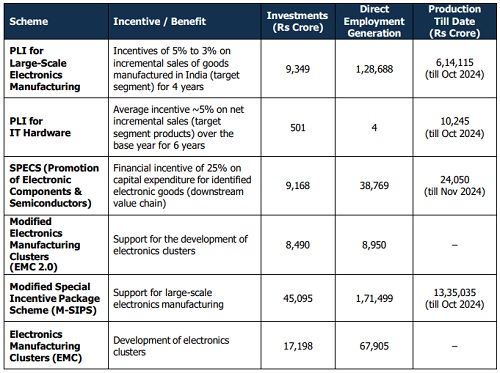

* Policy Push Meets Tech Innovation: India’s electronics manufacturing ecosystem is rapidly scaling, driven by government incentives (PLI, SPECS, ECMS, NPE, Digital India), global OEM outsourcing, and a skilled workforce. This, coupled with technology-led expansion through AI, IoT, and demand for customisation, India is strengthening its position as a competitive global hub for high-value ESDM and contract manufacturing.

Next-Gen Policy Pushes India Toward Global Electronics Leadership

According to the Government, India ranks 3rd globally in economy-wide digitalisation and 12th amongst G20 nations for individual user digital adoption. With its digital economy set to grow nearly twice as fast as the overall economy, contributing almost one-fifth of national income by 2029-30, the rising adoption of digital technologies and, consequently, the demand for advanced devices and infrastructure present growth opportunities for the electronics sector.

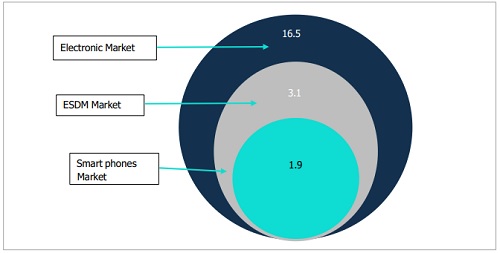

India’s electronics industry is undergoing a major transformation, positioning the country as a leading global hub for Electronic System Design & Manufacturing (ESDM). India’s electronics industry has witnessed a remarkable growth of 21% CAGR over the past five years, reaching Rs 16.5 lakh crore in FY25, supported by government initiatives, strong domestic demand, and a favourable policy environment.

The Indian electronics industry is projected to continue its strong growth momentum, reaching Rs 36-40 lakh crore (as per NITI Aayog) by 2030, expanding at a CAGR of 14-16%. This growth trajectory is being driven by flagship government programs, which aim to enhance domestic manufacturing capacity and gradually reduce reliance on imports. The growing demand for next-generation technologies, such as electric vehicles, IoT devices, semiconductors, and AI solutions, will further accelerate growth.

India is steadily emerging as a global hub for electronics. The market is also supported by other government initiatives, such as SPECS and the Phased Manufacturing Program (PMP). These schemes focus on strengthening the local component ecosystem and boosting domestic value addition. Growing exports and increasing investment by global companies are further positioning India as a major hub for electronics manufacturing.

From Design to Delivery: ESDM Powers India’s Electronics Growth Story

The Indian ESDM market is expected to double to Rs 7-8 lakh crores by 2030, expanding at a CAGR of 20-25% over the next five years. The rise in outsourcing to reduce costs and improve efficiency is driving ESDM adoption, with OEMs in consumer electronics, automotive, healthcare, and telecommunications industries relying on ESDM for design, prototyping, assembly, testing, and logistics. Regional manufacturing hubs, favourable trade policies, and demand for miniaturised, customised electronics are further expanding the market. Additionally, rising GCCs will boost India’s electronics industry by driving R&D, product design, and miniaturised solutions, complementing local manufacturing hubs and favourable trade policies.

Figure 1 Indian Electronics, ESDM and Smart Phones Market size in FY25 (Rs Lakh Crores)

Smartphones Take Centre Stage: The Engine of ESDM Growth

Smartphones have firmly established themselves as the cornerstone of India’s ESDM industry, contributing 62% of the ESDM industry in FY25. Their scale, complexity, and rapid pace of innovation position them as the primary engine of both volume growth and technological advancement within the ESDM value chain.

Affordable smartphones, coupled with low-cost data plans, have democratised internet access and led to healthy demand for smartphones and associated devices across metros as well as tier-II and tier-III cities.

