Dollar Is Facing Challenges, but De-dollarisation Remains Gradual by CareEdge Ratings

Introduction

In 1944, the Bretton Woods Agreement, signed by 44 nations, established a new global monetary order in the aftermath of World War II, positioning the US dollar as the world’s reserve currency—a role it continues to play even after 75 years. While the dollar’s dominance has facilitated financial globalisation over the decades, it has also transmitted dollar-driven shocks across the global economy. The 1971 suspension of the dollar’s convertibility to gold, known as the “Nixon Shock,” had far-reaching consequences worldwide, encapsulated by then US Treasury Secretary John Connally’s remark, “It’s our dollar, but your problem.” Concerns over dollar dependence briefly resurfaced during the 2008 Global Financial Crisis but soon receded. The debate on de-dollarisation has again reemerged in recent years, particularly after the Russia–Ukraine conflict, when punitive actions were taken via the weaponisation of the currency. These concerns have been further amplified by rising geopolitical fragmentation, protectionist trends, and growing debt vulnerabilities in the US.

In recent years, the momentum toward de-dollarisation has gained traction as several emerging economies seek to reduce their vulnerability to dollar fluctuations and financial sanctions. The push has been led by countries voicing for the use of local currencies in bilateral trade settlements. China’s efforts to internationalise the renminbi through mechanisms like the Cross-Border Interbank Payment System (CIPS), the expansion of swap lines and introduction of “petroyuan” in 2018 is in line with this trend. Similarly, the introduction of alternative payment systems and discussions on a potential BRICS reserve currency underscore the growing desire for a more multipolar monetary order.

That said, the US dollar’s entrenched historical dominance remains underpinned by the depth and liquidity of its financial markets, the credibility of its institutions, and its continued role as the preferred asset for global trade invoicing, and debt issuance. It also is worth noting that some of these strengths has weakened recently. While the gradual diversification of forex reserves and the increased use of regional currencies mark the beginning of a structural shift, a meaningful reduction in the dollar’s dominance is likely to be evolutionary rather than abrupt. In this report we discuss the potential issues challenging dollar as a reserve asset, steps taken by other economies to internationalise their currencies and India’s experience with the same.

Dollar and the Global Monetary Order

The 1944 Bretton Woods Agreement established the US dollar as the anchor of the global monetary order in the aftermath of World War II. Under this system, participating nations pegged their exchange rates to the dollar, which itself was backed by gold at a fixed rate. This arrangement effectively made the dollar the central currency in international finance. However, by the early 1970s, mounting fiscal pressures made it impossible for the US to maintain both domestic policy goals and the fixed gold parity. In 1971, President Richard Nixon suspended the dollar’s convertibility into gold, marking the collapse of the Bretton Woods framework. Despite the system’s demise, the dollar continued to dominate global trade and finance. The hegemonic power of dollars was further strengthened through the creation of the “petrodollar” system—an arrangement between the US and OPEC countries to conduct oil trade in dollars—and the expansion of the Eurodollar market, which facilitated the holding and circulation of US dollars outside America, particularly within Europe. In addition to these, growing economic heft of the US economy, institutional strength, stable policies, growing depth of financial markets and convertibility of the currency had instilled confidence on the currency.

A truly dominant global currency is expected to perform three critical roles:

a. International Unit of Account – serving as the benchmark for pricing and invoicing global Payments. b. Medium of Exchange/Payment – functioning as the principal vehicle for cross-border and foreign exchange transactions; and c. Store of Value – acting as a preferred currency for holding international reserves and assets.

The US dollar has historically fulfilled all these roles effectively. However, in recent years, it has begun to encounter challenges on some of the fronts. The following section examines each of these aspects in greater detail.

