Economy Sector Update : Industrial output accelerates, but still-elevated non-core CPI inflation is set to moderate By ICICI Securities

Industrial output accelerates, but still-elevated non-core CPI inflation is set to moderate

Industrial output accelerated in Jul’23 to 5.7% YoY growth, and is likely to strengthen further as infrastructure goods stay strong, and capital goods output rebounds from a brief hiatus in growth momentum. Other pockets of strength included basic metals (+12.8% YoY, with steel output up 21% YoY) and pharmaceuticals (+12% YoY) in Jul’23. Mining is likely to continue benefitting from strengthening metals output, in response to the broadening of the investment recovery. Consumer non-durables output was up 7% YoY in Nov’22-Jul’23, evidence of a clear recovery, while consumer durables contracted because garments (-22% YoY) offset the rebound in vehicles (+8.9% YoY). We expect 6% manufacturing growth in FY24, aided by a low base in Aug-Dec’23.

CPI inflation moderated to 6.83% YoY in Aug’23 (from the shock surge to 7.44% YoY the previous month) as vegetable inflation moderated to 26.1% YoY in Aug’23 (from 37.4% YoY in Jul’23). Importantly, core CPI inflation moderated to 4.79% YoY, a reassuring signal that underlying inflation was continuing to respond to the tightening of monetary policy over the past 16 months. We expect CPI inflation to moderate below 6% YoY no later than Nov’23.

Core inflation below 5% YoY, and energy inflation too set to fall

Core CPI inflation was below 5% YoY for the second consecutive month in Aug’23, and all components of food inflation moderated, helping to lower the headline CPI inflation rate to a still-lofty 6.83% YoY. Energy (fuel and light) inflation edged up slightly to 4.3% YoY in Aug’23 (from 3.7% YoY in Jul’23). Vegetable prices have moderated substantially further in Sep’23, and the cut in LPG prices at the end of Aug’23 should enable CPI inflation to moderate to 6.3% YoY in Sep’23, and to durably below 6% YoY no later than Nov’23. The monsoon was 11% below normal until 6th Sep’23, but both major weather forecasters expect normal rainfall in Sep’23 (as evident in the past week), so reservoirs are likely to be replenished to within ‘normal’ levels (less than 10% below the long-period average) by the end of Sep’23.

No more policy rate changes in FY24, but a cut likely in Q1FY25

The I-CRR hike is to be withdrawn in phases over four weeks ending 9th Oct’23, and this continuing period of slightly tight liquidity will also contribute to reining-in inflation. Once headline CPI inflation moderates below 6% YoY by Nov’23 (and likely below 5% YoY by Jan’24), there will be no need for any change in policy interest rates during the rest of FY24. However, we continue to expect a rate cut in Q1FY25.

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

More News

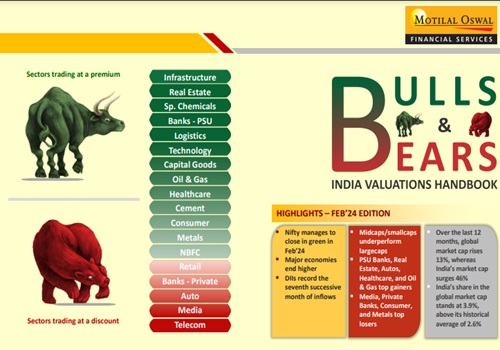

Bulls & Bears : India Valuations Handbook By Motilal Oswal Financial Services Ltd