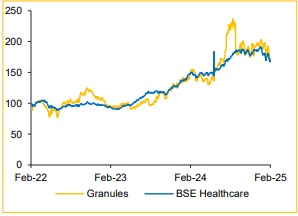

Hold Granules India Ltd For the Target Rs. 623 by Choice Broking Ltd

Granules India enters CDMO business by acquiring Swiss-based Senn Chemicals AG

We anticipate that this acquisition aligns with Granules' strategic vision to expand into peptide-based anti-diabetic therapies, strengthen its highmargin CDMO capabilities, and advance next-generation therapeutics. By leveraging Senn Chemicals' expertise in peptide synthesis alongside its own large-scale, cost-efficient manufacturing infrastructure, Granules aims to deliver high-quality peptide-based solutions globally. This acquisition enhances Granules' position in peptide-based drug development, particularly in the rapidly growing anti-diabetic and anti-obesity markets, including GLP-1 receptor agonists.

High-growth, High-margin CDMO business:

The CDMO sector is set for sustained growth, driven by structural shifts in drug development and highmargin opportunities. According to BCG, CDMO business is expected to grow at a CAGR of 20% ($15.6Bn in 2023 to $ 44.6Bn in 2029). Companies within our coverage, including Divi’s, Laurus Labs, and Piramal Pharma, are projected to achieve YoY growth of 35%, 40%, and 17%, respectively, in their CDMO businesses in FY25. This acquisition is a small acquisition contributing ~4% of the total revenue, however it opens door to explore larger opportunity in the CDMO space from a long term perspective. Considering that the acquisition is into CDMO business which is a high-margin business, valued at a higher multiple, will benefit the group company in the long-term.

Transaction Details:

* Senn Chemicals AG: Based in Switzerland, Senn specializes in peptide development, manufacturing, and CDMO services, supporting global clients across Pharmaceuticals, Cosmetics and Theragnostic industries, from early development to commercial production.

* Deal Value: The total consideration is approximately INR 192Cr.

* Equity Stake: Granules India is acquiring 100% of Senn Chemicals AG’s equity.

* Timeline: The transaction is expected to be completed in the H1CY25, subject to regulatory approvals.

* Subsidiary Formation: To facilitate the acquisition, Granules India will incorporate a wholly owned subsidiary with an authorized share capital of INR 500Cr and a paid up capital of INR 200Cr.

* Revenue: The target entity had estimated sales of CHF 19.6 Mn (INR 1.85Bn) in the CY24.

View and Valuation:

Considering this is a small acquisition, we do not anticipate significant impact from this acquisition. We continue to maintain our forecast and rating of ‘HOLD’ with a target price of INR 623 (PE of 22x) on FY27 EPS.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131