Index holds Bullish Hammer low, ends above 24500 support - Tradebulls Securities Pvt Ltd

Nifty

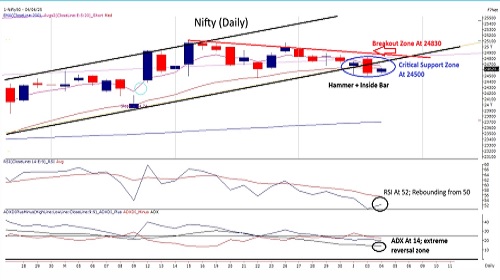

Despite persistent intraday weakness, the index respected the Bullish Hammer swing low and closed above the critical 24500 support zone. However, the failure to close above the 20-DEMA (24630) reflects underlying weakness and warrants caution. A sustained breakdown below 24500, particularly if accompanied by a daily RSI close below 50, could confirm a channel breakdown, opening downside potential towards 24185 (50-DEMA) or 23700 (200-DEMA). Options data reinforces a rangebound structure, with significant OI build-up at 24500 (puts) and 25000 (calls). Interestingly, the Put-Call Ratio suggests oversold conditions, increasing the probability of a technical bounce early in the week. Key levels to watch for a Bullish trigger is a close above 24830 to revive positive momentum and open the path toward 25000, followed by 25180 as a major resistance and sentiment gauge. While a bearish trigger could be a Sustained breach of 24500 which may initiate a deeper corrective move. Since it is a rangebound setup with inflection trigger points, until a decisive breakout occurs, contrarian long trades near 24600 may be explored with a strict stop-loss below 24450. However, aggressive positioning should be avoided until confirmation emerges on either side.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

More News

Nifty opened flat, hit a new high, but saw mild profit booking now - ICICI Direct