Dollar continues to Shine as Unit of Account and Exchange

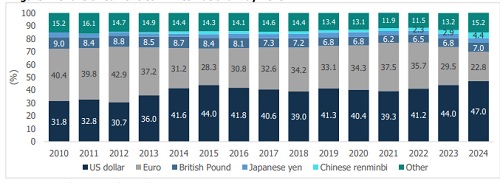

Dollar continues to shine as a unit of account and exchange in the global financial system. While other currencies like Chinese renminbi have increased their share, it is largely at the expense of Euro and British Pound (Figure 1). In fact, the share of USD in international payments has increased from ~32% in 2010 to 47% in 2024, while the share of Euro has fallen from 40% to 22.8% in the same period. Interestingly, share of yuan also rose from nil in 2010 to 4.4%.

Figure 1: Share of Currencies in International Payment

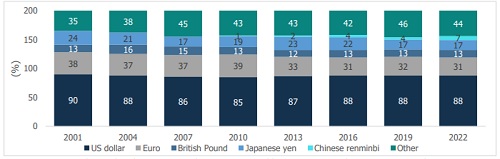

Figure 2: Share of Currencies in OTC Forex transactions

The US dollar hegemony is also visible in its dominance in global foreign exchange markets. According to the 2022 Triennial Central Bank Survey conducted by the Bank for International Settlements (BIS), the dollar was involved in approximately 88% of all global FX transactions in April 2022 — a share that has remained broadly unchanged over the past two decades (Figure 2). In comparison, the euro featured in about 31% of FX trades, marking a decline from its peak share of 39% in 2010. Chinese Renminbi also increased its share in FX transactions from nil in 2007 to 7% in 2022.

Dollar as Store of Value Has Been Challenged

While the US dollar continues to dominate global financial markets and foreign exchange transactions, its role as a store of value is increasingly being questioned. The dollar’s supremacy in global financial markets has long been sustained by a positive ‘network effect’ and the absence of alternatives. The euro and yen have so far been unable to effectively challenge the dominance of the US dollar, primarily due to factors such as persistent fiscal constraints, the absence of a unified sovereign debt market, and limited diversification advantages for global investors. The lack of full capital account convertibility in major emerging market currencies such as the Indian rupee and the Chinese renminbi further limits their ability to challenge the dollar’s position. However, the erosion of institutional credibility - such as concerns over the US Fed’s independence, the weaponisation of the dollar for geopolitical objectives, heightened policy uncertainty, and rising public debt—has begun to undermine the dollar’s credibility as a reliable store of value.

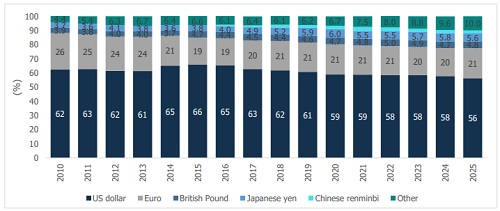

Figure 3: Dollar’s Share in Central Bank’s FX Reserves

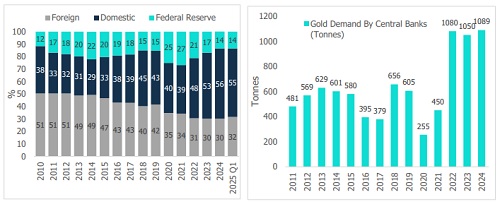

This shift is evident in the growing diversification of global central bank reserves away from the US dollar. According to the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) data, the share of dollardenominated assets in global forex reserves has been steadily declining—from around 66% in 2015 to 56.3% in recent years (Figure 3). A similar trend can be observed in the holdings of marketable US Treasuries by foreign investors (including foreign central banks, residents, and institutions), which have fallen sharply from 51% in 2012 to 32% as of Q1 2025 (Figure 4). To diversify their reserve holdings, global central banks have increasingly turned to gold, with the pace of accumulation accelerating notably after the Russia–Ukraine war in 2022. In the decade preceding the conflict, central bank’s demand averaged around 500 tonnes of gold annually; however, since 2022, this figure has more than doubled to 1,073 tonnes per year (Figure 5).

