Health makes wealth in the stock market too: Equirus report

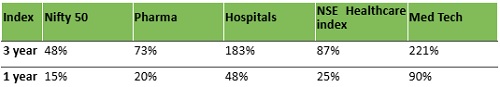

Health is wealth — and new research suggests this maxim now applies equally to India’s capital markets. A study by leading investment banking and financial services powerhouse Equirus reveals that the NSE Healthcare Index has outperformed the Nifty 50 over 1-, 3- and 5-year periods.

Healthcare Outperforms the Market

The Equirus analysis shows a broad-based outperformance across key subsectors including:

* MedTech

* Hospitals

* Pharma

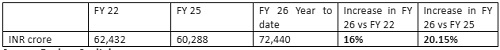

Record Fundraising and Larger Deal Sizes

This strong momentum in stock market performance has fuelled record fundraising, with the life sciences and healthcare sector surpassing the Covid-19 era high of Rs.62,432 crore recorded in FY22. “The current fiscal year has already seen fund raising cross Rs 72,440 crore led by ECM in Pharma and Buyouts in Hospitals. Apart from a significant uptick in activity across all sub sectors, we have seen the average deal size almost triple from Rs 700 crore in the pharma sector to Rs 2,100 crore and, from Rs 300 crore in the hospitals sector to Rs 850 crore,” said Siddharth Iyer, Director and Sector Lead – Lifesciences and Healthcare, Equirus Capital.

Fundraising in the healthcare and life sciences sector

The report also highlights a sharp rise in M&A scale, with average transaction sizes more than quadrupling from Rs.700 crore to Rs.3,000 crore.

In FY26, Pharma dominated equity capital markets, accounting for Rs.32,000 crore, or nearly 63% of the Rs.51,000 crore raised via this route.

Key Sector Forecasts

Equirus expects:

* IPOs of contract development and manufacturing organisations (CDMOs) as companies unlock value.

* Intense M&A, buyout activity and IPO/QIP momentum in Pharma.

Buyouts have already begun outpacing private trades due to asset scale and valuation arbitrage.

Five Trends That Will Shape 2026

- PE funds building platforms as healthcare delivery remains nationally fragmented

- Diagnostic chains acquiring regional players to penetrate Tier II and III cities

- PE interest rising in single-specialty care and MedTech

- Scarcity premium in MedTech driving valuations higher

- Hospitals shifting to asset-light expansion.

Public Market Premium Driving ECM Activity

“Public markets across sub sectors such as Active pharma ingredients, Formulations, CDMOs, Pan India hospitals, Regional hospitals and Diagnostics providers are all commanding significantly higher enterprise value to EBITDA multiples than private market valuations. This is driving equity capital markets issuance as there is a clear arbitrage available for IPO'able companies,” added Iyer.

Investment Outlook

Equirus forecasts:

* PE and M&A investments, exceeding $5.3 billion in the healthcare and life sciences sector over the next three years

* $8 billion ECM activity in the sector driven by PE exits

“We anticipate Healthcare and med-tech to attract private equity investment to the tune of USD 4.5 Billion over the next 3 years,” concludes Iyer.

Above views are of the author and not of the website kindly read disclaimer