ESG: Global carbon pricing trends 2023: Needs more ambition by Kotak Institutional Equities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Amid the energy crisis and economic stagnation, 2023 was a year of gradual progress in the uptake of global carbon pricing instruments (CPI). Multi-dimensional efforts are being undertaken worldwide to promote these instruments’ uptake and improve prices to meet the 2°C goal, especially in mid-income countries. The final bill for the rollout of the Indian carbon market is approved, and the finer details are awaited. We believe that companies enabling/transitioning to a lower carbon footprint will benefit from this.

Coverage of CPIs continues to rise but needs more ambition

CPIs continued to inch up to 75 in FY2024 (FY2023: 73), covering 24% of global GHG emissions (FY2023: 23%) (see Exhibits 1-2). This is further expected to increase in the near term by 4.5%, with: (1) large middle-income countries such as Brazil, India and Turkey making notable strides toward CPI implementation (see Exhibit 3); (2) the progress of sector-specific multilateral initiatives for international aviation and shipping; and (3) the implementation of the EU Carbon Border Adjustment Mechanism (CBAM; see Exhibit 4). However, its uptake needs more ambition and larger scale of action to achieve the COP26 goal of covering 60% of global GHG emissions by 2030. CPIs remain instrumental in reaching the global climate goal. Globally, 88 countries have so far committed to achieving the net-zero target, while 54 countries are considering this step (see Exhibits 5-6).

Higher CPI prices needed to meet 2°C goal

CPI revenues increased in CY2023 to US$104 bn (CY2022: US$95 bn), driven by high allowance prices and a temporary shift in some German ETS revenues from 2022 to 2023 (see Exhibit 7). CPI prices saw mixed developments as most instruments witnessed price increases in nominal terms; however, ten ETSs, covering ~5% of global emissions, saw price declines. This included significant price declines in large, long-standing ETSs in the EU, New Zealand, Korea and the UK (see Exhibit 8), which may lead to a decline in global carbon pricing revenues in 2024. CPI prices need to increase significantly to meet the 2°C goal (see Exhibit 9). Currently, less than 1% of GHG emissions are covered by the minimum recommended price range of USD63 per t/Co2e.

Weak demand from voluntary markets drags carbon credit issuances

Carbon credit issuance volumes fell for the second-consecutive year by ~9% yoy, mainly driven by: 1) a delay in the issuance applications due to the associated costs, resulting from a lackluster market demand environment and prices; and 2) a potential shift in investment/demand away from traditional projects (see Exhibit 10). Currently, voluntary carbon markets (VCM) account for ~90% of the total demand for carbon credits (see Exhibit 11). However, lingering credibility concerns in VCM underscore the pressing need for creating a minimum global benchmark for high-quality carbon credits. In order to address this, the Integrity Council for the Voluntary Carbon Market (ICVCM) has finalized its Core Carbon Principles (CCPs) and initiated assessments of crediting programs and methodologies covering 850 mn credits via its assessment framework. The first CCP-labeled credits expected to hit the market by 3QCY24.

New demand from compliance markets to provide some support

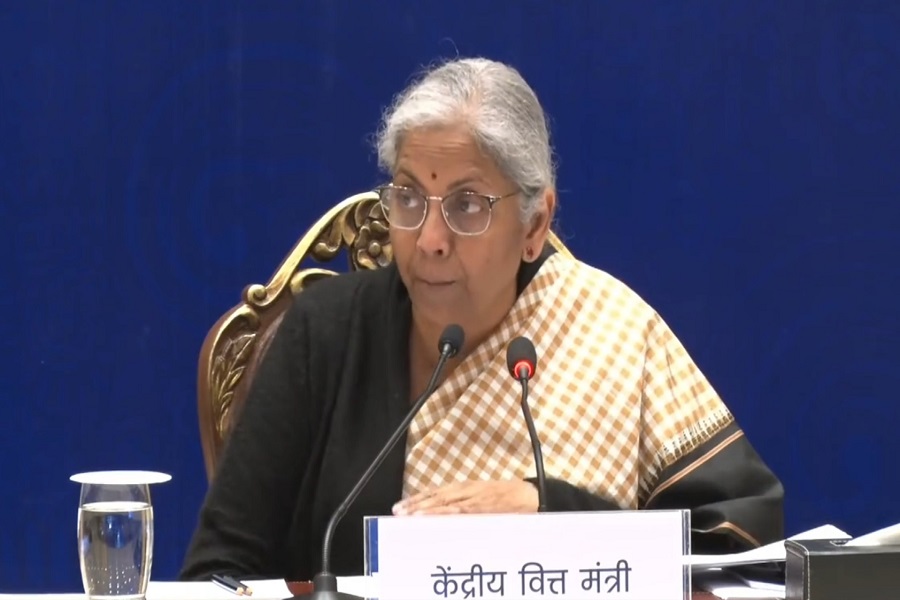

Compliance carbon markets (CCM) are also building up new demand for the future by: 1) 11 new jurisdictions, including India, currently considering carbon crediting mechanisms (see Exhibit 12) and 2) the launch of multilateral initiatives such as CBAM, CORSIA and IMO (see Exhibits 13). We note that India has already approved The Energy Conservation (Amendment) Bill, 2022, which empowers the government to roll out the Indian Carbon Market (ICM). The with finer details on its rules and regulations are expected to be announced soon.

Capital goods companies in renewable and energy efficiency space to benefit from roll out of ICM

The implementation of ICM will incentivize the low-carbon action by internalizing the cost of GHG emissions. Renewable energy and improving the energy efficiency of industries and buildings are the big themes in reducing GHG emissions. Capital goods companies such as ABB, Siemens, Thermax, L&T, Cummins, KEC and KPTL present in the renewable and energy efficiency value chain are already witnessing increased green order inflows over the past few years. Moreover, companies managing their emissions efficiently in carbon-intensive sectors such as power, metals and cement would also reap the fruits of their ongoing efforts to transition toward low-carbon footprint. Players such as JSW Energy, JSW Steel, Tata Steel and Dalmia Bharat in the current scenario could gain at the cost of others (see Exhibits 14-16).

Indian companies upping their game to transition toward lower carbon footprint

Several Indian companies have already upped their game by taking proactive steps to reduce their carbon footprints. Among the Nifty-50, 28 companies have set up goals/targets to achieve net-zero/carbon neutrality, with specific timelines (see Exhibit 17). Further, 312 companies (including 96 listed companies) have committed to science-based targets (see Exhibit 18) to reduce carbon emissions. The top-5 sectors that have adopted science-based targets- chemicals, pharmaceuticals and life sciences, software and services, construction materials and automobiles and components- comprise ~57% of total companies (see Exhibit 19).

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">

![Kotak [KIE] Pharmaceuticals: Jan Aushadhi - in the fast lane](https://portfolio.investmentguruindia.com/uploads/news/pharma_pi.jpg)