Figure 4: Holding of Marketable US Treasuries Figure 5: Central Bank Demand for Gold

In conclusion, while the US dollar continues to dominate in two key functions of a reserve currency—serving as a unit of account and a medium of exchange—its role as a store of value has come under increasing strain. The dollar’s continued dominance in the first two aspects ensures its near-term relevance in the global financial system. However, the gradual erosion of its credibility as a long-term store of value warrants close monitoring.

Lack of Credible Alternatives, Though Green Shoots Are Emerging

Major global currencies such as the euro and the Chinese renminbi (RMB) have yet to mount a meaningful challenge to the US dollar’s dominance, despite their substantial economic weight. The Euro Area’s combined GDP stands at around USD 16 trillion, while China’s GDP is approximately USD 19 trillion—the closest to the US economy at USD 29 trillion. However, despite this economic heft, several structural and institutional constraints continue to limit their ability to rival the dollar’s global role.

i. Lack of a Common Sovereign Market in the Euro Area: The euro’s limitations primarily stem from the absence of political and fiscal integration among member states, despite a monetary union. The lack of a ‘common sovereign bond market’ remains a key impediment to its widespread global acceptance. Each euro area country issues its own government securities at varying interest rates, reflecting its credit risk and fiscal health. For instance, Germany, with its strong fiscal position, can borrow at much lower rates than countries like Italy or Greece. This fragmented structure undermines the euro’s depth and liquidity— qualities essential for a global reserve currency—and was a major factor behind the European debt crisis of 2009–2012. ii. Limited Geopolitical Diversification Due to Close US–EU Alignment: The close strategic and military alignment between the US and the EU, including through institutions like NATO, limits the euro’s ability to offer geopolitical diversification. This alignment was evident during the Russia–Ukraine war, when both the US and the EU jointly imposed sweeping sanctions on Russia. Consequently, the euro provides limited insulation from the geopolitical risks associated with the dollar, particularly for countries seeking alternatives from non-Western or neutral blocs. iii. Structural and Economic Headwinds in the Euro Area: Persistent fiscal vulnerabilities and weak growth prospects continue to undermine confidence in the euro. Several member economies carry high public debt levels—Greece (around 150% of GDP), Italy (135%), France (113%), and Spain (102%). Moreover, growth remains subdued, with the IMF projecting Euro Area GDP growth at just 1% in 2025, compared to 1.5% for advanced economies. Adverse demographics repeated financial disruptions, and political uncertainties—ranging from the sovereign debt crisis to Brexit—further constrain the euro’s global appeal. iv. Limited Capital Account Convertibility Constrains the Renminbi’s Global Role: A key impediment to the internationalisation of the Chinese renminbi is the absence of full capital account convertibility, as cross-border capital flows remain heavily regulated. The currency is not freely convertible into foreign assets, with the People’s Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) exercising strict oversight over foreign exchange transactions under a managed float regime. These controls, while supporting domestic financial stability, restrict the currency ability to act as a reserve currency. Moreover, extensive state intervention and the absence of a democratic institutional framework heighten perceived political and governance risks, further constraining the currency’s acceptance in the global financial system. v. Fiscal Challenges in Yen Limits its Role: Japan’s general government debt-to-GDP ratio, at around 237%, is the highest among major economies, posing significant challenges to fiscal sustainability amid a rapidly ageing population. Moreover, prolonged ultra-loose monetary policies and the previous implementation of Yield Curve Control (YCC) measures have further constrained the yen’s appeal as a credible alternative to the US dollar.