Chart 1: Market Breakup by End Use Industries: Value Share in FY25 (%)

The surge in smartphone and broadband penetration, combined with government initiatives like Digital India and Bharat Net, is further strengthening the need for large-scale electronics manufacturing and assembly services. Going forward, the consumer electronics market is expected to grow, backed by recent GST reductions on appliances such as TVs, ACs, refrigerators, and dishwashers, which are now taxed at 18% (down from 28%). In comparison, small consumer electronics are taxed at 12% (down from 18%). These cuts are set to improve affordability, boost sales volumes, and spur investments in domestic manufacturing and retail, accelerating middleclass adoption and market expansion.

From Import to Independence: India’s Rise in Smartphone Manufacturing

India’s smartphone ecosystem has witnessed a remarkable transformation over the past decade. From being largely import-dependent, the country has evolved into a global hub for smartphone assembly, now ranking among the top three smartphone manufacturers worldwide.

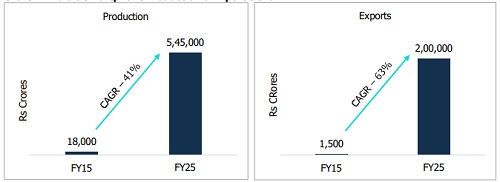

According to the Ministry of Electronics & IT, nearly 99% of smartphones sold in India are currently manufactured domestically, compared to just 26% in FY15, when the majority were imported. The manufacturing value of smartphones has also expanded significantly, rising from just Rs 18,900 crores in FY14 to an impressive Rs 4,22,000 crores in FY24, with annual shipments consistently crossing 150 million units. Within the ESDM segment, smartphones contributed an estimated Rs 2 lakh crore in FY25 and are projected to grow at a CAGR of 23-25% over FY25-30. Robust domestic demand, supportive government policies, and the combined presence of global ESDM giants and strong local players have all contributed to this growth.

Furthermore, global manufacturers shifting base to India, alongside the rise of domestic ESDM players catering to demand for high-quality, cost-efficient electronics, also support this growth momentum. Additionally, rising disposable incomes, rapid urbanisation, and aspirational spending are fuelling demand for innovative and energyefficient appliances, particularly across tier-II and rural markets.

The Production Linked Incentive (PLI) scheme has further incentivised large-scale investments, with companies committing billions of dollars to expand their ESDM operations. The government has recently cleared the Electronics Component Manufacturing Scheme (ECMS), which aims to attract investments of Rs 60,000 crore. This has led to an increase in the number of smartphone manufacturing units, from just two in 2014 to over 300 by 2024.

According to ICEA, India currently produces more than 325-330 million smartphones annually, not only meeting nearly all domestic demand but also strengthening its position in the global supply chain.

Chart 2: India’s Smartphone Production & Export trend

Indian exports have dramatically risen from 8% of total production in 2015 to over 36% by FY25, driven by the PLI scheme. The PLI scheme for electronic components, with an outlay of Rs 229 billion, has received investment proposals exceeding Rs 500 billion. The momentum began with the Phased Manufacturing Programme launched in 2017 and gained strong acceleration under the 2020 PLI scheme, driving large-scale growth in electronics manufacturing

India’s smartphone segment has recorded a sustained positive net export trend since FY19, underscoring structural strengthening in domestic manufacturing capabilities. This trajectory is further validated by India surpassing China in smartphone exports to the US in Q2 2025, highlighting a strategic shift in global supply chains.

According to the Ministry of State for Electronics and Information Technology, India is proactively promoting the growth of its indigenous electronics industry to expand and strengthen the country’s electronic manufacturing ecosystem, thereby enhancing India’s participation in global electronics value chains (GVCs)

These initiatives have significantly strengthened India’s electronic manufacturing ecosystem by attracting substantial investments, creating large-scale employment, and boosting domestic production. Collectively, they have positioned India as a competitive hub in the global electronics value chain, driving innovation, enhancing manufacturing capabilities, and reinforcing the country’s vision of becoming a global leader in electronics.

CareEdge Research’s View

“The Indian ESDM market is expected to double to reach Rs 7-8 lakh crores by 2030, registering a CAGR of 20- 25% over the next five years, backed by robust demand across smartphones, consumer electronics, and the automotive segment. The global manufacturers shifting base to India, government’s policy support, regional manufacturing hubs, and improving cost efficiencies with ESDM adoption are pivotal in driving this growth momentum.”, says Tanvi Shah, Senior Director, CareEdge Research.

“The smartphone segment within the ESDM market is around Rs 2 lakh crore as on FY25 and projected to grow at a CAGR of 23-25% over the next 5 years. This surge will be driven by robust domestic demand, government policy support, rising exports, and strong participation from global and local manufacturers.”, says Praveen Pardeshi, Associate Director, CareEdge Research.

Above views are of the author and not of the website kindly read disclaimer