FY 2025 Residential Registrations Across Top-Cities Hit 5.44 Lakh, Up 77% from FY 2019 Primary Transactions Account for 57% Share: Square Yards

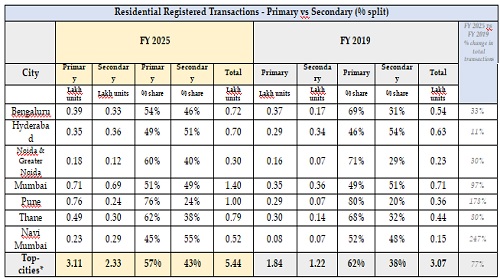

Residential registered transactions in India have shown consistent growth in recent years, particularly following the pandemic. As per Square Yardslatest report, “Primary Vs Secondary: Unpacking Demand Trends in India’s Residential Market”, the total number of registered residential transactions withInspector General of Registration (IGR) across key Indian cities increased from 3.07 lakh units in FY 2019 to 5.44 lakh units in FY 2025, marking a 77% rise. The report also highlights a that the primary market transactions took the highest share of 57%, while secondary took the remaining 43% in FY 2025.

The analysis covers seven major cities: Bengaluru, Hyderabad, Mumbai, Navi Mumbai, Noida & Greater Noida, Pune, and Thane. In volume terms, secondary transactions rose from 1.22 lakh units in FY 2019 to 2.33 lakh units in FY 2025. During the same period, primary market transactions increased from 1.84 lakh units to 3.11 lakh units.

* Tanuj Shori, CEO & Founder, Square Yards,“The residential market has witnessed a remarkable V-shaped recovery since the pandemic, as reflected in the sharp rise in annual housing transactions—from 3.07 lakh units in FY 2019 to 5.44 lakh in FY 2025, a significant 77% increase. This strong growth cycle has been largely driven by a renewed preference for homeownership, which has bolstered primary sales. In fact, primary sales accounted for 57% of all registered residential transactions during this period. Interestingly, our data reveals that the growth isn't limited to primary demand alone. The secondary market has also gained considerable traction, with its share rising from 38% in the pre-pandemic era to 43% in FY 2025. This growing preference for ready-to-move-in homes—particularly in well-connected and established locations—has steered more buyers toward the secondary segment. The uptick in secondary sales is evident not only in terms of market share but also in absolute transaction volumes. Looking ahead, we anticipate this dual-track momentum to persist, with sustained demand continuing to drive growth across both the primary and secondary residential markets.”

* Key City-wise Insights and Trends:

* Bengaluru:Of the approximately 72,000 residential transactions registered in FY 2025, 54% were from the primary market. This was supported by increased new supply from both established national and local developers across the eastern, southern, and northern micromarkets. The share of secondary market transactions grew notably—from 31% in FY 2019 to 46% in FY 2025—with volumes more than doubling. This growth was primarily driven by heightened demand for ready-to-move-in homes, underpinned by Bengaluru’s expanding IT sector and the rising influx of professionals seeking immediate occupancy.

* Noida & Greater Noida:The region recorded an 11 percentage point increase in the share of secondary market transactions, rising from 29% in FY 2019 to 40% in FY 2025. These cities are seeing strong end-user and investor interest in residential sector amid anticipation surrounding the opening of Jewar International Airport. However, new supply is relative limited in these cities, with of the new supply being concentrated in the high-end segment, making resale properties, which are availble across broader price bands more appealing to buyers.

* Mumbai:As a mature residential market, Mumbai has traditionally been led by secondary transactions. In FY 2025, the city registered approximately 69,000 secondary transactions—up from 36,000 in FY 2019. However, upcoming redevelopment projects in central parts of the city has also contributed to an increase in primary supply. As a result, primary registrations nearly doubled, reaching ~71,000 in FY 2025 from ~35,000 in FY 2019, reflecting a stronger growth rate in the primary segment.

* MMR:

- * Navi Mumbai:The share of secondary transactions increased by 7 percentage points, supported by renewed buyer confidence amid ongoing construction of the Navi Mumbai International Airport.

- * Thane:Of the ~79,000 total registered transactions in FY 2025, 62% were primary. The city continues to see growth in both supply and demand in the primary market, particularly in Thane West. The secondary market also showed strength, with its share rising by 6 percentage points. Resale transactions more than doubled from ~14,000 in FY 2019 to ~30,000 in FY 2025.

- * Pune: The city recorded a 4 percentage points rise in secondary transactions but remains heavily skewed toward primary sales, with 76% registered transactions being primary. This trend is shaped by large-scale project launches in hubs like Pimpri-Chinchwad, Hinjewadi, Kharadi, Wagholi amongst others.

- * Hyderabad:Hyderabad exhibited a relatively balanced market profile. Secondary transactions accounted for 51% of total registrations in FY 2025. However, this represented a decline of 3 percentage points compared to FY 2019, as new supply across the western suburbs gained traction. Despite this, demand for resale units remains stable in established neighborhoods near HITEC City and other IT corridors

Above views are of the author and not of the website kindly read disclaimer