China’s Attempt Towards Internationalising Renminbi

Despite its limitations, China has actively pursued measures to internationalise the renminbi (RMB), positioning itself as a key player within the non-Western economic bloc. Beijing’s strategy has been multi-pronged, focusing on deepening economic and financial engagement with regional and emerging market partners, developing RMBbased infrastructure for cross-border payments, and promoting the use of the renminbi in commodity pricing, particularly in sectors where China holds dominance, such as clean energy supply chains. These efforts are designed to strengthen the RMB’s role in global trade and settlement systems. However, persistent structural challenges— including relatively shallow domestic capital markets, tight capital controls, and limited investor confidence— continue to constrain the RMB’s evolution into a credible global store of value. Here we look at three major ways in which China has attempted to internationalise its currency.

I. Higher financial and economic integration with the regional countries

a. Currency Swap Agreements with regional partners: Conceptualised in the aftermath of the 1998 Asian Financial Crisis, the Chiang Mai Initiative (CMI) was established in 2010, following the Global Financial Crisis, to create a regional currency swap framework among neighbouring economies— marking China’s early efforts toward developing a regional financial safety net. A bilateral currency swap enables a monetary authority to exchange its domestic currency for an equivalent amount of foreign currency, facilitating liquidity support and cross-border settlements. In a significant development, the Bank for International Settlements (BIS) and the People’s Bank of China (PBoC) jointly launched the Renminbi Liquidity Arrangement (RMBLA) in 2022, with participation from Indonesia, Malaysia, Singapore, Hong Kong, and Chile. The IMF’s analysis1 has found evidence that such swap arrangements have contributed to the internationalisation of the renminbi by expanding its global usage in trade and finance.

As of 2024, the PBoC has signed bilateral currency swap agreements with over 40 foreign monetary authorities, of which around 31 are currently active, with a combined value of ~ USD 586 billion. Through these arrangements, China has not only strengthened regional financial linkages but has also positioned itself as a lender of last resort for several countries facing balance of payments constraints or debt-servicing challenges. Over the past two decades, these extensive swap lines have played a key role in enhancing offshore renminbi liquidity and facilitating its use in cross-border trade and investment.

b. Investments and Belt and Road Initiatives: The Belt and Road Initiative (BRI), launched in 2013, has provided a significant avenue for the internationalisation of the renminbi. Through this initiative, Chinese financial institutions finance large-scale infrastructure projects across participating countries, thereby creating sustained demand for the RMB in project funding and settlement. Moreover, the BRI framework facilitates a closed-loop financial ecosystem, enabling the smooth and efficient circulation of the RMB between China and its partner economies, further strengthening the currency’s role in cross-border trade and investment.

II. Development of financial institutions and infrastructures

a. Cross-Border Interbank Payment System (CIPS): Established in 2015, the CIPS is regarded as China’s alternative to SWIFT, even prior to the recent exclusion of Russian banks from SWIFT. CIPS facilitates the clearing and settlement of international transactions in renminbi. In 2024, the system handled approximately 8.2 million transactions, totalling around USD 25 trillion. b. mBridge Platform for trading Central Bank Digital Currency: China’s PBoC and other countries central banks like Hong Kong, Thailand, UAE and Saudi Arabia in collaboration with BIS has launched the platform mBridge to establish a multicurrency platform for trading of central bank digital currency. BIS has later distanced from the project. However, there are talks about expanding it to include other BRICS members and rebranding as BRICS Bridge. This would promote bilateral trading in local currency. c. SCO, NDB, and Other Multilateral Platforms: China has leveraged multilateral platforms such as the Shanghai Cooperation Organization (SCO) to encourage the use of local currencies in bilateral trade among member countries. Additionally, the BRICS New Development Bank (NDB) regularly issues “Panda Bonds” under its RMB bond programs, supporting the internationalization of the renminbi

III. Development of Domestic Currency-Based Commodity Markets

a. Promotion of the Petroyuan: In 2018, China introduced its first long-term oil trading contracts denominated in renminbi. The yuan has increasingly been adopted by countries facing sanctions, including Russia, Venezuela, and Iran, for oil transactions. China is actively promoting the petroyuan among GCC nations, especially following the expiration of the 50-year petrodollar agreement.

