Index opens strong, stays bullish early, then trades range-bound - GEPL Capital Ltd

Market News:

* HUDCO signs Rs.5,000 crore MoU with Jawaharlal Port Authority to finance infrastructure projects at Jawaharlal Nehru Port.

* Knowledge Marine secures Rs.386 crore LoI from VO Chidambaranar Port Authority for 15-year hire of battery-operated electric green tug.

* SpiceJet doubles its flight operations to 250 daily services for winter 2025, up from 125 in the summer season.

Technical Summary:

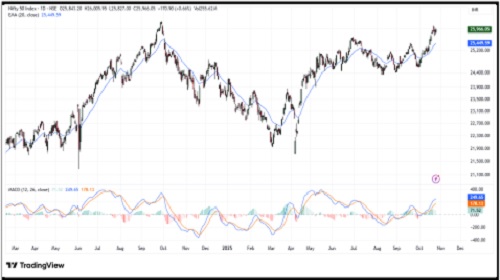

The index opened on a positive note and remained bullish during the first half of the session, while the second half saw range-bound movement around the prior day’s high. On the daily scale, the index continues to trade above its 5-day average, reaffirming the prevailing positive sentiment. On the sectoral front, PSU Bank and Oil & Gas emerged as the top gainers, whereas Defence and Media sectors witnessed notable declines.

Levels to watch:

The Nifty has its crucial resistance 26100 (Multiple Touches) and 26300 (Key Resistance). While support on the downside is placed at 25800 (Pivot Level) and 25700 (Key Support).

What should short term traders expect?

The Index can short below 26000 for the potential target of 26100 & 26300 with stop loss 25930 of level.

Technical Data Points

NIFTY SPOT: 25973 (0.69%)

TRADING ZONE:

Resistance: 26100 (Multiple Touches) and 26300 (Key Resistance)

Support: 25800 (Pivot Level) and 25700 (Key Support).

STRATEGY: BULLISH TILL ABOVE 25700 (Key Support).

BANK NIFTY SPOT: 58196 (0.86%)

TRADING ZONE:

Resistance: 58600 (Pivot Level) / 59000 (Key Resistance)

Support: 57700 (Pivot Level) / 57300 (Key Support)

STRATEGY: BULLISH TILL ABOVE 57300 (Key Support)

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

More News

Market Watch: Fed cut rates by 25bps, but December`s cut appears less certain by Geojit Inve...