Gold Insight As On 01092025 by Amit Gupta, Kedia Advisory

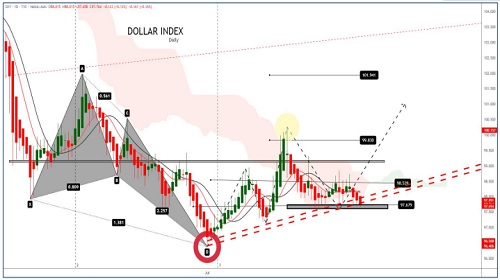

Dollar Index

Gold $

Gold Silver Ratio

MCX Gold

USDINR

Conclusion

* MCX Gold hits record high of 1,05,937, supported by rupee weakness as USDINR slips to an all-time low of 88.30.

* Geopolitical risks intensify with renewed Russia-Ukraine tensions and failed ceasefire talks, boosting safe-haven demand.

* Trade war concerns resurface as tariff tensions escalate, adding to global economic uncertainty.

* China’s continued gold buying and dovish Fed outlook support strong physical and investment demand.

* Technical outlook: Resistance at 1,03,500 and support at 1,00,350; breakout above resistance may trigger further rally, while dips likely remain well-supported.

Gold on MCX hit an all-time high of 1,05,937, supported by rupee weakness with USDINR at 88.25. Geopolitical tensions, trade war risks, and China’s consistent buying added to safe-haven demand. $Gold rallied near all time, alongside rising expectations of a September Fed rate cut, further boosted sentiment. With traders pricing in an 86% chance of a 25 bps cut, gold’s outlook remains bullish.

Key resistance lies at 1,06,400 / 1,08,000, while strong support is placed at 1,02,000, keeping the trend positive.

Stay Cautious, avoid any big positions.

Above views are of the author and not of the website kindly read disclaimer