b. Renminbi-Based Markets for Copper and Other Hydrocarbons: To challenge Westerndominated commodity pricing benchmarks, China is developing renminbi-denominated markets for metals, rare earths, and various hydrocarbons. These markets operate on domestic exchanges such as the Shanghai International Energy Exchange, Ganzhou Rare Metal Exchange, and Shanghai Petroleum and Natural Gas Exchange

India’s Experience with Internationalisation of Rupee

In contrast to China’s extensive efforts to internationalize the renminbi, India’s initiatives to globalize the rupee are still at an early stage. The RBI published a report on the Internationalization of the Rupee, prepared by the InterDepartmental Group (IDG) in October 2022 and released in July 2023. The report outlines a combination of short, medium, and long-term measures aimed at enhancing the international acceptance and use of the Indian rupee.

Short-term measures include expanding currency swap arrangements and bilateral trade agreements, leveraging the Asian Clearing Union (ACU) for regional trade, allowing non-residents to open INR accounts, integrating UPIbased payment systems with partner countries, promoting rupee invoicing and settlement by exporters, and strengthening domestic financial markets. Medium-term measures focus on liberalizing Masala Bonds, expanding the RTGS system for international rupee transactions, harmonizing taxation and banking services for offshore INR operations, and facilitating banking in rupee through overseas branches. Long-term measures propose the inclusion of the rupee in the SDR basket and addressing issues related to capital account liberalization

Beyond the recommendations outlined in the RBI’s report, India has made notable progress in recent years toward expanding bilateral currency and payment arrangements. The country has entered into bilateral currency swap agreements with several nations, including Japan, Sri Lanka, the UAE, and the Maldives. Additionally, the Union Cabinet approved a Framework on Currency Swap Arrangement for SAARC Countries (2024–27), with a total corpus of ?250 billion.

Alongside currency swaps, India has permitted bilateral trade settlement in rupees with 30 countries through Special Rupee Vostro Accounts (SRVAs) maintained by foreign banks in India. This mechanism enables trade settlements in Indian rupees, thereby reducing dependence on the US dollar. However, these arrangements often face challenges when India’s imports from a partner country significantly exceed its exports. For instance, the trade imbalance with Russia has led to an accumulation of balances in Vostro accounts.

In the October 2025 Monetary Policy Meeting, the RBI expanded the scope of SRVA utilisation, allowing balances to be invested in corporate debt instruments, in addition to previously permitted government securities. This broadening of investment options provides greater flexibility in deploying rupee holdings. Moreover, the RBI has allowed authorised dealer banks to extend INR-denominated loans to non-residents from Bhutan, Nepal, and Sri Lanka for trade-related purposes, further promoting rupee-based settlements with neighbouring economies. The integration of UPI with international payment systems, such as PayNow, marks another milestone in India’s push for financial connectivity. UPI is now operational in Singapore, the UAE, Mauritius, Nepal, and Bhutan, enabling faster and more secure cross-border fund transfers. While the internationalisation of the rupee remains a gradual process, these initiatives represent important steps in the right direction.

Way Forward

Despite emerging challenges and growing concerns over the reliability of the US dollar as a store of value, it continues to dominate the global macroeconomic and financial landscape. Among non-Western economies, China has made significant strides in promoting the internationalisation of the renminbi, positioning it as a credible alternative in select markets. India, though still at a very early stage compared to China, is gradually advancing its own efforts to globalise the rupee

Looking ahead, the rise of a multipolar world is likely to give prominence to multiple major currencies from the Global South, gradually challenging the dollar’s entrenched hegemony. While the dollar’s dominance may be contested, a complete de-dollarisation will still take a long time. Nonetheless, the early indicators point toward a gradual but undeniable shift away from dollar dependency

Above views are of the author and not of the website kindly read disclaimer

More News

Vehicle Scrapping Policy likely to reduce prices of auto components by 30%: Nitin Gadkari