F & O Rollover Report 25th November 2025 by Axis Securities

HIGHLIGHTS:

Nifty Rollover: The Nifty November rollover activity concluded at 55.8% on Monday, trailing the 56.5% recorded at the same stage of the previous expiry. This figure is notably below the three-month average of 63.7% and the six-month mean of 66.5%, signaling a subdued sentiment where traders are exercising caution rather than aggressively carrying forward positions against the historical trend.

Bank Nifty Rollover: The banking index witnessed a significant deceleration in momentum, with Bank Nifty rollovers dropping to 52.4% from 61.6% in the previous expiry. This metric is substantially lower than both the three-month average of 60.7% and the six-month average of 61.7%, reflecting a defensive stance and a distinct lack of conviction to extend exposure in financial heavyweights at current levels.

Market-Wide Rollover: In contrast to the headline index, broad market participation remains robust, with the market wide rollover standing at 80.6%. While this is marginally below the 83.5% from the prior expiry's comparable day, it encouragingly surpasses both the three-month (80.4%) and six-month (80.0%) averages. This stability above recent historical benchmarks points to sustained, healthy liquidity and continued interest across the wider derivatives segment.

Rollover Cost: Despite the lower rollovers in indices, the cost of carry widened to 0.67% on Monday, up from 0.60% in the previous series. This divergence suggests that while fewer positions are being rolled, the premium traders are willing to pay for maintaining those specific positions has increased, potentially hinting at underlying conviction among committed participants.

Stock-Level Rollover Gains: Investor interest appears to be pivoting toward the energy and public sector utility segments, as BPCL, COALINDIA, HINDPETRO, POWERGRID and ONGC all registered higher rollover figures compared to the same day of the previous expiry. This accumulation suggests a strategic rotation into defensive value stocks and potential long build-up in the power and oil marketing sectors.

Stock-Level Rollover Declines: Conversely, unwinding pressure or a lack of follow-through buying was evident in select names such as FORTIS, RBLBANK, DELHIVERY, RECLTD and LTF, which observed lower rollover activity relative to the prior month. This reduction indicates potential profit-booking or a "wait-and-watch" approach from market participants regarding these specific counters.

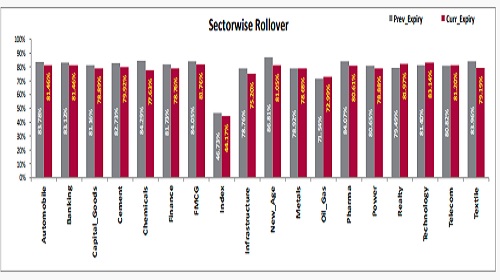

Sector-Level Rollover Trends: Realty, Technology, Oil & Gas and Telecom sectors saw elevated rollover activity. This suggests growing market conviction and carry forwarding of positions into these areas. Conversely, sectors including Chemicals, New-Age, Textile, Pharma and Infrastructure recorded lower rollover percentages when compared to the last expiry. This change indicates that trader’s attention may be waning away from these segments.

NIFTY HIGHLIGHTS

Nifty October November rollovers stood at 55.8% on Monday, trailing the previous expiry's 56.5% and significantly underperforming the three-month average of 63.7% and six-month mean of 66.5%, pointing to cautious trader sentiment and reduced positioning. Bank Nifty rollovers dropped sharply to 52.4% on Monday from 61.6%, significantly lagging the three-month average of 60.7% and six-month mean of 61.7%, highlighting a distinct lack of conviction to carry forward banking exposure. The widening rollover cost to 0.67% on Monday from 0.60% in the previous series suggests underlying conviction among committed participants willing to pay higher premiums. The Market wide rollovers moderated to 79.2% on Monday from 80.6% previously, staying below both the three-month average of 80.52% and the six-month benchmark of 80.5%, suggesting a period of broad-based market consolidation. The option data for the November series indicates a strong Call Open Interest (OI) at the 26,100- strike price, followed by 26,200. In contrast, a substantial concentration of Put OI is observed at 25,800, with additional levels at 25,700. This suggests the likely range for the current expiry is between 25,700 and 26,100.

Nifty Rollover Vs Market-wide Rollover

Stock & Sector Highlights

* BPCL, COALINDIA, HINDPETRO, POWERGRID and ONGC saw higher rollover on Monday compared to same day of previous expiry.

* FORTIS, RBLBANK, DELHIVERY, RECLTD and LTF saw lower rollover on Monday compared to same day of previous expiry.

* Highest rollover in current expiry for the day is seen in ABCAPITAL, HCLTECH, BAJFINANCE, MARICO and TECHM.

* Lowest rollover in current expiry for the day is seen in SAIL, NCC, KAYNES, RECLTD and IRFC.

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633