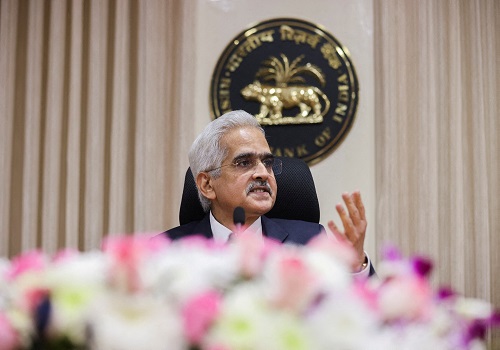

Domestic economic activity continues to be resilient: RBI Governor

The Reserve Bank of India (RBI) Governor Shaktikanta Das has said that domestic economic activity continues to be resilient. On the supply side, steady progress in south-west monsoon, higher cumulative kharif sowing, and improving reservoir levels augur well for the kharif output. The likelihood of La Nina conditions developing during the second half of the monsoon season is likely to have a bearing on agricultural production in 2024-25.

RBI Governor further noted that manufacturing activity continues to gain ground on the back of improving domestic demand. The index of industrial production (IIP) growth accelerated in May 2024. Purchasing managers’ index (PMI) for manufacturing at 58.1 in July remained elevated. Services sector maintained buoyancy as evidenced by the available high frequency indicators. PMI services stood strong at 60.3 in July 2024 and is above 60 for seven consecutive months, indicating robust expansion.

On the global growth, Das said that global economic outlook exhibits steady though uneven expansion. Manufacturing is indicating slowdown, while services activity is holding up. Notwithstanding sticky services prices, inflation is receding grudgingly across major economies. With varying outlook for growth and inflation across countries, monetary policy is showing signs of divergence across jurisdictions. Several central banks are cautiously moving towards policy pivots through forward guidance and rate cuts; at the same time, there has been tightening by a few central banks.

He further added that global financial markets are exhibiting volatility. Bond yields and the dollar index have softened since the last meeting. While the near-term outlook looks positive, there are significant challenges to medium-term global growth outlook. Demographic shifts, climate change, geopolitical tensions and fragmentations, rising public debt and new technologies, such as artificial intelligence, pose new sets of challenges. A coherent policy approach in which monetary policy is complemented by other policies to manage the policy trade-offs will be crucial to deal with such multiple challenges.